Crypto FTX Contagion to Tech Transformations

Whether or not one believes decentralized finance will change the world like tech innovations have over the past couple decades after the FTX Contagion, be prepared that crypto, blockchain and related enterprises are simply a newer evolution of tech, assets and digital platforms with specific characteristics that may be here for the long run.

The question of whether and how much to invest in these assets should be no different than deciding on any individual stock, bond, currency, commodity or alternative investment, from real estate, art, wine, music rights, fine jewelry to classic cars.

Trading crypto, blockchain and related tech in the short run because you want to make a quick buck like in Vegas is quite different from investing in its transformative (long term) potential – a distinction that parallels the 90s tech boom, dotcom bust and then moderate growth over time with more defined balance sheets and proof of concept than a sock puppet. Many agree that these crypto technologies are still in their infancy and their best uses may take years to materialize and become a wee-bit more regulated.

Mirage of Coins

While most crypto tokens rode the wave up and then quickly back down from the 2020 pandemic through this month, a crypto- “warning shot” was fired off earlier this year from the remarkable collapse and $60B loss of the stablecoin known as terraUSD, or UST, and its sister token luna.

More recently we were provided the even more amazing story and Lehman Brothers-if not Madoff typed debacle of Sam Bankman-Fried’s (known as SBF) crypto exchange FTX and self- branded (FTT) coins that went from zero in 2019 to over a $32B empire earlier this year to bankruptcy court. The fallout in our opinion may have been plagued from a combination of the overall crypto implosion, huge leverage in the billions, risky investments and lack of accountability and oversight. I would not be surprised to see Bitcoin tank another 25% to 40% from the SBF fiasco from more panic selling, if not the US Gov. wanting to get involved in the crypto auditing and industry oversight.

It’s a bit amazing that SBF’s personal enthusiasm like a “Wolf of Crypto” put the FTX logo on the Miami Heat’s South Florida stadium while attracting millions of investors to his Bahamas based sanctuary driven in part by by FOMO (fear of missing out) to get on board and get rich. Sam attracted the likes of Tom Brady, Kevin O’ Leary, the Ontario’s Teacher Pension Plan, Black Rock and more -while SBF was on the road raising awareness like a Taylor Swift concert tour, even landing at the Boca Raton Hotel Futures Industry Conference.

5 Lessons Learned from FTX

The FTX collapse provides harsh reminders to investors of all ages that (1) “there is no such thing as a free lunch” when investing (2) only invest what you are willing to lose 100% (3) remove emotions and greed when investing (4) do your homework up front and (5) Don’t invest in something because of a friends post or a celebrity endorsement

Jon here. When pro-athletes, celebrities and media personalities are pitching crypto and related companies in TV commercials like a new hot viral dance trend on TikTok, or something that will significantly change your life, prudence and skepticism should be taken before investing a dollar.

Through the ongoing stock market crash, it may seem fashionable and intriguing to invest in something “off the grid” that many younger investors see as something a bit more intriguing than growing wealth over years and decades in the traditional stock market inside and outside one’s 401(K) or other type employer retirement plan.

Still, regardless of one’s views on crypto and the future of decentralized finance since the crypto FTX contagion debacle, it’s important to maintain diligence and construct portfolios properly to minimize risk while benefiting from trends. Start out by following the rule of thumb to invest 15% of every paycheck for your retirement in a traditional portfolio and then defer if you wish to more speculative assets to no more than 5% to 10% of your liquid net worth. Even if a financial asset is speculative in nature, it can still play a role in a well-diversified portfolio, albeit in small amounts.

Amara’s Law and the Future of Crypto

There is a common saying that “we tend to overestimate the effect of technology in the short run and underestimate the effect in the long run.” This quote, often referred to as Amara’s Law, is as relevant today as it was during past technology revolutions.

With growing investor enthusiasm for crypto, blockchain, decentralized finance (DeFi) and similar advancements, long-term fundamentals are often thrown out the window in favor of short-term gains.

