Consumer Spending Drives Stocks

In the dance between consumers and prices, the economy finds itself in a curious limbo, akin to a ship caught in the doldrums, neither propelled forward nor dragged back by the winds of inflation and interest rates. It’s a peculiar treading of water, where the ripples of consumer behavior seem to dictate the currents of economic momentum more so than ominous headlines driving short term human and ai/ quant volatility as we experienced last month.

There’s some positive news on the inflation front, but it’s likely to offer little comfort to most American’s perception. As discussed in today’s MarketWatch headline, “There’s more good news on inflation.” Purchasing power for the average household increased from 2019 to 2024 at the same or slightly greater clip with goods and services prices- according to a new report from the Congressional Budget Office. This illustrates that inflation may have had less of an impact on households’ bottom lines than months of sticker shock on everything from Big Macs to daycare might suggest.

Still, even in the face of a hawkish “higher for longer” Fed and the ominous warnings of an inverted yield curve, investors remain buoyant as well, riding high on the wave of cash paying a 15-year high rate near 5%a as the bull market keeps advancing, now in its second year. It’s a paradoxical phenomenon, where the dire warnings of economic pundits seem to fall on deaf ears as the allure of profits outweighs the specter of financial peril.

Supply and Demand

In this delicate balance, inflation emerges as the wild card, a capricious force driven by the whims of the service sector. From landscapers, child caregivers, restaurant owners, to even professional photographers capturing our lives, service-based businesses wield the power to dictate prices with impunity. They swiftly increased their rates over the past five years, confident that consumers will continue to foot the bill without protest.

With the service sector comprising a whopping 70% of the economy, it operates as a colossus, impervious to the ebb and flow of the Fed’s interest-rate maneuvers. Only a widespread downturn in demand can sway its course, a rare occurrence in the turbulent seas of consumer spending.

On the flip side, goods producers find themselves in treacherous waters, encountering a hostile reception when attempting to raise prices. From the hallowed aisles of Lowes to other bustling retailers, key intermediaries stand as gatekeepers, blocking the path to exorbitant price hikes. The hard-earned lessons of the past, gleaned from the tumultuous aftermath of the 2008 financial crisis, loom large in the collective memory of U.S. companies. They’ve learned the bitter truth that customers are quick to flee at the first sign of inflated prices.

Yet, amidst the chaos of the pandemic, a curious transformation took hold. Firms seized newfound pricing power, capitalizing on the willingness of consumers to shell out for scarce goods and services. It was a seismic shift, a departure from the established norms, where price hikes were once met with scorn and resistance.

In this delicate dance of supply and demand, consumers hold the reins, guiding the trajectory of prices, economic growth and corporate earnings. As the economy teeters on the precipice of uncertainty, caught between the twin specters of inflation and interest rates, it’s the whims of the consumer that ultimately dictate its fate.

Earnings Guide Investors Through Turbulent Times

With markets nervous about stubborn inflation, a gradually slowing labor market, and the timing of the first Fed rate cut, investors are more focused on this corporate earnings season than usual.

This is because while the economy has avoided a “hard landing” corporate earnings only began to rebound in the second half of 2023. Since the stock market tends to follow the trajectory of earnings in the long run, many investors are hoping for signs that corporate profits will grow sustainably in the coming quarters.

With 92% of S&P 500 companies having reported their first quarter earnings results, the trends are positive. According to FactSet, 78% of large cap companies had positive earnings-per-share surprises last quarter which is better than the 10-year average. Blended earnings growth is coming in around 5.4% year-over-year, the highest in almost two years, making this the third straight quarter of earnings growth.

On a full-year basis, the consensus estimate for S&P 500 earnings in 2024 is now $239 per share according to LSEG data. If this is achieved, it would represent a 10.2% increase from last year. Wall Street analysts also expect continued growth of 14.0% and 11.7% in 2025 and 2026, respectively. The hope of an earnings rebound is one reason the stock market has rallied over the past year, driving up valuations.

Thanks in part to steady earnings growth, the S&P 500 is now only about half of one percent below its all-time high. In this environment, there are three key points long-term investors should keep in mind.

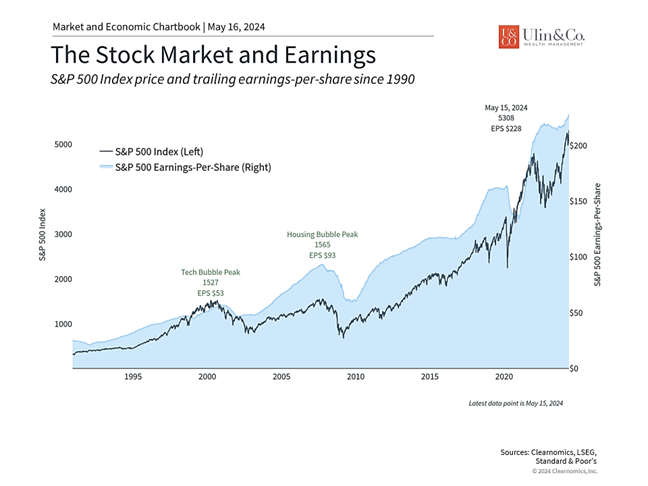

Earnings growth supports the stock market over time

First, while investors focus a great deal on topics such as inflation, the job market and GDP, investors do not directly invest in the economy. Issues such as the impact of higher interest rates, a slowdown in the labor market, or a “hard landing,” affect investors through the financial performance of companies. In turn, this affects stock prices which then impact the overall market and investor portfolios.

