Don’t Run Out of the Store When Stocks are on Sale

Cat-4 hurricane catastrophe, pandemic variants, virtual work, market mayhem, crypto-crash, historic inflation, a hawkish Fed, crude problems, Russia/Ukraine War, boarder crisis, tons of stimulus, snowballing Federal deficit and political discord on capitol hill with approaching midterms has more than defined the folly and insanity of 2022.

On the flip side, many core inflation gauges are decreasing alongside used auto sales, lumber, oil, energy and food prices. The Fed is getting a step closer to their Fed Funds rate target goal and should help cool off CPI. Unemployment numbers are at a record low. Steady earnings growth for 2022 may lead to a positive result for 2022 and eventually sunnier days ahead after the last two quarters of GDP results are tallied in and not indicating a 2008 style Great Recession is around the corner. Still, it is not going to be a smooth ride to the next bull market.

Third Time is Not a Charm

After the third major pullback this year by equites solidifying the stock and bond bear markets through September, even some patient, disciplined, diversified investors are incurring anxiety from the many Armageddon predictions of “worse things to come,” more so than the actual volatility even though three or four pullbacks is typical and not unexpected through a bear market.

There is a famous quote that “the stock market is the only market where things go on sale and all the customers run out of the store screaming.” In uncertain times where financial oracles are out in full force, staying the course while buying low, dollar cost averaging and rebalancing can be very difficult, but history shows that it is ultimately rewarded.

Most investors understand that markets naturally swing on a regular basis and that the economy tends to operate over the years through expansion and contraction cycles. At maximum fear and uncertainty is typically when the momentum changes. Still, this knowledge doesn’t make it any easier to avoid overreacting to large market moves and negative headline loops.

This Time is Always Different

The four most dangerous and expensive words in the English language are “This time it’s different,” according to the popular maxim by Sir John Templeton. “This time is different” is a ubiquitous phrase with over 17 billion google search results. Yet it could be extrapolated in two different ways when it comes to investing between human behavior and market history.

Perhaps this time is ALWAYS different, as every “black-swan” event and subsequent stock market crash is unique like a snowflake no matter the cause, but this time is NEVER different as investor behavior studies illustrate that many people get very emotional while taking swift action with their investments at exactly the wrong time and end up greatly underperforming the stock market and their own target goals due to human error and market timing.

This is why, despite the importance of having an understanding of investment analysis, financial planning and portfolio construction, it’s often our own behavior that has the biggest impact on achieving financial objectives. Investors understandably prefer to wait for the “perfect” time to invest, which often translates into waiting until it feels safe and comfortable to do so.

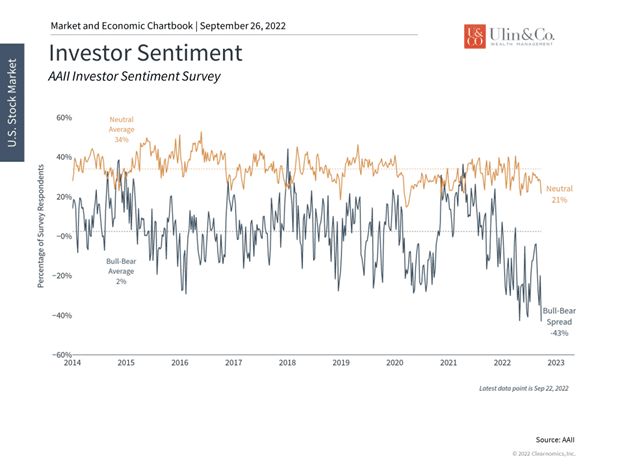

The average investor has never been more bearish

The reality is that no market environment is ever perfect, whether it’s the challenging period following the 2008 financial crisis, in 2020 during the pandemic, or in the early 1980s when the Fed was last battling inflation. Waiting until investing feels comfortable tends to backfire.

When viewed with perspective, how investors feel often turns out to be a contrarian indicator since investors are most confident when markets are at their peak, and most uneasy when markets have already bottomed out. As the Warren Buffet quote goes, having the fortitude to “be fearful when others are greedy, and greedy when others are fearful” is what rewards investors over long periods of time. Investing when others are bearish may feel uncomfortable, but this is when prices and valuations are the most attractive.

