The Waiting is the Hardest Part Amid Economic Headwinds

“Time is your friend; impulse is your enemy.”- John Bogle. “The big money is not in the buying and selling, but in the waiting.”- Charlie Munger “The waiting is the hardest part.”-Tom Petty.

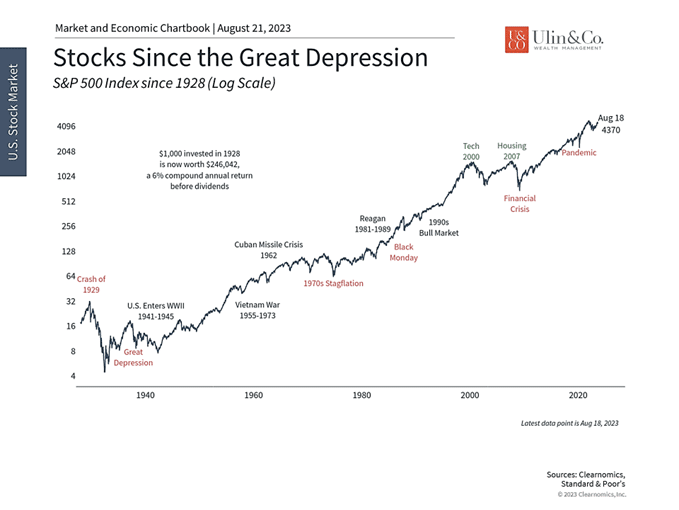

Time is on your side, whether you are pushing 80 years old like Mick Jagger and President Biden, or a millennial building up your home and family, recognize that eventually the markets, like the planets rotating around the sun, do change. At the same time marketing timing, making too many changes, cashing out your hand, or buying and locking in longer term complicated products with your life savings may end up hurting more than helping you.

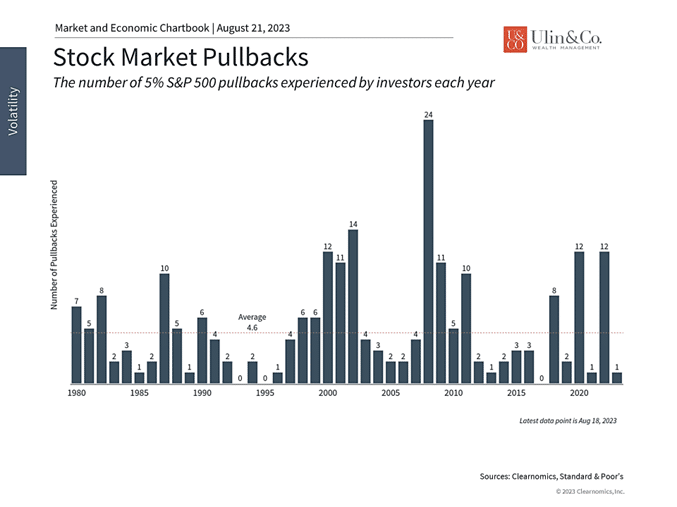

After one of the best starts to the year for stocks with a near 20% run by the S&P 500 and 29% for the Nasdaq index, investors are again getting a bit of PTSD crash trauma from the near 5% S&P 500 pullback and 7% Nasdaq pullback in August, though both may be part of a typical seasonal adjustment. In fact, more volatility this year would not come as a big surprise, as most years the stock market incurs about three 5% pullbacks with near 14%- 15% total drawdowns, even over the course of many bull market years. (See chart)

Bulls, Bears and Headlines

Jon here. We discuss with our clients that sometimes headline risk can move investors, markets and quant trading mechanisms reading the news before you wake up in the morning from posts on X (formerly tweets) more so than company, industry or sector performance or stressors. No matter what the catalyst may be for volatility, in many instances, you may be your own worst enemy, to paraphrase the 1999 song by Lit released right before the dotcom crash.

The S&P 500 index, along with most diversified portfolios are still below their high-water mark when the crash incepted January 2022, leading to now almost two years of investor frustration and treading water, but that is par for course. To paraphrase Sir John Templeton, this time is never different for investor behavior, but may always be different when looking at market catalysts and crashes.

Climbing a Wall of Worry

A perennial challenge for investors is distinguishing short-term issues and headline risk from long-term trends. This is because, when it comes to investing, there are always reasons to be concerned. Financial markets are in flux because of the combination of lingering, if not increasing inflation, sizzling interest rates, geopolitical risks (war), upcoming elections, debt ceilings, banking crises, bear markets, and growing uncertainty around China.

Even when these worries are resolved – or when they fall out of the news cycle – they are always replaced by seemingly more urgent issues. Unfortunately, it appears to be human nature for investors to constantly shift focus from one set of problems to another, creating an endless hamster wheel of anxiety in their head.

Despite this, financial markets have experienced many periods of strong returns, especially when considering longer time frames. As the accompanying chart shows, the market trend over the past century has been one of long-term wealth creation driven by economic growth and technological advancement.

This perspective of growth through uncertainty and economic events matters because the market is once again experiencing a period of volatility after a robust rally. The following are our two primary sources of concern.

First, interest rates have jumped over the past month. The 10-year Treasury yield has risen above 4.25%, the highest level since 2007. This has coincided with events such as Fitch Ratings downgrading U.S. Treasury securities and Moody’s downgrading many banks. This has forced other interest rates higher, including the average 30-year mortgage rate which is now above 7.5%, the highest in two decades since 2000.

