DeepSeek AI: Beyond the Sputnik Hype

DeepSeek burst onto the scene last week with the debut of its generative AI platform—developed at a fraction of the cost of OpenAI’s ChatGPT—that vaulted it to the top of the Apple App Store and sent Nvidia shares into a tailspin. Yet, there’s still no definitive data to confirm whether this breakthrough was truly achieved on a modest $6 million budget or if it merely repurposed ideas from OpenAi.

Not sure on the $6 million, though the latter scenario would be hardly surprising, given China’s long-standing practice of acquiring American patents, trademarks and technology—often through mandatory disclosures when U.S. corporations do business in China—or reverse-engineering U.S. innovations from smartphones to military aircraft, typically with diminished quality. Some headlines are dubbing this a “Sputnik moment,” drawing parallels to the Cold War panic sparked by the Soviet Union’s 1957 launch of Sputnik 1, which ignited the U.S. Space Race and led to the creation of NASA. In our view, that comparison is overblown.

Such comparisons might be overblown, exaggerating the actual impact on the global AI landscape. We view DeepSeek more of a blip on the radar screen of tech-advancement, than an event to lose sleep over the recent mini-tech wreck. For investors, this isn’t a doomsday scenario but a reminder of how competition sparks progress while providing buying opportunities for investors.

Buckle Down, For Now

The market reaction was dramatic – a 17% plunge in Nvidia’s stock in a single day, wiping out roughly $600 billion in market cap and rattling tech giants like Dell, Oracle, and Super Micro for an almost mini 10% tech correction in January. Yet, after Nvidia’s meteoric rises of 239% in 2023 and 171% in 2024, a pull back due to an existential event should not come as a surprise.

Jon here. Rather than signaling a tech bubble burst akin to the dot-com era, this sell-off seems more like an industry recalibration. DeepSeek’s open-sourced, low-cost approach is seen not as a revolutionary threat but as an evolutionary spark that could empower AI innovators, especially across the Mag-7 tech leaders, to launch new, cost-effective products across a myriad of industries.

Looking ahead, the potential for change is immense as computer learning driven by generative AI continues to integrate into every facet of our lives. The demand for advanced chips from Nvidia to expanded data centers will only grow. U.S. cloud computing giants are already setting their sights on the next frontier: artificial general intelligence (AGI). With analysts predicting that the AI accelerator market could double from 2025 levels to reach $500 billion by 2028 or 2029, this isn’t a doomsday scenario but a reminder that competition fuels progress.

As the tech correction dust settled for January 2025, it’s food for thought that while tech ended the month down nearly 3%, industrials, materials, financials, healthcare and communication stocks ended the month up 5%, 5.6%, 6.6%, 6.8% and 9.1%, amplifying the power of diversification through the tech sector reversion. (see chart)

How we Got Here

In the 1940s and early 1950s, computers were the size of buildings and used vacuum tubes – large glass tubes that were fragile and consumed enormous amounts of power, generating significant heat. A former IBM Chairman is thought to have said “I think there is a world market for about five computers.” However, by the mid-1950s, semiconductor chips were invented which were far smaller, more efficient, and performed calculations much faster. This breakthrough led to the information technology revolution that continues today.

The recent reports on DeepSeek’s tech advancements are reminiscent of the shift from vacuum tubes to semiconductors 70 years ago. Building AI models like those that power ChatGPT has been extremely expensive and only a few companies in the world have the resources to do so. Like the semiconductor revolution that dramatically reduced the size, cost, and power requirements of computing, DeepSeek has reportedly achieved a similar leap in AI efficiency.

What does this mean for investors?

For investors, this “DeepSeek moment” represents a fundamental shift in AI deployment, potentially broadening access to advanced capabilities while easing the need for massive chip and infrastructure investments. ***Despite immediate market jitters—driven by fears of fewer, smaller data centers and reduced chip demand—the long-term perspective suggests that fierce competition will drive progress and, in the end, corporate profits.

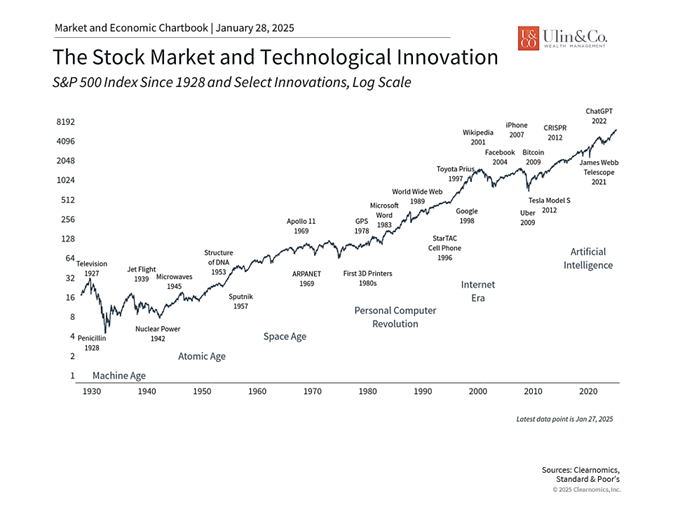

Despite this immediate reaction, and keeping in mind things can change quickly, the history of markets and technological change can help to provide a longer-term perspective. **To help make sense of this development, there are three important facts that investors should remember.

