Dot-Com Tech Crash PTSD- While the Fed Fights Inflation

The Nasdaq is down 78% with near-biblical reckoning, unemployment is spiking, and a recession is eminent. You would think this would be the case today just by reading many of the horrific financial headlines – not just pondering about the dot-com bubble crash aftermath.

With the Nasdaq down near 30% and the S&P 500 index continually teetering near the 20% crash territory level like a computer game, many investors are having sweaty PTSD like symptoms that stocks will soon be heading back to the year 2000 and that the year-to-date losses are just a teaser for more discomfort to come.

Hot 8%+ inflation, record gas prices, Ukraine war, China COVID lockdowns, tech companies crashing, high stock valuations, the worst returns on bonds since 1842, and a hawkish Fed hiking rates to help cool off some of this pain that was partly self-inflicted – does provide a bit of uncertainty.

One piece of good news is that tech companies today are in better shape and are much less expensive than they were in the late 1990s before the dotcom imploded and that a crash does not always cause a recession. The Nasdaq was trading at more than 100X forward earnings in 1999 whilst you were pondering your tech gains, sock-puppet stock commercials, a potential Y2K virus and a song by Prince before the clock hit midnight year end. By last November near its latest peak, the index was only priced at 33X forward earnings.

It’s Not 1999 Tech

Back in 1999, many investors were following the herd and buying into new dot-com companies like the 1800’s gold rush or the 2000- 2006 real estate fiasco or the recent crypto mania- without even knowing what they were purchasing. Before the days’ of watching Shark Tank on TV, investors quickly learned the hard way about business planning, execution and balance sheet valuation which are all driving forces behind an assets price.

There are significant differences between 2022 and 2000. The main one: Unlike the dot-com era, many of the most valuable publicly traded tech companies today are actual companies – they make and sell things people value, and usually make a profit doing so more than the pets.com fiasco. While Facebook, Google, and Amazon (FAANG leaders) have all seen their shares tumble this year, it doesn’t mean they are going out of business – just that investors are not compelled by their growth prospects.

It’s also worth pointing out that while the tech industry employs a lot of people — an estimated 5.8 million in 2021, – that represents only about 4% of total US employment. Still, the current Nasdaq composite index has only about half as many companies as it did in 2000.

Unlike the 90’s, today you’re likely invested in tech even if you don’t think you are. Many of the biggest tech companies —make up significant chunks of the big stock indexes while tech, AI and disruptive innovation has bled into almost every industry from farming to medical research. Even if you are not invested in Ark innovation or Tiger Global (both 2/3rds down from peak) many well named/known funds and ETF’sinside and outside your 401(K) may likely hold tech.

Don’t Fight the Fed Fighting Inflation

The Fed has never lowered inflation as much as it is setting out to do now by 4% over the past 8 decades -without significantly raising unemployment and causing a recession – but does not necessarily mean it will not succeed.

Fed officials can find reasons for both optimism and caution from history. In seven different episodes during the past 80 years, inflation has fallen as much as the Fed bank wants it to drop now, with varying outcomes. Just the same no one has a working crystal ball to foresee if main inflation stressors recede and do some of the heavy lifting. If the U.S. dollar continues to surge in value, the cost of imports could fall. Russia could retreat from Ukraine; Covid-19 might retreat from China, oil prices could fall helping to deflate inflation.

Jon here. The environment today can be best summed up by the quote- hope for the best, plan for the worst. We are continually executing market resistant diversified balanced portfolio strategies for our clients to help minimize losses and provide a smoother ride if for one of few times in history a recession rears its ugly head in the junior year of a bull market. At the same time, we are focused to keep investors educated, calm and orderly. Jumping off an airplane midflight without a parachute because of turbulence while capturing losses can put you in worst shape than staying on board. Risk managed diversification, not panicking, is a long term strategy to follow- as until you sell you are not capturing losses or derailing your long term goals.