The dot-com bubble of the late 1990s is the perfect example of Amara’s Law. The popularity of tech stocks was, in hindsight, driven by the expectation of ever-rising stock prices. However, there was also the idea that the internet and software would be transformative, thereby justifying lofty valuations. This view was eventually proven to be correct, but this transition took place over decades – not days or weeks – and also not in the way that many expected. Since then, this has occurred in many other industries including innovation in biotech, energy, and more.

These lessons are widely applicable today. While speculation – i.e., trading with the goal of making short-term Vegas-like profits – may have some place in a portfolio, it is long-term investing that has historically created financial success. The difference, of course, is that speculation is exciting and get-rich-quick stories naturally attract attention. Investing for years and decades sounds boring but has help many to achieve financial freedom over time.

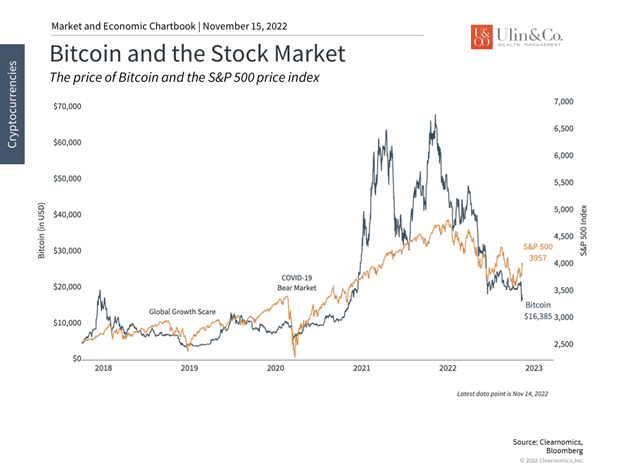

Cryptocurrencies, including Bitcoin, have plummeted

Time will Tell

One important difference between now and the early 2000s tech bubble to industry transformation is that many tech companies are not only profitable but have long-established business models. This is in contrast to the dot-com crash when some highly valued internet companies were backed by little more than promises. In fact, today’s tech companies span many sectors beyond Information Technology. Amazon, for instance, is categorized under Consumer Discretionary while Alphabet (Google’s parent company) falls under Communication Services. Technology has driven growth across all other sectors from Energy to Health Care.

Unfortunately, profitability and adoption are still open questions for the most hyped parts of tech. Blockchain and cryptocurrencies, for example, have struggled due to falling coin prices and, more recently, the collapse of FTX and other companies. While the full saga is beyond the scope of this discussion and the situation is still evolving, it can be summarized by overexuberance among investors on the one hand, opaque financial leverage on the other, combined with alleged illegal practices across FTX, Alameda Research and other related companies. Regardless of one’s views on crypto and the future of decentralized finance, it’s important to maintain diligence and construct portfolios properly to minimize risk while benefiting from trends.

Thus, the current market environment with both tech and crypto beaten down highlights the aftermath of valuations becoming detached from reality. In both good and bad markets, the question of whether and how much to invest in any asset, whether it’s a blue-chip stock, cryptocurrency, hyped tech stock, or a Treasury bond, depends on the risk and return characteristics relative to a balanced portfolio. While shake-ups are occurring in the tech space, the need for diversification and proper portfolio allocation, ideally with the guidance of a trusted advisor, have not changed.

The bottom line? With challenges among tech companies and in the crypto space in the headlines from the crypto FTX Contagion,, investors ought to stay focused on the long run and maintain proper portfolio allocations across sectors.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetically used for illustrative purposes only and do not represent any actual investment.

The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), IFP Securities LLC, dba Independent Financial Partners (IFP), and its advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment

objectives, financial situation, or needs of individual investors. This report may not be reproduced, distributed, or published by any person for any purpose without IFP’s express prior written consent.