Consumers Driving Inflation and the Economy

The decelerating, yet still robust jobs and consumer spending reports have effectively counteracted the Fed’s swift rate hike medicine to deter a great recession despite lingering higher prices along with near 7.5% 30-year mortgage rates and 7%-11% lines of credit and SBA loans that we have not seen since 1999 before the dotcom bubble burst.

While CPI gravitated slightly up to 3.2% in July, the now lower 4.7% year-over-year “core” CPI rate, which strips out food and energy prices, is still more than twice the Fed’s 2% target. As shelter/living costs encompass the largest chunk of CPI and core CPI, it will take quite some time to cool off to the Fed’s goal.

Recent increasing oil and energy prices fueled by Russia and other OPEC+ members aggressive pledge to slash output through the end of 2024, along with America’s dependency on foreign crude, may further curtail the Fed’s goal to curb inflation.

Consumer Spending Patterns

Jon here. We are in a steadfast cycle because as long as we continue to pay higher prices for goods and services partly fueled by wage inflation and a glut of cash in the system, inflation will remain stubbornly high, and the more likely the Federal Reserve will continue to hike rates, or at the very least not cut them for the next 12 months or so. Suffice to say, the bear is not quite out of the woods just yet to give the “all clear” sign despite many positive economic indicators though we do foresee a soft landing over time as is the consensus.

Consumers have been an engine of economic growth over the past three years and play a critical role in the economy by engaging in spending and consumption activities. the strong labor market and manageable debt service levels have supported consumer driving inflation and the economy forward Their spending patterns can have a significant impact on economic growth and can potentially help avoid a recession while at the same time add to inflation. Consider that retail sales help determine whether the U.S. enters a recession or not as consumer spending accounts for nearly 70% of GDP. Consumer spending affects three areas of economic growth.

Economic Stability: Consistent consumer spending provides a level of stability to the economy and for global trade. When consumers maintain their spending habits, it can help prevent sudden drops in demand that could trigger a recession.

Confidence Effect: When consumers feel confident about the economy, they are more likely to make purchases, whether it’s buying goods, investing in stocks, or purchasing real estate. This increased consumer confidence can stimulate business investments and overall economic growth and job creation.

Multiplier Effect: Consumer spending has a multiplier effect on the economy. For example, if a consumer buys a car, it not only benefits the automobile manufacturer but also the suppliers of car parts and semiconductor chips, dealerships, insurance companies, and more.

Personal Savings Patterns

Despite the economic uncertainty of the past year, everyday individuals and households have been resilient coming out strong and awash with cash from the pandemic. Consumer spending has remained steady in the face of high inflation, rising interest rates, housing market challenges, and layoffs in sectors such as tech that got hard-hit in Q1.

While it has helped that the recession anticipated by many investors and most economists in January has not materialized, this fact is partially due to the strength of consumer finances as we discussed above. Consider how consumer balance sheets look today, and how this might impact the economy and the stock market in the coming year.

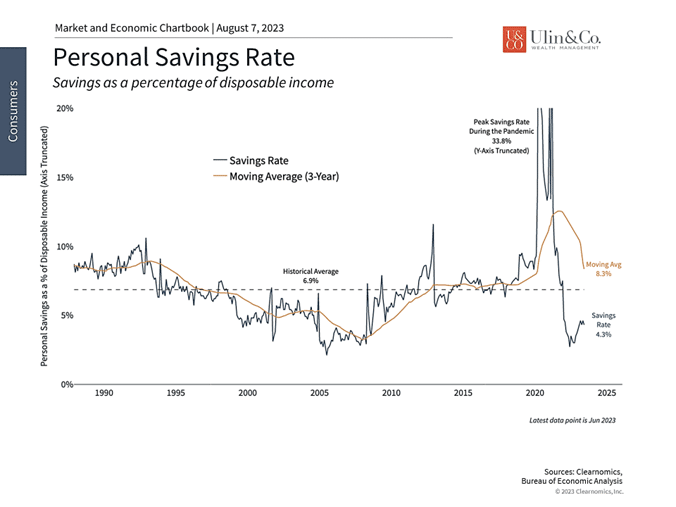

Personal savings have helped cushion consumer finances

During the pandemic, consumer spending plummeted which led to record savings rates from early 2020 through much of 2021. (see chart) At its peak, consumers in aggregate saved over one-third of their paychecks, an unprecedented rate that is seven times the historical average. Although this occurred under difficult personal and financial circumstances, these savings shored up consumer balance sheets and created a cushion for the inflation that came later. Government stimulus checks through measures such as the CARES Act also helped consumers make important purchases and pay off debts.

Since then, savings rates have fallen as consumers have spent more dining out, attending events, and on other services. Still, as shown in the accompanying chart, the trend over the past three years is well above average with individuals saving 8.3% of their disposable income. This is often viewed in terms of “cumulative excess savings” – i.e., the total dollar amount that individuals have saved beyond what they typically might – a figure that rose to $2.1 trillion at its peak.

Since mid-2021, these excess savings have fallen as spending has picked back up, declining by $1.9 trillion. Automobile sales have recovered, dining activity is 23% above pre-pandemic levels, and travel activity has jumped this summer with almost 2.6 million travelers per day. While this spending shrinks financial cushions, it also supports economic growth.

