Don’t Let These Dangerous Words Drive Your Investments

The new year started off with a reversal in fortune as a sharp equities sell-off tied to a surge in bond yields drove the tech-heavy Nasdaq composite index into correction territory (down more than 10%) along with many bond indices into the red. The S&P 500 index is down near 5% and the VIX “fear index” is up over 40% just this month as investors adjust to sharply higher interest rates, rising inflation, faster Fed tightening and new pandemic variants.

After the past year with minimal volatility, ominous headlines are helping fuel the selloff and stress-levels for investors. Is there a bear lurking around the corner? Should you buy a bigger mattress, gold or crypto’s? Is this time any different? The quick answer to all these questions, is no.

Four Dangerous Words

The four most dangerous and expensive words in the English language are “This time it’s different,” according to the popular maxim by Sir John Templeton. “This time is different” is a ubiquitous phrase with over 5 billion google search results. Yet it could be extrapolated in two different ways when it comes to investing between human behavior and market history.

Perhaps this time is ALWAYS different, as every “black-swan” event and subsequent stock market crash is unique like a snowflake, but this time is NEVER different as studies continually illustrate that many people get very emotional while taking swift action with their investments at exactly the wrong time and end up greatly underperforming the stock market and their own target return goals due to human error.

If you hear ominous headline news in the morning and think “maybe I should sell everything and buy a bigger mattress,” it’s either too late or a bad decision. While the ongoing pandemic, skyrocketing inflation and interest rate headlines may spark panic, and market swells may be substantial, they can be “counter-balanced” in a strategically diversified portfolio.

Jon here. In many instances, an investor’s portfolio “ailment” leading to their financial demise may be due more to being “over-weight” in stocks or poor market timing than the headlines causing the selloff. Staying invested and maintaining discipline and patience with one’s portfolio and financial plan has been a smart approach and highly helpful to drive long-term success before and through retirement.

For example, at the outset of the Covid-19 pandemic in 2020, we endured one of the deepest and quickest crashes and rebounds in history. The S&P 500 lost 30% in a matter of weeks – and then remarkably regained it all inside of five months. The Covid event offers a key lesson: When stocks go through a correction or crash, avoid slamming on the breaks and “overcorrecting” and locking in losses.

Three Key Reminders for Investors

While this month has been a shock to markets like jumping into a cold shower, long-term investors have seen episodes like this many times over the past decade. Most years there are 10-14% market pullbacks on average. Rather than focusing on short-term market news, it’s more important than ever for investors to hold onto well-constructed, globally constructed portfolios to start the year off right. Staying in your own lane and not getting distracted by others is key.

Just as a sensible sedan, SUV or minivan may not be able to keep up with a race car on an open highway, they will handle the inevitable potholes and traffic jams much better, just as a disciplined investment strategy can help get you through market turbulence and uncertainty. In the end, a practical car or balanced portfolio can help you reach your destination in a safer, and hopefully more comfortable manner. Below are three charts that highlight the challenges investors face as markets adjust.

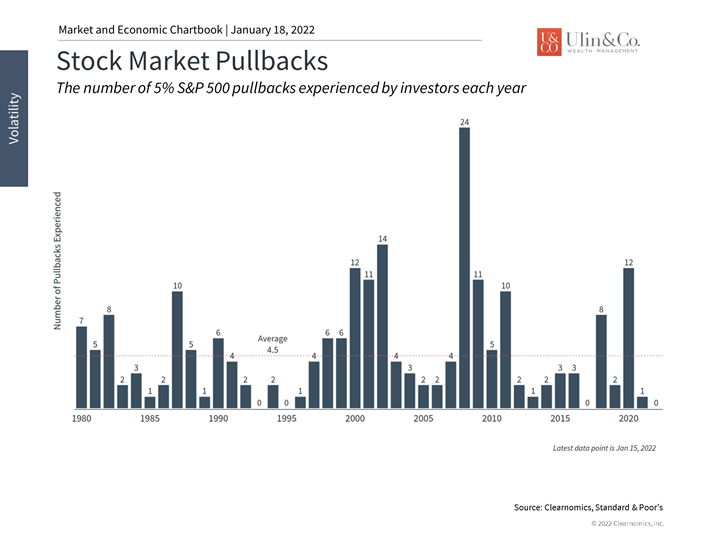

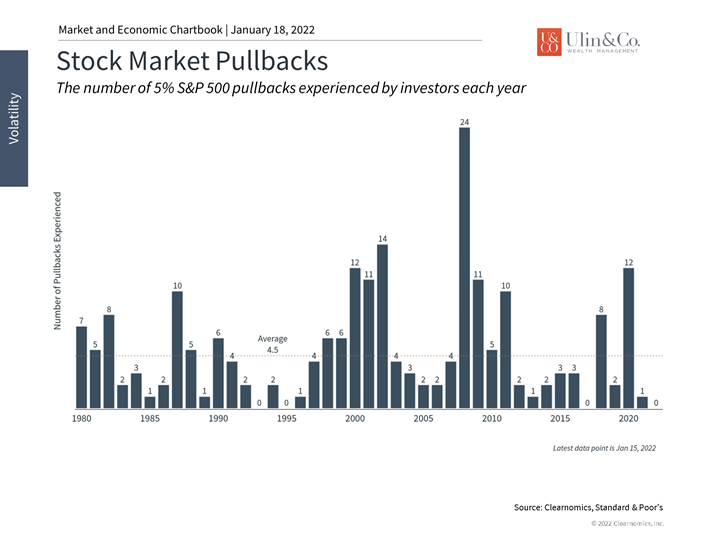

First, short-term stock market pullbacks are not only normal but can happen at any time. They are not a cause for panic but can serve as a reminder of why we build portfolios and seek financial guidance in the first place. There are typically four or five market pullbacks of 5% or larger each year that tend to fully recover within weeks or months. (see below) Thus, the fact that the S&P 500 is down over 5% and the NASDAQ over 10% year-to-date (as of this writing) may seem significant at first, but this is par for the course.