1 AI stocks have been significant drivers of the broad market

First, it’s no secret that tech stocks—including those in the so-called Magnificent 7—have become significantly overweighted in many investment portfolios, even among conservative investors in 401(k)s and similar plans. With tech comprising about 35% of the bellwether S&P 500 index—and accounting for roughly 50% of its volatility—portfolios can become highly sensitive to the performance of just a few high-flying stocks. This concentration makes it a real challenge to design a balanced portfolio that captures the upside of the tech boom while also safeguarding against downside risk through diversification. As we pointed out above, last month the tech index, mostly represented by the Nasdaq index was in the red with many other indices and sectors in the green helping to protect diversified investors from losses.

Regardless of how technology stocks perform in the near term, recent market moves underscore that investing isn’t about making a few concentrated bets. Instead, it’s about constructing a well-rounded portfolio aligned with long-term financial goals, ideally with the guidance of a trusted advisor.

Technological advances drive long-term growth

Second, the real benefits of new technologies take years or decades to play out. As computer scientist Roy Amara said, investors tend to overestimate the impact of technology in the short-term and underestimate the effect in the long run.

While markets have shown strong enthusiasm for AI, we are likely still in the early stages of understanding how this technology will reshape the economy and our lives. For example, the latest market reaction is driven by the “supply side” of the AI story, i.e., those that provide chips. The other half of the story – the demand for AI capabilities – is still in its infancy.

This is often described as the Jevons Paradox, which states that increased efficiency can result in greater use of a resource, not less. For example, the invention of semiconductors did not result in just more efficient computers, but the ability to use chips in all devices. This created consumer applications that were impossible to imagine in a world of vacuum tubes. Similarly, the possibility of small but powerful AI models could have transformative effects that require more, not less computing power.

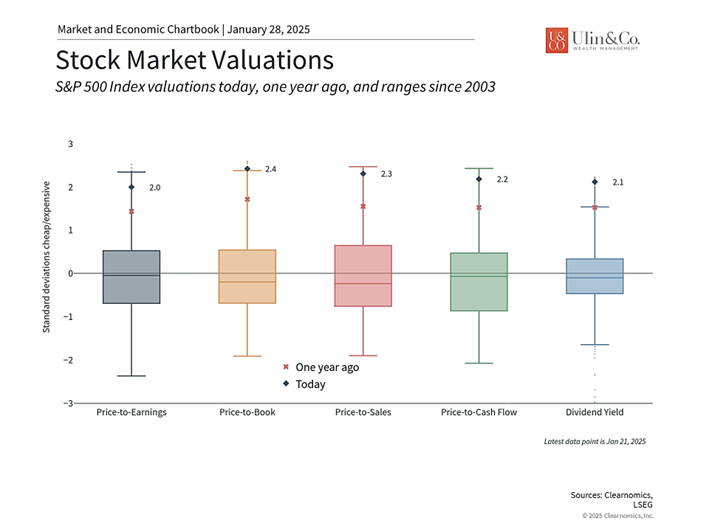

Stock market valuations are near historic levels

Third, stock market valuations are approaching dot-com levels, especially among AI-related companies. This is sometimes referred to as being “priced to perfection,” meaning that current stock prices reflect extremely optimistic expectations about future growth and profitability. When valuations reach such elevated levels, even small changes can lead to significant price adjustments.

Stock valuations are not a market-timing tool and do not predict what markets will do over the coming months. During bull markets, stocks can grow increasingly expensive for long periods. However, valuations are extremely important when deciding on the right mix of assets for your portfolio.

Ultimately, investors should focus on positioning themselves for long-term growth with a properly constructed portfolio and an understanding of current valuations. A well-balanced approach that includes exposure to different sectors and asset classes can help weather short-term volatility while benefiting from technological advancement and economic growth.

The bottom line? Despite recent news and stock market swings in tech triggered by the release of Deepseek generative ai, transformative technologies creates value over decades, underscoring the importance of maintaining a long-term investment approach and financial plan.

For more information on our firm or to request a complementary investment and retirement check-up with Jon W. Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

Diversification does not ensure a profit or guarantee against loss. You cannot invest directly in an index.

Note: This content is for informational purposes only and should not be construed as financial, legal, or tax advice. Please consult your financial advisor, attorney, or tax professional regarding your specific situation.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that are believed to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as NewEdge Advisors, LLC does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.