Corporate Earnings Matter to the Bull Market

As the corporate earnings season kicked off in October, it’s important to consider not only how companies are doing, but also how far they have come over the past decade. This is because, for long-term investors, there’s nothing more important than economic growth and its impact on corporate profits.

Over the long run, the stock market tends to follow the direction of earnings which, in turn, is driven by the economy. Rising profitability makes companies more attractive and, over time, causes their stock prices to rise. Even when there is significant market volatility and investors are fearful, steadily rising earnings can serve as a foundation for market recoveries.

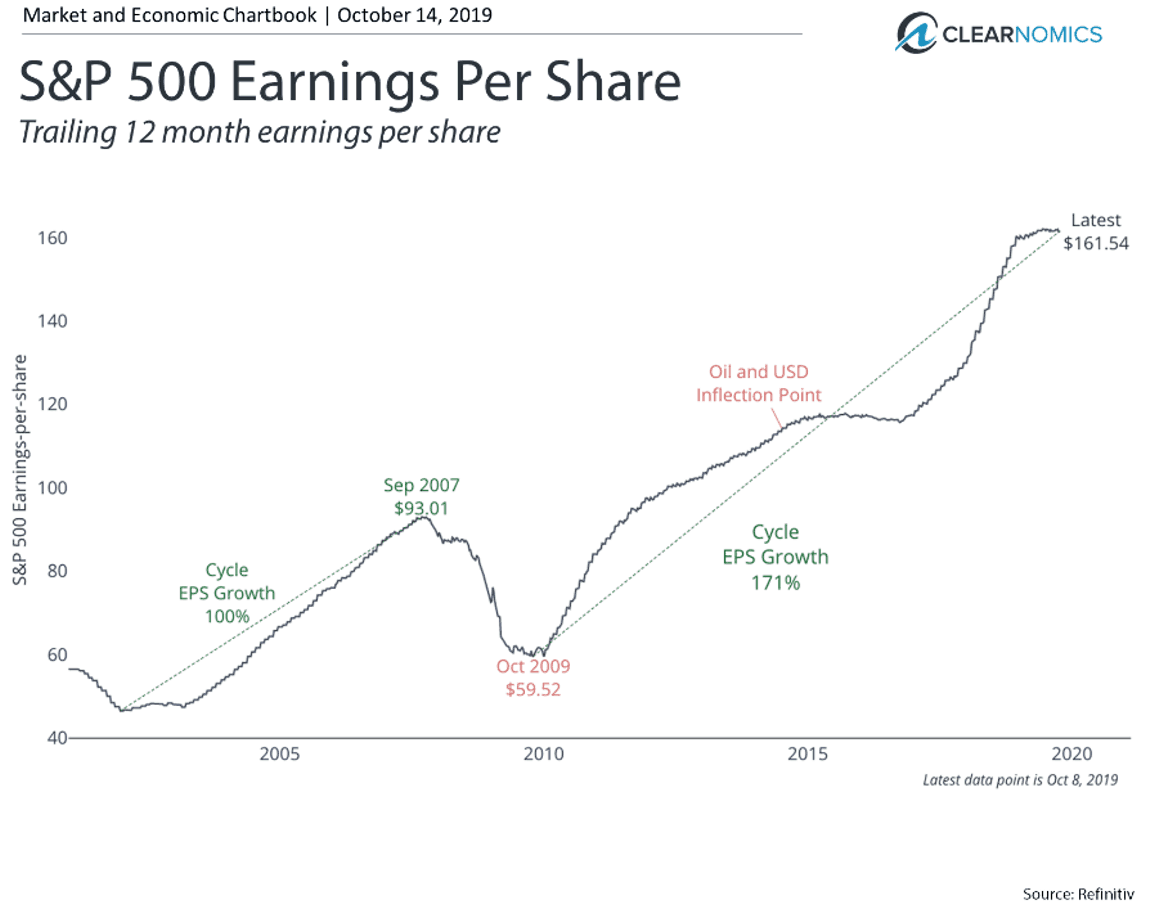

This has certainly been the case over the past ten years. Investor fears over a wide range of problems – from the U.S. debt ceiling to the Eurozone crisis – resulted in significant market volatility. However, healthy growth in the economy and profits helped to stabilize markets once the headlines passed. In total, the S&P 500’s earnings-per-share has grown by over 170% since 2009 (shown below). To put this another way, large companies are 2.7 times more profitable than just a decade ago.

However, now that the business cycle is the longest in U.S. history, corporate earnings growth is slowing. At the moment, consensus forecasts provided by more than a few investment companies in the news suggest that S&P 500 earnings-per-share will grow by less than 1.8% in 2019. It’s important to note that these forecasts don’t imply that corporate earnings will actually shrink – only that they will grow at a slower pace.