As the chart above shows, investor sentiment today is at historic lows due to fears of the Fed pushing the economy into a recession. Not only have these concerns been driving markets all year but they are also widely understood. Experienced investors know that boom and bust cycles are a natural and unavoidable part of both the stock market and the economy. Today, the economy is not dealing with shocks from a once-in-a-century pandemic, a credit/housing crisis, or a 2000-style tech bubble. Instead, it is in the process of restoring the balance between economic growth and inflation. This takes time and there can be stumbles along the way as markets adjust to a new period of more sensible interest rates.This takes time and there can be stumbles along the way as markets adjust to a new period of more sensible interest rates.

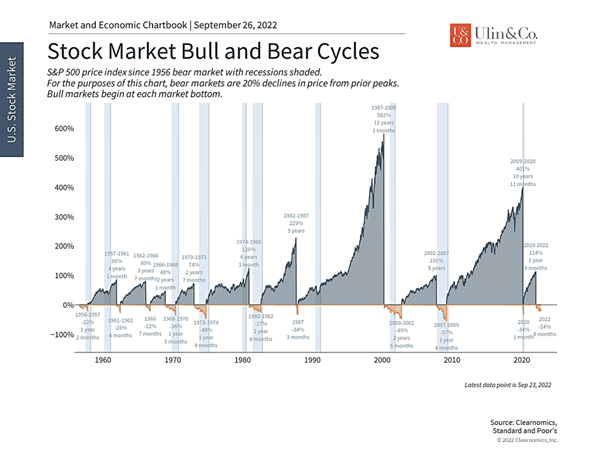

Bull and bear markets behave very differently

Eventually, all recessions and bear markets across history stabilized, paving the way for economic expansions and bull markets. These phases of the economic and market cycle are not created equally. The history of modern market and economic cycles suggests that while downturns may be sudden and deep, the subsequent expansions more than make up the difference. As the chart above shows, bear markets since World War II have lasted anywhere from 6 months to two-and-a-half years. During these periods, the U.S. stock market has fallen anywhere from 22% (1957) to 57% (the 2008 financial crisis) at their worst points.

In contrast, bull markets have lasted from about 2 years to over a decade in length, with the two longest cycles occurring during the past 30 years. These cycles have seen the stock market multiply in value many times over. The eleven-year bull market that ran from 2009 to 2020 experienced a price return of 401% and close to 530% with reinvested dividends. If seasons behaved like the bear and bull markets of recent decades, there would be beautiful weather 11 months out of the year. While preparing for winters is important, focusing on them at the expense of springs and summers is counterproductive.

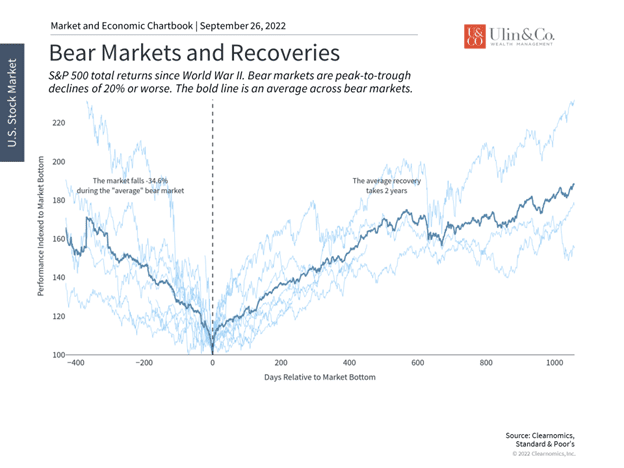

Overreacting to pullbacks can lead investors to miss rebounds

Of course, past performance is no guarantee of future results, and the point is not that bear markets are insignificant or inconsequential. Instead, it’s a reminder to stay invested and diversified in order to benefit from all parts of the market cycle. The chart above highlights the fact that it can take two years for the market to fully recover from the typical bear market. However, the most important point is not when the market fully recovers, but when it begins to turn around. This rebound can happen suddenly even as most investors remain skeptical. Being patient and not focusing on each and every market headline allows investors to avoid their own worst behavior.

The bottom line? It may take time for markets to adjust to this new economic period of higher interest rates and tighter Fed policy. History shows that periods like these may be uncomfortable, but investors who can stay the course and not run out of the store when stocks are on sale will be better positioned to achieve their financial goals.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetically used for illustrative purposes only and do not represent any actual investment.

The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), IFP Securities LLC, dba Independent Financial Partners (IFP), and its advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment

objectives, financial situation, or needs of individual investors. This report may not be reproduced, distributed, or published by any person for any purpose without IFP’s express prior written consent.