We’ve seen multiple near bear markets bottom near 19%, close to where stocks bottomed last past couple weeks. “Going back more than 50 years shows that only once was there a bear market without a recession that lost more than 20% and that was during the Crash of 1987,” noted by LPL Financial strategist. “With other near bear markets without a recession bottoming near 19% corrections in 1978, 1998, 2011, and 2018, not far from the recent lows.”

Market Cycles Are Normal

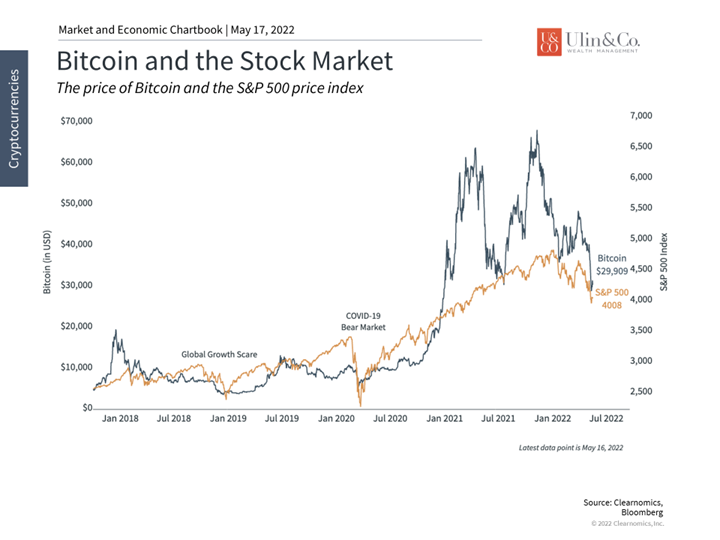

Different parts of the market have swung wildly throughout the pandemic recovery, including tech stocks, energy, bonds, crypto, and more. It can be difficult to judge whether these developments change the nature of investing or reflect normal market behavior. Its interesting to note that Bitcoin and the S&P 500 have generated similar returns over the past several years. (see below)

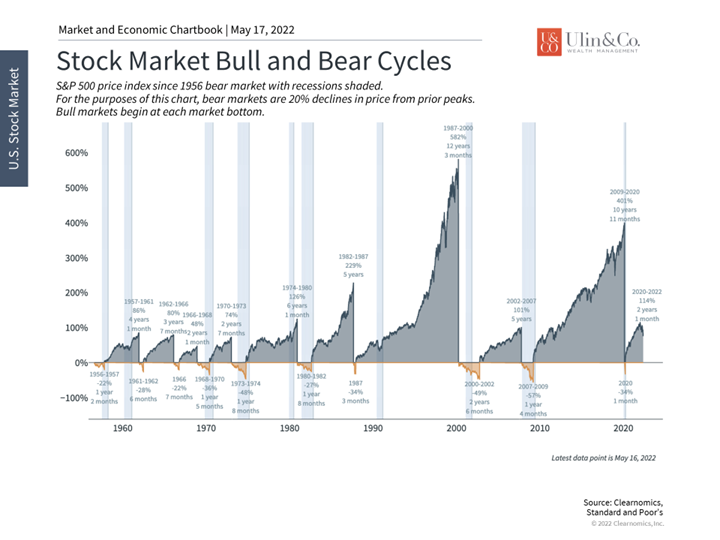

As the saying goes, those who don’t learn from history are doomed to repeat it. For investors, perhaps the most important historical lesson for the economy and financial markets is that both operate in cycles. There are well documented booms and busts across centuries in addition to those that investors have experienced over the past few decades. However, it’s also the case that markets fluctuate within cycles, making it difficult to judge whether a large market swing is a true turning point or a temporary event.

This matters because some investments are simply more prone to big booms and busts. Technology, for instance, often makes bold promises of reshaping the future. In the cases when these promises are realized, it seems silly to have focused on earnings or valuations in hindsight. The same argument has been made for cryptocurrencies, artificial intelligence, financial technology, and many other sectors. It often feels as if these claims are accelerating alongside technological advancement.

