2020 Vision- Market Outlook

Bull markets are born on pessimism, grow on skepticism, mature on optimism, and die on euphoria, according to Sir John Templeton. The time of maximum pessimism is the best time to buy, and the time of maximum optimism is the best time to sell.

While we may be somewhere on the “back nine” of the current economic expansion, investors are cheering last year but don’t yet appear to be at the “euphoria” stage. Yet many people of all ages seem to be stuck in 1st gear in the skepticism stage, fearful to invest for their financial future.

We are all wired to think we’re making smart decisions. Even if you aren’t sure where you’re going, your gut can provide valuable assurance. But when it comes to investing, the best behavior is often the opposite of what your gut is telling you.

2019 Recap

2019 was one of the best years of the current market cycle, capping the first decade in U.S. history without a major market crash. Yet, there is a technicality to be aware of that visually inflated last year’s results.

Because 2018 ended near the market lows, a significant part of 2019’s return was simply returning to previous levels. From the 2018 peak to the end of 2019, the U.S. stock market gained just 10%. While this is still a terrific return, it’s not quite the 28% S&P 500 price return number that will be discussed in the news. (see below.)

The unavoidable truth about investing is that there are always reasons to be worried. All of the recent investment gains in 2019 happened despite negative headlines and investor concerns all year long.

Despite constant worries around the Fed, trade wars, impeachment hearings, Brexit, and geopolitical issues, investors who stayed disciplined were rewarded in the end – especially those who stayed invested at the end of 2018.

Thus, an important skill when investing over the long run is to be able to see past short-term news. The fact that the economy stayed healthy and a trade deal, even an interim one, was eventually reached, meant that much of the anguish by investors during the year was all for naught.

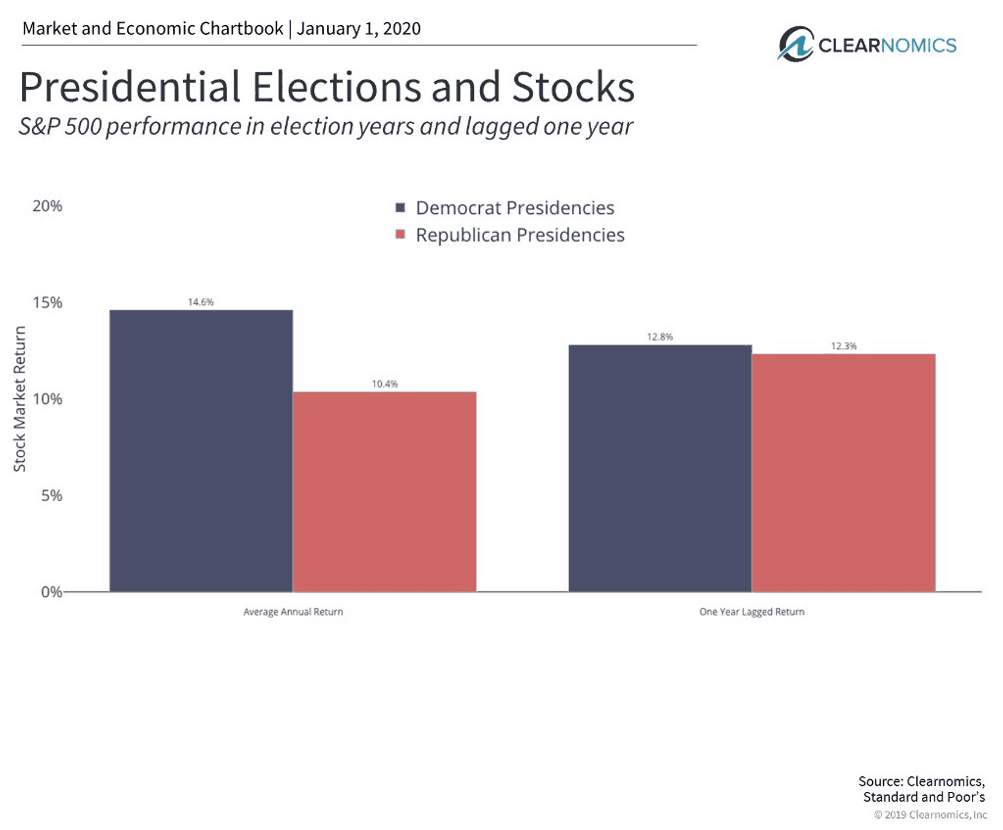

On that note, one challenge investors will face in 2020 is that media attention will focus on the presidential election. There will be endless speculation and concern over what each candidate will mean for the stock and bond markets. And while elections are incredibly important as citizens, voters and taxpayers, investors should avoid over-reacting or jumping to conclusions based on political preferences.

