Will Cryptocurrencies Be Transformational?

Speculative assets that are gaining momentum among investors looking beyond the stock market involve hot alternatives such as collector watches, jewelry, precious metals, numismatic coins, fine art, classic cars, wine, scotch barrels, music and rights. Many of these unorthodox moves not only bestow the pleasures of tangible ownership but also aren’t tied to the ups and downs of the capital markets or currencies.

Whether cryptocurrencies and blockchain technology will develop into transformational investments over time as a currency and utility can be more complex to understand than most speculative assets combined while also evaluating whether they can serve a role in an investor’s portfolio diversification.

Currencies have value because they can be used as a store of value and a unit of exchange. Successful currencies have key attributes including scarcity, divisibility, utility, transportability, and durability. While Bitcoin and other cryptos have some of these traits, they are not backed by any currency nor widely accepted as a form of payment.

Still there may be the potential for crypto and blockchain to be transformational over time, more so than just a short-term speculative investment. While Bitcoin is the world’s largest crypto by market capitalization, there is no knowing if it may succeed over time, be surpassed by another crypto, or succumb to a more ominous outcome and vanish off the web3. Its value and incredible swings are driven mostly today by speculative crowd-mania and a lack of transparency.

A few large holders commonly referred to as “whales” continue to own most of Bitcoin. About 2% of the anonymous ownership accounts that can be tracked on the cryptocurrency’s blockchain control 95% of the digital asset, according to researcher Flipside Crypto. The study also found Ninety-five percent of spot bitcoin trading volume is faked and manipulated by unregulated exchanges.

Amara’s Law

There is a common saying that “we tend to overestimate the effect of technology in the short run and underestimate the effect in the long run.” This quote, often referred to as Amara’s Law, is as relevant today as it was during past technology revolutions.

With growing investor enthusiasm for cryptocurrencies, blockchain, decentralized finance (DeFi) and similar advancements, long-term fundamentals are often thrown out the window in favor of short-term gains. This is amplified when popular cryptocurrencies experience sudden drops as they have recently.

The dot-com bubble of the late 1990s is the perfect example of the adage above. The popularity of tech stocks was, in hindsight, driven by the expectation of ever-rising stock prices. However, there was also the idea that the internet and software would be transformative, thereby justifying lofty valuations. This view was eventually proven to be correct, but this transition took place over decades – not days or weeks – and also not in the way that many expected. Since then, this has occurred in many other industries including innovation in biotech, energy, and more.

These lessons are widely applicable today. While speculation – i.e., trading with the goal of making short-term Vegas-like profits – may have some place in a portfolio, it is long-term investing that has historically created financial success. The difference, of course, is that speculation is exciting and get-rich-quick stories naturally attract attention. Investing for years and decades sounds boring but has help many to achieve financial freedom over time.

Cryptocurrencies and the related topic of DeFi do show some promise in transforming the financial services industry, but this may also be overestimated in the short run. A full discussion on the topic is complex and beyond the scope of whether it can serve a role in portfolios today. A proper explanation would involve the blockchain, smart contracts, NFTs, hashing algorithms, energy consumption, financial theories and more.

Investing in Crypto and Blockchain Technology Over Time

In short, trading cryptocurrencies and related tech because prices have risen is quite different from investing in its transformative (long term) potential – a distinction that parallels the 90s tech boom. Many agree that these technologies are still in their infancy and their best uses may take years to materialize.

There is nothing wrong with either approach, per se, as long as it is done in a way that enhances the risk/reward of an appropriate portfolio. Even if a financial asset is speculative in nature, it can still play a role in a well-diversified portfolio, albeit in small amounts.

From a disciplined investor’s standpoint – whether or not one believes decentralized finance will change the world – cryptocurrencies and related investments are simply assets with specific characteristics and may be here for the long run. The question of whether and how much to invest in these assets should be no different than deciding on any individual stock, bond, currency, commodity or investment theme. We typically advise investors to follow the rule of thumb to not deploy more than 5-10% of one’s liquid net worth in an individual security.

Below are three insights that can help investors think about new assets in terms of their overall portfolios.

