Corporate Earnings May Drive Powell’s Hole in One

Bull markets climb a wall of worry; bear markets slide down a river of hope. -Anonymous, 1950

“The time has come for policy to adjust” was a noteworthy phrase from Jerome Powell’s mouth at the recent Jackson Hole Symposium that “the direction of travel is clear” regarding upcoming rate cuts. The Fed finally has confidence that the disinflation progress is working now that PCE inflation is down to 2.62% and within a stones throw of their 2% goal.

While the prospect of a Fed “hole-in-one” soft landing seems within reach, Powell is continually following the Regan motto of Russian origin to “trust but verify,” as taking action to start a new historic easing process will depend on incoming data points, the evolving outlook, and the balance of risks. If a major black swan specter does not show up in September or October to spook the economy and inflation, Powell may be regarded as a hero for achieving one of very few soft landings in U.S history.

Will we soon be partying like it’s 1995 when Fed Chair Alan Greenspan began cutting the Fed funds rate? The 1995 rate cut cycle coincided with disinflation and an economic soft landing that, importantly, did not morph into a recession. There are enough similarities that the [1995 cycle] could provide a potential roadmap for corporate earnings and equity prices in the coming year that we will cover in detail below.

Jon here. Whether we get a soft or hard landing or periodically land in a correction sand trap, we keep reminding our clients that cash has consistently underperformed core fixed income over time, emphasizing the cost of not being fully invested, especially in bonds as yields on cash will become nominal as rates are cut. The time has more than come for investors to consider whether portfolios are properly allocated for the upcoming rate cut cycle while tech and growth sectors are cooling and the recovery is broadening.

September Effect

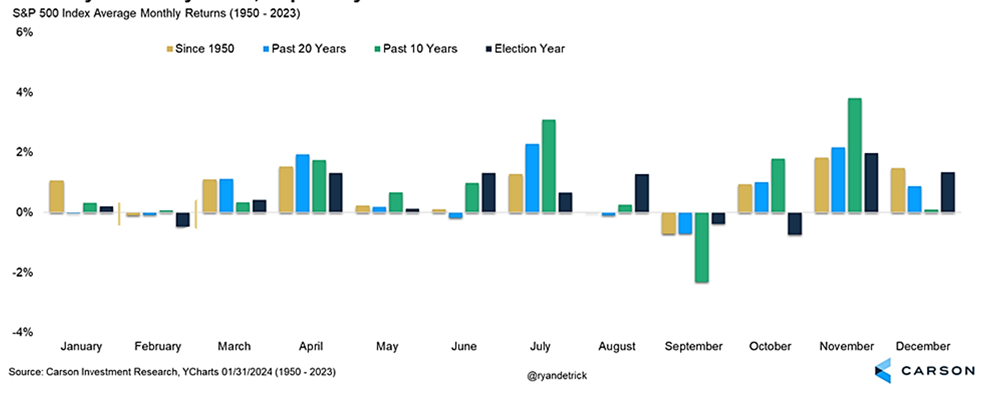

“Sell in May and go away,” is a popular adage referring to the historically weaker performance of stocks from May to October compared with the other half the year. The past three years have been difficult for investors through the spooky September and October months, otherwise the 2022 crash.

Historically, September has been the worst month of the year for the stock market. (see chart) In fact, the market has declined so consistently in that particular month that the phenomenon is called the “September Effect.” In fact, the S&P 500 has declined in 7 of the 10 Septembers since 2014, or 70% of the time (Nasdaq). Yet, September has only had a mild draw down in election years (about 1%) followed by a historically strong November and December, once the dust settles and investors have a better grasp of the newly elected U.S President along with their policies.

Nevertheless, we do not promote market timing as a strategy for long-term investors. Regardless of market history, maxims, tea leaves, hem lines, and tarot cards, investors can use history to their advantage by keeping cash on hand to buy stocks during September or any future month there is a correction.