The reality is that how the stock market responds to elections is very difficult to predict. In fact, investors have feared that just about every presidential candidate in history would spell the end of economic growth and stock returns. In recent times, this was certainly said of both Presidents Obama and Trump.

While economic policies can certainly make a difference over time, investors are usually better off focusing on what affects portfolios in the long run rather than reacting to day-to-day political headlines. In other words, investors should stay invested in disciplined, diversified portfolios to help reach their long term goals and retirement aspirations while saving their energy for the polls.

Looking Further into the Cycle

There are some indisputable facts about the market and economic cycle. In March of 2020, we will celebrate the 11th anniversary of the bull market and economic expansion – already the longest in history.

The economy appears to be growing at a healthy pace of around 2%. Inflation is still benign despite historically low unemployment, although wages are beginning to rise more quickly. Interest rates are also quite low after a tumultuous 2019 during which the yield curve briefly inverted. All of these facts are classic signs of the later stages of the business cycle.

How much longer and further the business cycle goes requires a large degree of speculation. Areas such as manufacturing which have suffered over the past year will have to recover. Global economic growth, dampened by recent trade disputes, will have to rebound as well. Corporate earnings, which are forecast to have grown by only 1% in 2019, will need to accelerate in the next couple of years. The Fed will need to carefully maintain balance in the financial system, and Washington may need to engage in fiscal stimulus and pro-growth policies.

Ultimately, just as many investors were too fearful in 2018, some investors may be too greedy after a historic 2019. With stocks up significantly last year, many may continue to expect similar gains.

While we should be grateful for a strong year, investors should have realistic expectations. The most important takeaway is that many of the reasons that stocks rose last year, may be of less help in 2020.

Stocks can still do well if the economy is healthy, but we shouldn’t expect the U.S. stock market to rise another 30%. Instead, holding a diversified portfolio has always been the best way to benefit from stock market gains while protecting from uncertainty. This will continue to be the case in the decade ahead.

Below are four charts to help to put the market and economy in perspective:

1. The stock market reached new record highs in 2019

The S&P, NASDAQ and Dow Jones Industrial Average all achieved new record highs near the end of 2019. A combination of factors including the Fed, a healthy economy, and an interim trade deal helps to overcome investor fears.