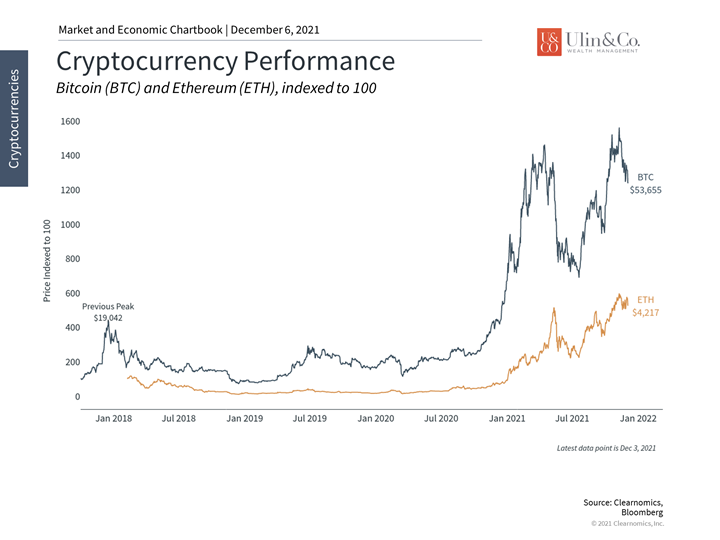

1 Cryptocurrencies have risen but can swing wildly

Cryptocurrencies have seen a spectacular rise over the past year. However, they have also experienced wild swings that would challenge even the most patient investor.

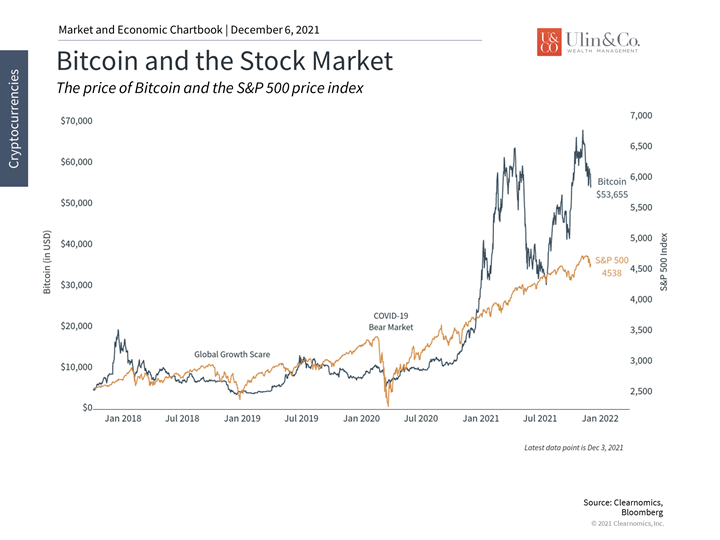

2 Bitcoin is many times more volatile than even the S&P 500

From a portfolio perspective, cryptocurrencies like Bitcoin often move with the broader market but in an amplified way. In other words, cryptocurrencies have not acted as a hedge in recent times.

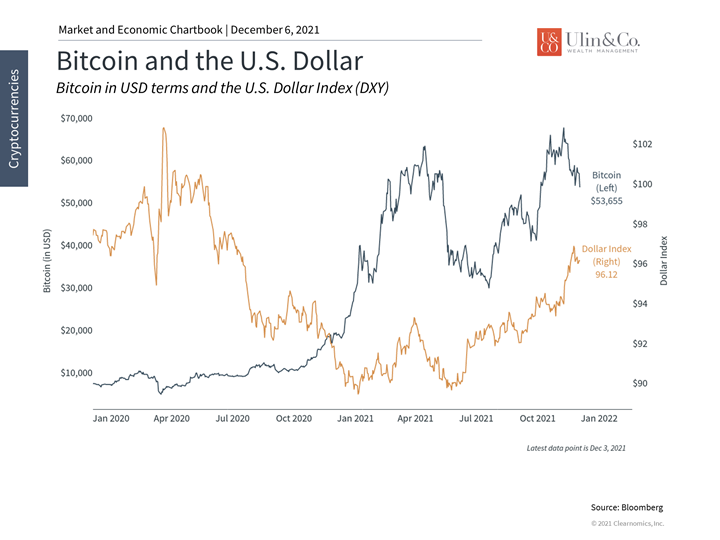

3 Bitcoin also hasn’t moved with the dollar in a simple way

Bitcoin has also not moved in a strongly correlated way to the U.S. dollar, despite arguments that it can act as a hedge. Only time will tell if this relationship strengthens as the market matures.

The bottom line? Investors ought to stay focused amid the hype surrounding cryptocurrencies and related investments. While these assets can play a role in portfolios, they should complement other diversified holdings.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), and it advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.