The accompanying chart shows that while they do not mirror each other exactly, there is a strong relationship between corporate earnings and the stock market. The stock market tends to follow the trajectory of earnings, with differences between the two lines the result of changes in stock market valuations and investor sentiment.

This is why economic cycles matter for long-term investing: when the economy is growing and consumers are strong, company sales tend to improve. Conversely, spending tends to slow during economic downturns, hurting corporate profits. For investors, focusing on these longer-run trends is far more important than trying to guess what the market might do over a day, week or month.

These dynamics can also impact how markets behave during pullbacks. If the market does experience a decline when the economy is otherwise strong, valuations will grow more and more attractive. Eventually, investors will find it appropriate to add to their portfolios, helping to stabilize the market. In contrast, market pullbacks are much more challenging when they are the result of economic challenges such as recessions. This is why bear markets have typically only occurred when there has been a significant recession or economic shock.

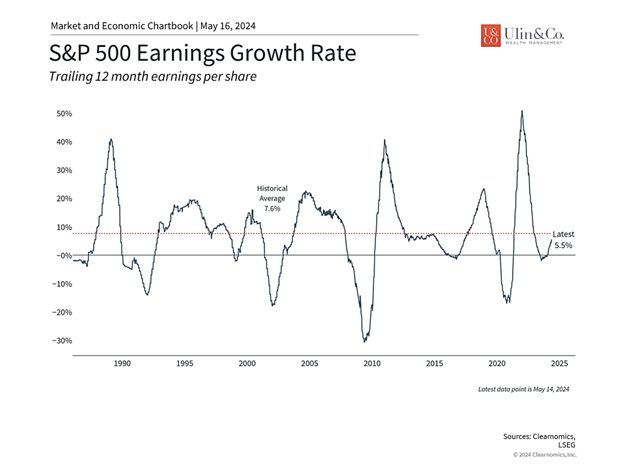

Earnings growth reached an inflection point last year

Second, as the accompanying chart shows, the growth of corporate profits reached an inflection point last year and has begun accelerating again after struggling in 2022. While the economy avoided a recession that year, the stock market did enter a bear market partly because there was an “earnings recession” among large cap companies. While the historical average earnings growth rate is 7.6% since the mid-1980s, earnings growth tends to fluctuate in cycles tied to the business cycle and shorter-term industry trends.

Earnings growth rates also affect whether the stock market appears “cheap” or “expensive.” The price-to-earnings ratio, for instance, is simply the price of a stock or index divided by some earnings measure, such as expected earnings over the next twelve months. What this means is that even if prices don’t change, increasing earnings will make the market more attractive, and vice versa.

Of course, stock market prices have risen significantly over the past 18 months. The current S&P 500 price-to-earnings ratio is just under 20 times next-twelve-month earnings partly due to the strong bull market rally pushing up the numerator, and partly because earnings growth is only now supporting the denominator. So if earnings growth does continue to accelerate, valuation measures such as the price-to-earnings ratio could improve.

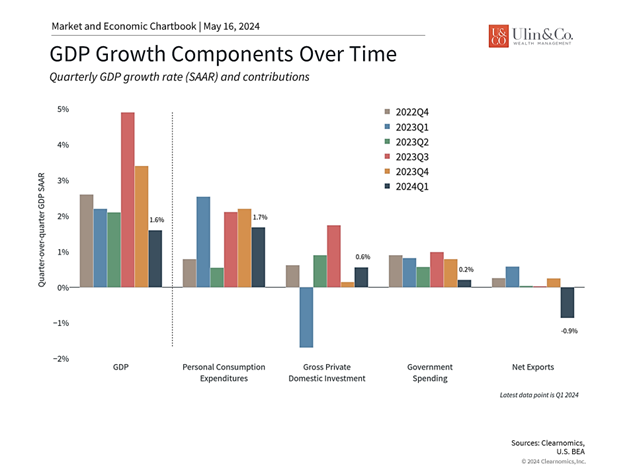

Economic fundamentals remain strong

Third, concerns over a recession or “hard landing” have moderated in recent quarters. According to FactSet, the term “recession” showed up in only 100 transcripts of earning calls of S&P 500 companies compared to 302 a year ago. This is the fewest number of mentions in two years and mirrors the improving sentiment across financial markets. Fed funds futures, for instance, are now anticipating mild rate cuts this year compared to the start of this year when many investors expected the Fed to cut rates rapidly in response to a possible recession.

The bottom line? The latest earnings figures show that companies are performing well, driven by continued consumer spending, which is a positive sign in this uncertain market environment. In the long run, investors should focus more on trends around economic fundamentals such as earnings than on day-to-day stock moves.

For more information on our firm or to request a complementary investment and retirement check-up with Jon W. Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

Note: Diversification does not ensure a profit or guarantee against loss. You cannot invest directly in an index.

Information provided on tax and estate planning is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that are believed to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as NewEdge Advisors, LLC does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.