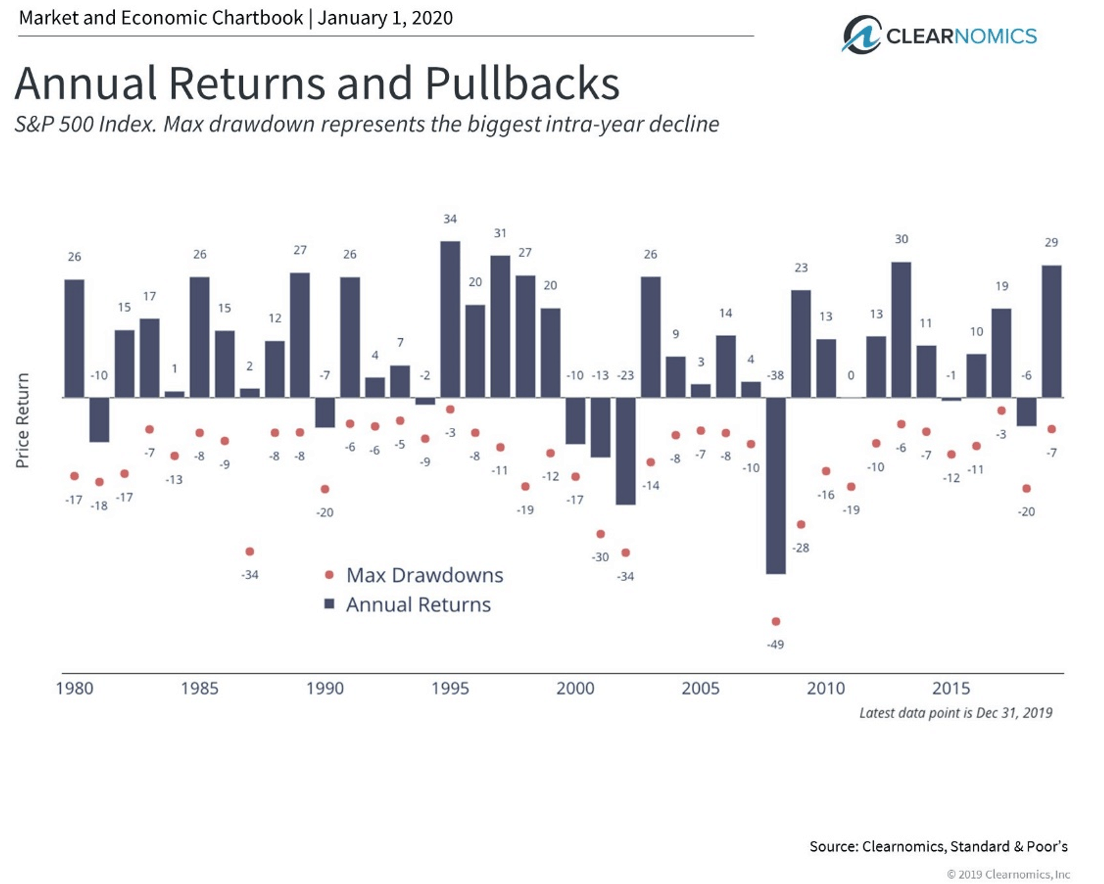

2. The market was relatively calm throughout the year

Despite daily and weekly market volatility, including three periods of market pullbacks, markets were calm in 2019 by historical standards. The largest decline in the S&P 500 was 7%, only about half of the historical average in any given year closer to 14%.

One principle of investing is that temporary market swings can occur at any time. Investors should have proper expectations and be prepared for volatility in the months ahead by staying diversified, not by trying to time the market.