Just as they did last year, rising rates have acted as a headwind on the broader stock market and tech stocks in particular. Many of the best performing tech stocks, which also happen to be the largest stocks in the S&P 500, have struggled as a result. Some company-specific factors, such as weaker-than-expected earnings due to softer demand, have acted as a drag as well. These rate moves could also have a mixed impact on the economy. Higher long-term rates tend to slow the economy by increasing the cost of capital. At the same time, the yield curve has steepened, which may be viewed as positive, especially if it helps to slow inflation further.

Market Calmness Despite Headlines

The accompanying chart (below) shows that despite the current pullback of the S&P 500, which is near 5% so far, the market has been quite calm compared to the average year. Most years experienced several 5% intra-year declines, and the worst years’ experience about a dozen. The last one occurred during the banking crisis earlier this year before the situation stabilized and tech stocks resumed their leadership. This shows that the market is often not as volatile as it may seem, especially when it is driven by natural dynamics such as the ebb and flow of interest rates.

China

Second, concerns over slowing economic growth in China coupled with a long-simmering debt crisis have reemerged. Investors have worried about a “China hard landing” since at least 2010 as the country’s growth rate has slowed. From 1980 to 2010, Chinese real GDP grew by 10% per year – a remarkable pace as it caught up to the rest of the world. The most recent official data suggest that growth has decelerated to 6.3% year-over-year, a rate that is slower but that still outpaces most of the world. There are other signs that consumer spending and industrial production are slowing as well, in addition to signs that unemployment, especially among youths, is higher than previously expected.

The term “Lehman moment” appears every few years over the property market and the “shadow banking system” in China. Two years ago, the Chinese property developer Evergrande faced a liquidity crisis leading to widespread market concerns (it has now filed for bankruptcy). More recently, Chinese companies such as Zhongrong International Trust and Country Garden Holdings, both large private companies, both missed bond payments. Some see this as the culmination of the rapid growth and slowdown in China that created imbalances over the past two decades.

This situation is still playing out but previous episodes show how difficult it is to predict the outcome of financial instability in China, even if there are signs of bubbles. China’s command-and-control economy gives it tools to control a crisis, up to a certain limit, even without bailing out defaulting entities. Of course, economic theory suggests that this only kicks the can down the road, but it’s unclear where the road ends. In the meantime, China must try to shore up its currency which has depreciated against the dollar in recent weeks. At the same time, a weaker yuan can be positive for economic growth if it helps to spur export activity. Our main concern is that China may be highly motivated to invade Taiwan, as war brings productivity and growth, no less they will gain control of most of the semiconductor chip production for the world.

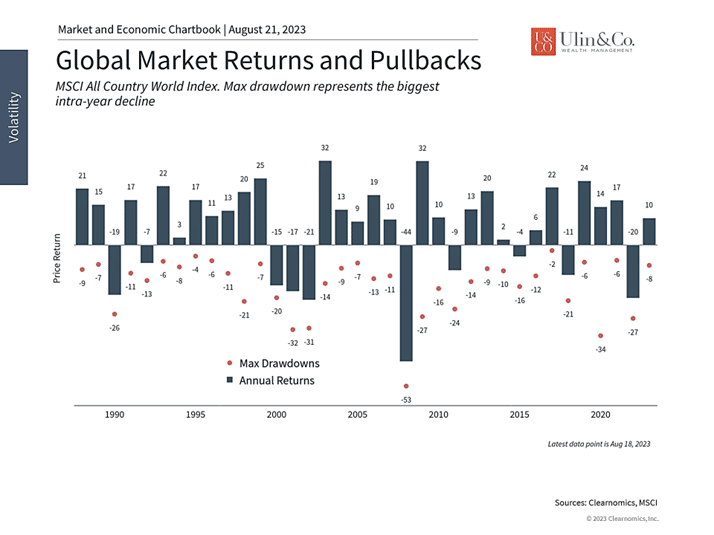

Global stocks have generated strong returns this year

While investors may be concerned about these issues and their repercussions across markets, these risks are exactly why investors are rewarded in the long run. Despite recent market volatility, emerging markets have contributed significantly to diversified portfolios over the past twenty years. Investing in China and EM requires accepting a large degree of uncertainty but this is ultimately what drives long run returns. The chart above shows that global markets, which includes the U.S., developed international, and emerging markets, can experience significant intra-year declines. Despite this, most years experience positive returns, benefiting those with the fortitude to stay invested.

Thus, while every market pullback is challenging and each new situation feels unique, the reality is that diversified portfolios tend to stabilize and recover regardless of the underlying causes. Rising rates are a headwind for markets, just as they were last year. The problems in China are large in scale, but investors have been watching closely for signs of trouble for over a decade. Understanding these events, while not overreacting to every headline, is the key to maintaining balance and focusing on long-term financial goals.

The bottom line? Investors ought to maintain perspective and stay diversified through periods of market uncertainty and economic headwinds whether due to rising rates, China, or other concerns.

For more information on our firm or to request a complementary investment and retirement check-up with Jon W. Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

Note: Diversification does not ensure a profit or guarantee against loss. You cannot invest directly in an index.

Information provided on tax and estate planning is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), and it advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.