Some investors fear that this trend could result in economic problems in the coming quarters. While there could be a slowdown in consumer spending, this isn’t guaranteed. History shows that there have been long periods during which consumers saved very little, including throughout the mid-2000s. While it’s prudent for consumers to save more from a financial planning perspective, the reality is that savings rates have fluctuated significantly over time – in both good and bad economic environments.

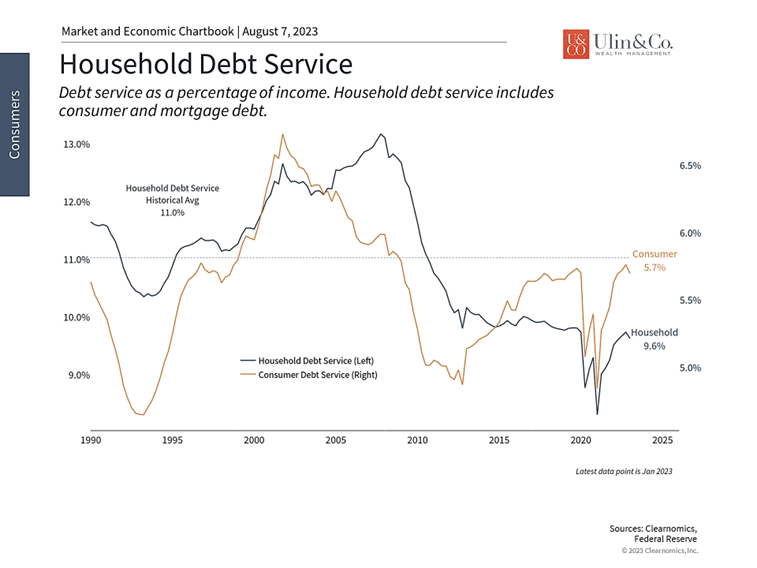

Household debt service has risen but is still historically low

Additionally, trends such as wage growth due to the strong job market could support both spending and savings. The latest report from the Bureau of Labor Statistics shows that wages rose 4.8% year-over-year. While this has generally been slower than inflation, hourly earnings are still rising at their fastest pace in 40 years. This is happening at a time when the national unemployment rate, at 3.5%, is near historic lows. Job openings have fallen to 9.6 million, but this still represents 1.6 openings per unemployed person across the country.

Other trends have helped to support consumer finances, including the steadily growing economy and this year’s market rally. While household net worth has not yet recovered to its pre-pandemic peak, it reached $150 trillion at the start of the year according to the latest report by the Federal Reserve on the Financial Accounts of the United States.

This is partly because while the aggregate levels of household debt are high across student loans, auto loans, credit cards, etc., what households pay every month is still at reasonable levels. As the chart above shows, debt service levels, with and without mortgage payments, are still below average at 5.7% and 9.6% of incomes, respectively. (see chart) This is even more true when compared to highly levered periods such as during the housing bubble when debt service ratios were above 13%. Rising interest rates will likely worsen this picture, but this might happen steadily as homeowners benefit from mortgages that were locked in at much lower rates.

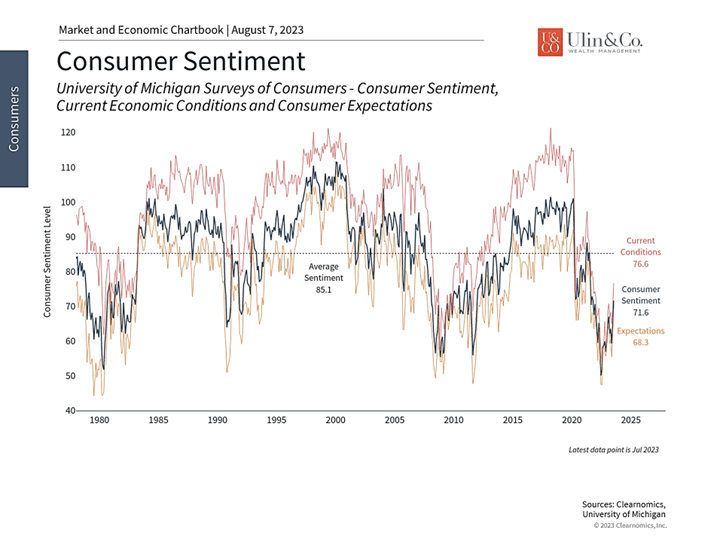

Consumer sentiment is only slowly improving

Of course, how consumers feel can differ from their financial pictures, especially as they look to the future. Consumer confidence, as measured by the University of Michigan Survey of Consumers, has suffered over the past year due to inflation and economic uncertainty. (see chart) Fortunately, this is slowly improving as the economy stabilizes. According to the same survey, consumers expect inflation of 3.4% in the next year which could then decline to 3% over the next 5 years. While these represent high inflation rates, they are far better than what many had feared even just six months ago.

The bottom line? Consumers have been an engine of economic growth over the past three years. Although savings rates have fallen, the strong labor market and manageable debt service levels have supported consumer spending and the broader economy. From a financial planning perspective, investors should continue to save appropriately, ideally with the guidance of a trusted advisor, to achieve their long-term goals.

For more information on our firm or to request a complementary investment and retirement check-up with Jon W. Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

Note: Diversification does not ensure a profit or guarantee against loss. You cannot invest directly in an index.

Information provided on tax and estate planning is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), and it advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.