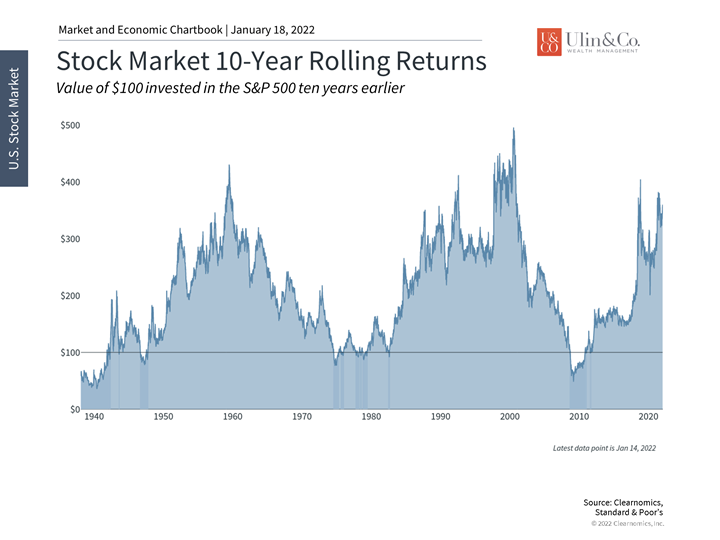

The challenge for investors is squaring the news that the market is down with the fact that markets tend to rise over longer timeframes. The key is that risk and reward go hand-in-hand. The ability and fortitude to take intelligent and well-considered risks is exactly why investors are rewarded in the long run.

Second, rising interest rates and Fed tightening are natural and expected at this stage in the business cycle. However, they often require a period of adjustment which the market is undergoing right now. This was true in 2013 during the Fed taper tantrum, in 2015 when the Fed announced its first rate hike that cycle, last year when the Fed was expected to taper again, and so on.

The Fed’s job is not to keep rates low or to stimulate the economy indefinitely. Instead, the Fed’s goal is to maintain full employment and stable prices. Even if inflation were not at multi-decade highs, the strength of the economy would justify raising rates at this point in the economic expansion. History shows that once markets and businesses adjust, interest rates tend to rise alongside the economy.

Additionally, the topic of the Fed can be controversial among investors. However, many have been calling on the Fed to normalize its excessively large balance sheet and too-low interest rates for over a decade. The fact that inflation is higher-than-expected has pushed to Fed to do exactly this.

Third, while many factors have pushed markets to ever-higher levels over the past couple of years, investors should have realistic expectations for the economy and markets. Although once-in-a-lifetime levels of GDP growth and job gains kicked off the economic recovery, the next few years could experience steadier, more traditional levels of growth. Broad market valuations remain close to dot-com era highs but can improve over time as earnings grow.

This is important because it may be tempting to try to eke out gains by trading in and out of markets. But once again, history shows that it is often better to simply stay put. Over the past 25 years, the hypothetical average investor that held onto their stock allocation gained at least twice as much as an investor that tried to exit and re-enter markets at a later date. (see below) In fact, because markets tend to recover unexpectedly and rise over time, the longer an investor stays out of the market, the more they potentially miss.

Thus, investors ought to stay focused in the weeks and months to come. The timing of market swings is impossible to predict but the fact that they occur is a certainty. The goal of long-term investors is not to swerve in and out of markets based on past returns, but to stay invested in an appropriate portfolio through both good times and bad. Below are three charts that highlight the challenges investors face as markets adjust.

1 There are several market pullbacks each year

The average year experiences several stock market pullbacks and there’s nothing special about the fact that this is occurring at the start of the year. Thus, while the current pullback seems alarming and involves big issues such as inflation and the Fed, long-term investors know this is typical for markets.

2 Investors are rewarded for long-term thinking

There have been very few periods when the market has been down over long timeframes. While average returns can vary significantly based on market cycles, those investors who can focus on years and decades will likely increase their odds of success.

3 Staying invested is better than trying to time the market

While trading in and out of markets may be tempting, history shows that it’s usually better to stay put. In fact, it’s not even close. The chart above shows the benefit of staying fully invested instead of being out of the market for one week or one year after market pullbacks.

The bottom line? Short-term market pullbacks are normal and inevitable. Investors ought to focus on their financial goals over years and decades rather than market swings over the course of days and weeks. Keeping one’s personal fears and concerns separate from long-term plans is still the most important principle to help achieve financial independence over the long run.

For more information on our firm or to request a complementary investment and retirement check-up with Jon W. Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com. Get Started Today: Contact Us.

Note: Diversification does not ensure a profit or guarantee against loss. You cannot invest directly in an index.

The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), IFP Securities LLC, dba Independent Financial Partners (IFP), and its advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. This report may not be reproduced, distributed, or published by any person for any purpose without Ulin & Co. Wealth Management’s or IFP’s express prior written consent.