The slowdown in profits was generally expected by analysts over the past year and can be attributed to a broad deceleration in global economic conditions, which includes factors such as the U.S.-China trade talks. While consensus forecasts provided by many investment companies in the news are also predicting an acceleration in growth to over 10% next year, whether this happens will depend on how these issues play out.

Thus, there are two key trends tied to these issues that will evolve over the course of quarters and years.

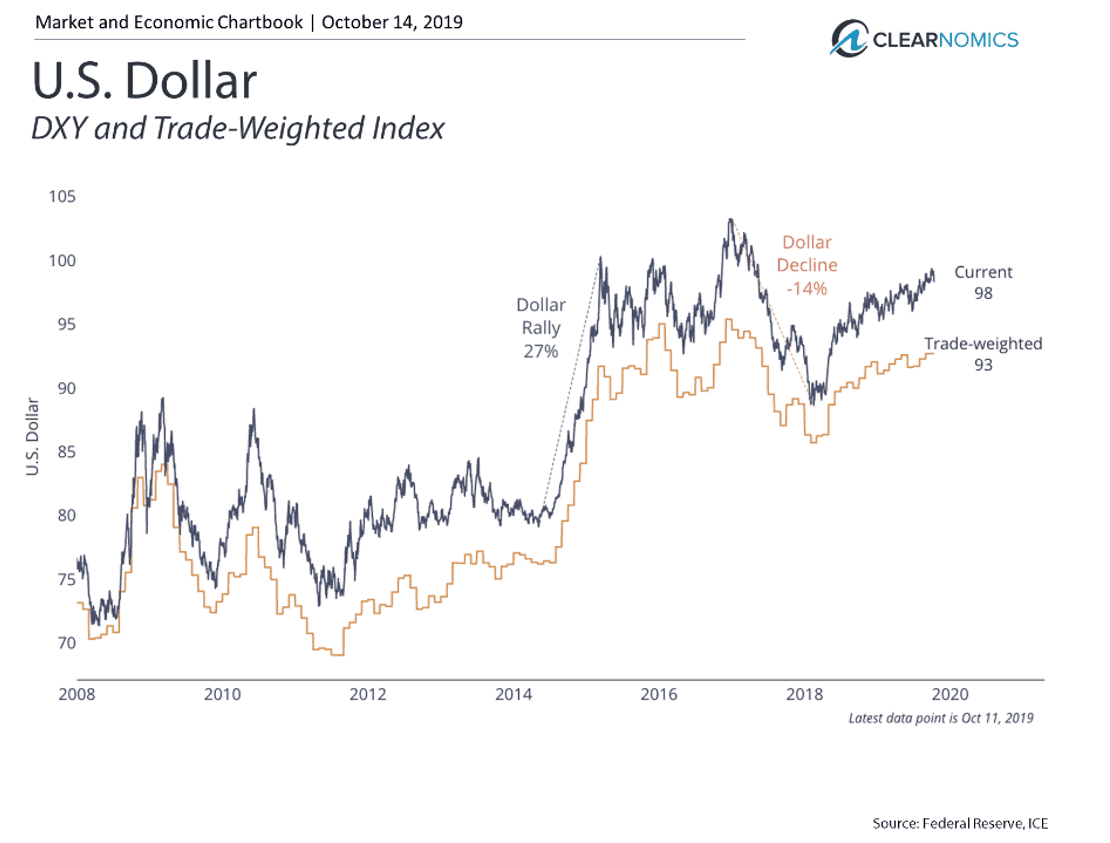

The first is the value of the U.S. dollar. When the dollar is strong, as it is now, earnings growth is often weaker since the goods and services of U.S. companies are effectively more expensive for foreign companies and consumers. Thus, the level of the currency can act as a drag of profitability, at least in the short run.