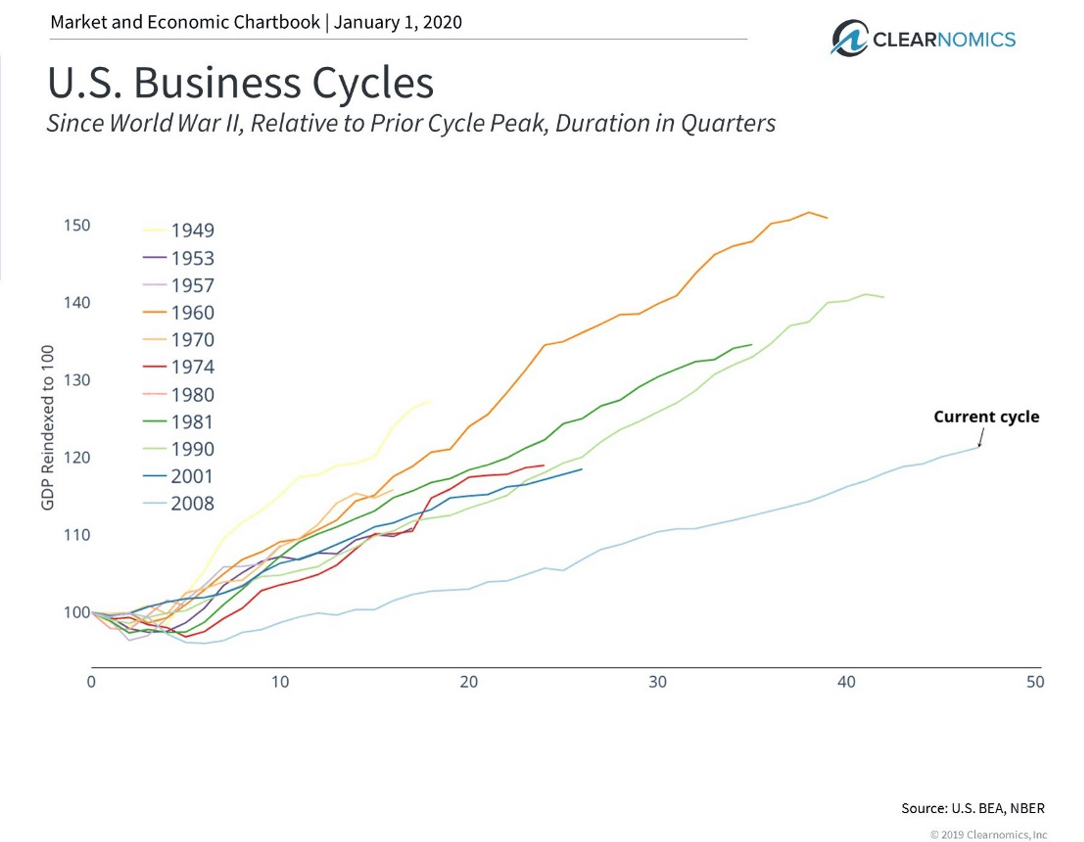

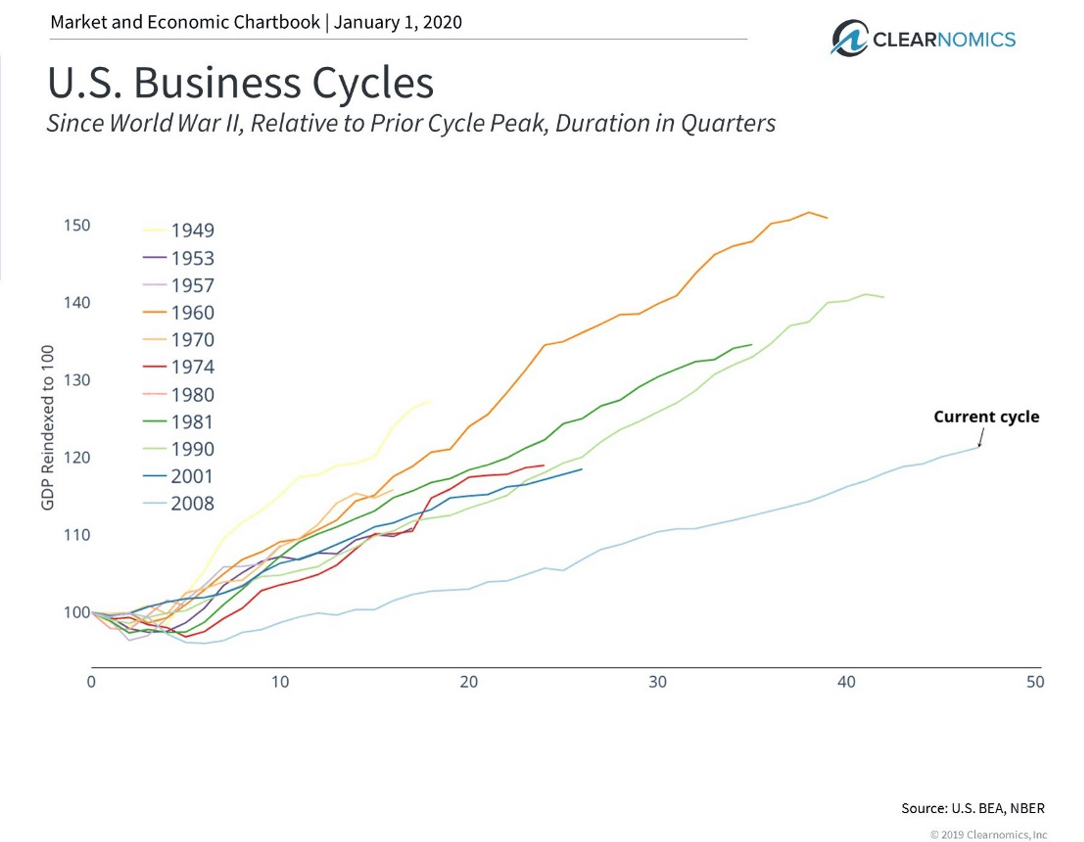

3. The current market cycle hit a historic milestone (longest ever, surpassing the 90’s run.)

At nearly 11 years, this U.S. economic expansion is officially the longest on record. The bad news is that the economy grown at only a fraction of the pace of past business cycles. Still, even slow and steady growth has been enough to push asset prices to record levels.

4. Investors shouldn’t over-react to presidential elections

Presidential elections will garner a significant amount of media attention, and rightly so. However, investors should be cautious when reacting to headlines in their portfolios. The reality is that markets have performed well under both political parties, especially when one considers the time it takes for policies to be passed, implemented, and trickle across the economy. For investors, the business cycle is a much more important driving force.

Summary

A breadth of asset classes performed well in 2019, with a hypothetical 60/40 portfolio generating the highest returns since 2009. Both stocks and bonds did well, especially with interest rates falling.

The U.S. stock market outperformed many other regions again in 2019. However, if the global economy can re-accelerate, it will be even more important for investors to diversify across the globe.

The bottom line? Investors who can see the current market and economic landscape clearly are in a better position to stay balanced and invested in 2020.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com. Get Started Today.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss.

The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), IFP Securities LLC, dba Independent Financial Partners (IFP), and its advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. This report may not be reproduced, distributed, or published by any person for any purpose without Ulin & Co. Wealth Management’s or IFP’s express prior written consent.