However, the reason to focus on fundamentals is exactly because it is difficult to predict the exact winners. The transformative nature of technology is exciting but also a reason it is difficult to forecast its impact. Trying to predict the tech winners in the late 1990s, among the thousands that did not survive, would have been quite a feat. Instead, using a disciplined portfolio approach and utilizing ETF and fund manager expertise- allows investors to take advantage of these trends while helping protect from downside and individual company failures.

As we discussed above, the impact of the information technology revolution of the past two decades was felt across the entire economy. There is no major corporation today that is not heavily dependent on digital technology, and many “technology” companies are now found across market sectors beyond Information Technology, including Communication Services and Consumer Discretionary. This has helped to boost productivity and increase profit margins via digitization, automation, and more. Thus, focusing on only a single stock or industry doesn’t quite capture the true impact of transformational technologies.

Of course, market prices and valuations can deviate from fundamentals for quite a while, as was the case recently. Trying to get the timing right is nearly impossible and being too early is often the same as being wrong. Today, the stock market is still well above its levels both prior to the pandemic and at most points during the recovery. For the average investor, trying to time the market rather than holding onto an appropriate portfolio would likely have done more harm than good.

As we discuss in almost every newsletter, much of investing depends not just on facts and figures but also on our own behavior. While it’s clear that there are manias, booms/busts, and expansions/contractions in the economy and markets, it is difficult to know how any particular situation will play out. What makes this more difficult is that downturns tend to occur swiftly, often with little notice, while rebounds occur slowly and steadily. This means that market pullbacks can drive a greater emotional response even if history shows they occur regularly. Below are three charts that highlight the fact that boom/bust cycles and market volatility are a normal part of investing.

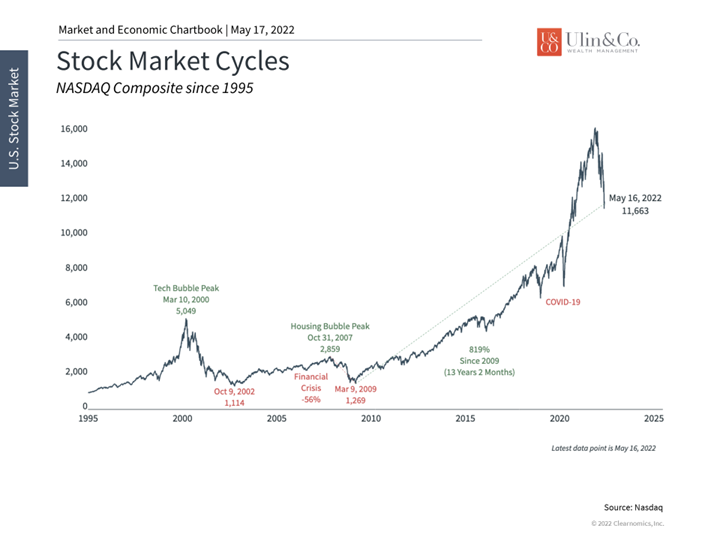

1 The Nasdaq has fallen into bear market territory

The Nasdaq is in bear market territory compared to its recent all-time highs. While this is challenging for many investors, it caps off a spectacular run that accelerated during the pandemic. Staying invested across sectors, not trying to pick individual winners, and staying invested are still the best ways to manage this market environment.

2 Bitcoin and the S&P 500 have generated similar returns

For investors, risk-adjusted returns are often more important than absolute returns. Bitcoin, for instance, garnered significant attention by rising in spectacular fashion over the past few years. However, with recent problems around rising rates and issues such as stablecoins, Bitcoin and the S&P 500 have generated similar returns over the past several years.

3 Investors should focus on long cycles and not short-term swings

The stock market operates in cycles. Not only is this normal, but investors should not overreact to short-term pullbacks that occur within a cycle. Instead, the gains that are made in bull markets are what allow investors to gain true financial independence – if they have a well-constructed portfolio and stay the course.

The bottom line? Market cycles and intervening market volatility are a normal part of investing. Thus, this challenging market environment is an ideal time even with the severe tech crash to remind ourselves to stay invested, diversified, and disciplined.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), and it advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.