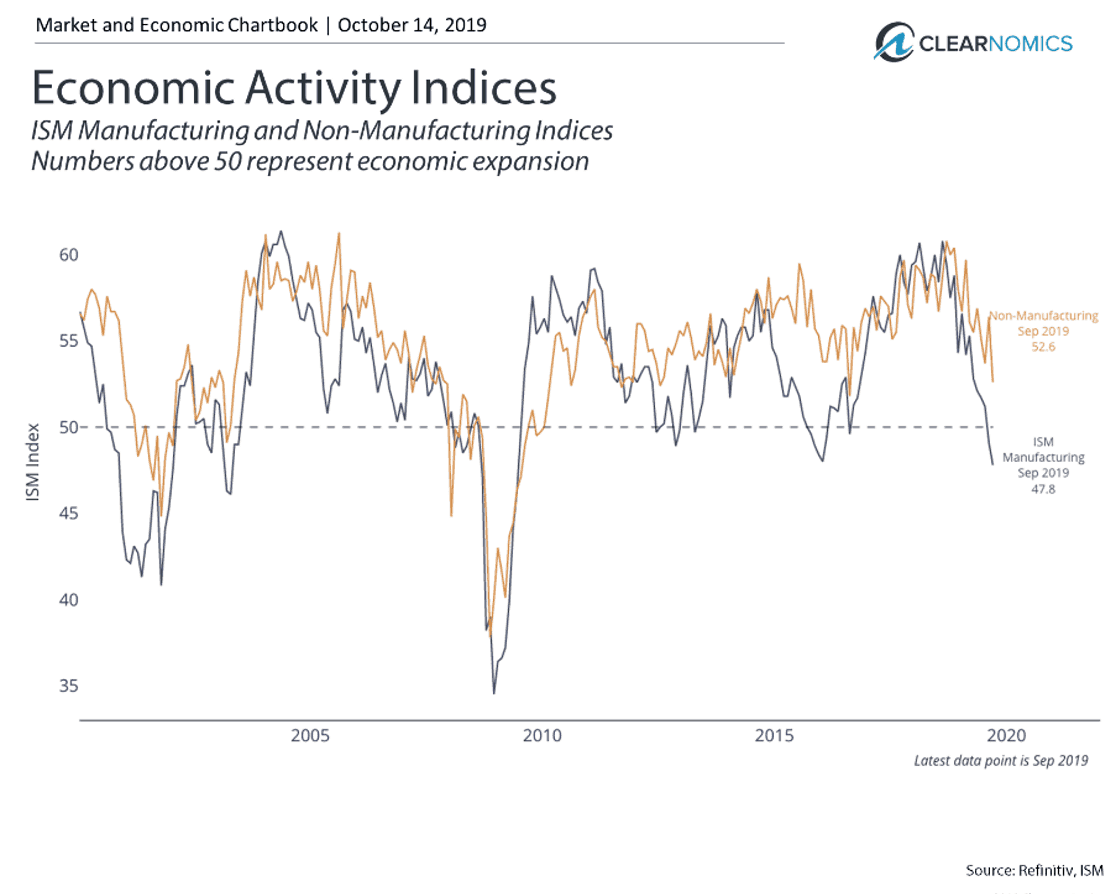

Second, the manufacturing sector saw a reduction in activity over the past couple of months (shown below). Part of this impact is related to on-going trade disputes, especially since non-manufacturing activity is still growing at a healthy pace. Whether manufacturing rebounds, especially if there is more stability in trade relations, will directly affect the path of corporate profits.

Ultimately, it’s important to remember how far the economy and corporate profits have come. Together, they have propelled the stock market through the longest bull market in history and have generated significant returns for long-term investors. With the economy still healthy, even earnings growth around the historical average of about 7% (multpl.com) in the coming years could help to support market returns.

Here are three charts on this important topic:

1. Earnings growth has slowed but is still healthy

Earnings growth has slowed over the past year, as highlighted in the chart above by the flatter earnings trend. However, this chart also shows how far earnings have grown over the past decade. With earnings-per-share now over 170% higher than in 2009, corporate profitability has been a driving force in rising stock prices.

2. The strong dollar could reduce earnings growth

The stronger U.S. dollar has dragged on corporate earnings growth over the past year and could continue to do so if the currency remains strong. This is because a stronger dollar makes it more difficult for U.S. companies to sell to foreign markets. When the dollar is strong, U.S. goods are effectively more expensive for businesses and consumers who use other currencies. This had a significant impact on earnings in 2015 and 2016 when the dollar rose significantly.

The good news is that slow and steady moves in the dollar give companies time to adjust. In other words, uncertainty in the value of the dollar can be worse than steady strength.

3. Manufacturing activity is decelerating as well

By some measures, manufacturing activity has not only slowed, by may have even shrunk in recent months. This is yet another symptom of slowing economic conditions globally and is a direct impact of on-going trade disputes.

Still, the underlying U.S. economy is fundamentally healthy. Unemployment is now at 50-year lows and non-manufacturing is still rising steadily. This suggests that if global economic issues such as the U.S.-China talks are resolved, the economy may be able to get back on track.

What’s the bottom line? While corporate earnings may be slowing, they can still grow at a healthy pace in the coming years. Long-term investors should have reasonable expectations around the pace of growth and should hold appropriately balanced portfolios.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com. Get Started Today.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss.

The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), IFP Securities LLC, dba Independent Financial Partners (IFP), and its advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. This report may not be reproduced, distributed, or published by any person for any purpose without Ulin & Co. Wealth Management’s or IFP’s express prior written consent.