Keep Calm and Invest On Through Record GDP

Wall Street’s wild ride over the past month has been an emotional roller coaster for investors as the market tries to find a floor if not some footing through record-setting GDP and inflation numbers. Adding fuel to the fire, Face Book (Meta) stock just plummeted 26% to log its worst single-day loss on record putting it alongside Netflix, with both now in bear-territory down over 30% since last quarter.

Perhaps the notorious FAANG Stock acronym that was devised in 2013 to include Meta (Facebook), Amazon, Apple, Netflix and Alphabet (Google) should be revised to just AAA. The question of the week is if you should take this news as a warning shot to bail out of the market, or will these setbacks not derail the fastest GDP growth we have seen in decades? The short answer is to stay calm and invest on.

Portfolio Stress Test

A down month in the stock market is actually a great time to open your statements and perform a an “emergency stress test.” Checking your portfolio performance, like checking your health vitals, can provide clarity while helping to reduce stress if your blood pressure and portfolio evaluations are in good shape despite stressful conditions. We remind clients that investing in the stock market in a diversified portfolio should not look or feel like a roulette game in Vegas with the odds on the house. Market volatility is like blood pressure. Both are elevated in the face of uncertainty and adversity.

Many investors may have very little idea of how their portfolios have held up through corrections, or if their losses were reasonable, or if not better than expected. For example, if the maximum drawdowns before last week’s turnaround were near -12% for the S&P 500, -18% for the Nasdaq index and quite worse for many individual stocks- as compared to a 3% portfolio drawdown (by example for the typical moderate risk portfolio), your strategy may be in line with your risk tolerance and benchmark metrices. If your investment returns are matching the provided index or worse, it may be time to update your strategy before the next bear market arrives. While volatility is the price you pay for admission, it’s important to keep your brain and expectations in check.

Brain Stress Test

It often takes real discipline to avoid short-term panic. There is no direct correlation between your actual IQ and your “investor EQ” even if you are a member of Mensa. In today’s new tech- connected world, investors are bombarded by influential sources online such as the financial media, pundits focused on short-term trading on message boards, and even friends and colleagues on social media. It can be difficult to distinguish between appropriate investment advice and knee-jerk reactions driven by market fear and panic.

Stress can leave a lasting, negative impact on your health and brain while affecting your sleep to your short-term memory and decision-making capability. It’s understandable that in these situations, some investors may be tempted to sell well-planned investments and seek safety. Our advice to investors is to consume less financial news, not check your portfolio hourly, and not to consult yourself online for wealth or health matters with Dr. Google. Times like these amplifies the need and value to work with an accredited financial professional while perhaps spending more time on a hobby or activity that brings calmness to your life.

Always remember that you are investing for your “future self” in retirement and for future generations even if you are in retirement in your 70’s and 80’s. There is a reason why the windshield in a car is bigger than the back window. Investing can be emotional and frustrating at times but keeping your focus forward on upcoming traffic, hazards and economic events while driving defensively can better help you to maintain financial independence for the long run.

Sharpest GDP Growth in Decades

The economy is growing at a healthy pace as we approach the second anniversary of the pandemic-driven recession. Despite the many challenges facing markets, from inflation to Fed rate hikes, a growing economy provides a foundation for long run market returns despite the uncertainty of Wall Street to kick off 2022.

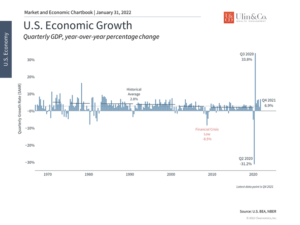

While there are many ways to measure and compare economic growth, by all accounts the country’s GDP is expanding at a robust pace. (see below) The latest figures for the fourth quarter of 2021 show that the economy grew 6.9% on a quarter-over-quarter basis, the fastest since the year 2000. When comparing the fourth quarter to the same quarter a year prior, the 5.5% growth rate is the fastest since 1984. In other words, the economy performed well at the end of last year despite issues around supply chains and the omicron variant.

Perhaps more importantly, the economy expanded by 5.7% throughout 2021, the most since 1984 as well. This was a significant rebound from the -3.4% contraction in 2020 which experienced the sharpest recession and recovery in history. To put this in perspective, the years after the global financial crisis saw average annual GDP growth of only 2.2%. These figures are after adjusting for inflation, so last year’s GDP figure was even higher compared to the decade after 2008.

Every Time is Different

Not all boom-bust cycles are made equal. The root of the 2008 global financial crisis was debt, and it is harder for the economy to recover if individuals, businesses and banks are de-leveraging and afraid to expand their spending and investment activities. In contrast, the latest (2020) recession was a self-induced shutdown in response to the pandemic. Whether one agrees or disagrees with how this was managed, it’s undeniable that many businesses and factories were able to reopen without losing much know-how or productive capacity. In many ways, this was like turning off and on a light rather than having a bulb burn out.

Of course, this overlooks many challenges across the economy. Not all industries have recovered fully, even as the overall economy reaches new peaks and unemployment hovers around 3.9%. Many individuals have struggled and have yet to get back on their feet. Inflation is also a significant concern, even if it could begin to stabilize in the coming months. The Fed would be in a real conundrum if a wage-price spiral ensues where inflation is baked into expectations in an uncontrolled way.

While this is not what most economists expect, it’s clear that investors ought to have more tempered expectations for growth in the years ahead. The lights are back on but we shouldn’t expect it to keep getting brighter at the same pace. For instance, the Fed’s latest forecast for 2022 GDP growth is 4% before settling down to 2.2% each of the next two years. This is slower, yes, but this level of growth would still be one of the fastest in decades (since the year 2000).

Investors will have to adjust to these trends. However, what matters is not that the economy is perfect – it’s that overall growth will support corporate earnings and thus market returns. At the moment, companies are doing extremely well across the board with an S&P 500 earnings-per-share (see below)estimate of $223 in twelve months, despite other sources of market uncertainty. Over the course of full business cycles, it is profitability that propels stocks and portfolios ahead, allowing investors to achieve their financial goals.

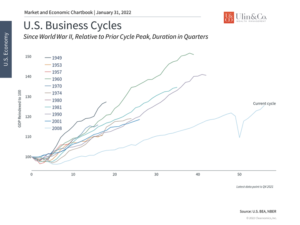

Below are three charts that provide perspective around today’s economic growth trends.

1 The economy continues to reach new peaks

The overall economy exceeded its pre-pandemic levels in the middle of 2021. As GDP growth continues as a fast clip, the economy is reaching new peaks each quarter. In the long run, this is what matters to investors – not day-to-day headlines.

2 In 2021, the economy grew at its fastest pace in decades

The 6.9% quarter-over-quarter growth rate in Q4 is the fastest since Q2 2000, not counting the initial post-pandemic rebound in 2020. While GDP growth should be above average in 2022, investors should expect growth to return to more average levels in the coming years as the effects of the pandemic lockdowns fade.

3 Corporate profitability is strong

Ultimately, investors care about economic growth because it is what drives spending, investment and profits. Zooming out over decades, history shows us that markets do well when corporate profitability is high. This depends on business cycles and long-run trends.

The bottom line? As elevated market volatility continues, investors should stress-test their portfolio results, adjust accordingly and stay focused on long term economic trends rather than day-to-day news.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), and it advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.