S&P 500 Monthly Returns Over Decades

Corporate Earnings Safety Net

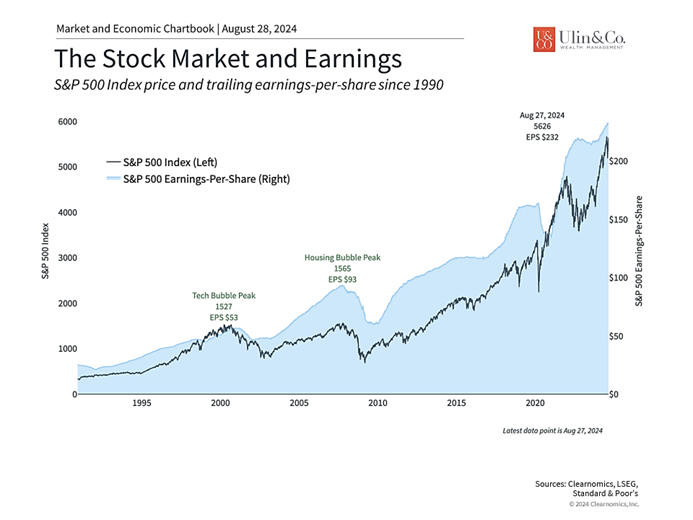

Over the course of market cycles, the stock market tends to mirror the trajectory of corporate profits, rising as the economy grows. This is because shares of a stock represents an ownership claim on a company’s profits. So, while markets can experience turbulence from time to time, a steadily growing economy and rising corporate profitability have historically fueled the stock market.

While markets and earnings do not move in perfect lockstep, they follow similar patterns. The gap between the two accounts for stock market valuations such as the price-to-earnings ratio – i.e., how much investors are willing to pay per dollar of earnings. Valuations have been expensive in recent years, so market pullbacks can be healthy as investors adjust their expectations.

Corporate earnings drive market returns in the long run

Over the past twelve months, S&P 500 earnings have risen to $232 per share, a healthy growth rate of 7.4%. This has accelerated with second quarter S&P 500 earnings rising at a blended growth rate of 10.9%, according to FactSet. If the final numbers don’t change much, this will represent the fastest pace since the end of 2021.

While it’s positive that 79% of S&P 500 companies have reported higher-than-expected earnings, they have only beaten estimates by 3.5% on average. This is partly because S&P 500 revenue growth is below the 5-year average of 5.2%. The direction of sales in the coming quarters will depend heavily on whether consumers and businesses spend more or tighten their belts.

Companies are concerned about consumer spending

This is one reason companies are concerned about the financial health of consumers, especially given the economic swings and rapid inflation of the past few years. It’s no secret that the prices of everyday necessities such as food and housing have remained high. On their latest earnings calls, many companies cited worries about consumers being more budget-conscious with their decisions when it comes to restaurants, vacations, entertainment, and so on. This was echoed by executives from Marriott, McDonald’s, Disney, and more.

On the one hand, the latest consumer spending data came in hotter than expected, showing a 1% month-to-month jump in retail sales compared to expectations of just 0.3%. On the other hand, it’s also clear that savings rates have fallen from their pandemic peaks, acting as a drag on future spending. The accompanying chart shows that much of the extra money from each paycheck that households were able to save in 2020 and 2021 has already been spent. While this has not materially slowed consumer spending just yet, it is a factor that investors and economists have been following for some time.

It’s also clear that consumer sentiment is still poor due to the higher prices of the past few years. The University of Michigan’s Consumer Sentiment index is still well below average. In a recently published financial well-being index from Deloitte, sentiment appeared mixed. Among the highest earners, consumer sentiment is sunny, with 74% of higher income respondents saying their finances have improved in the last 12 months. Among middle- and lower-income earners, however, the outlook is less rosy, with just 61% and 50% of respondents respectively reporting improvement.

Consumer net worth is at record levels

With inflation moving back toward 2%, the Fed poised to cut rates, and markets rebounding, household net worth has reached new all-time highs. (see chart) Over time, the growing value of financial assets could help to support consumer spending and sentiment as well. This is often referred to as the “wealth effect” and, when business cycles are in their expansionary stage, historically drives further growth.

The bottom line? Markets are recovering from the swings experienced just a few weeks ago. Corporate earnings are growing at a healthy pace which supports markets in the long run. Investors should continue to follow these broader trends rather than short-term market swings.

For more information on our firm or to request a complementary investment and retirement check-up with Jon W. Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

Note: Diversification does not ensure a profit or guarantee against loss. You cannot invest directly in an index.

Information provided on tax and estate planning is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that are believed to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as NewEdge Advisors, LLC does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.