Don’t Get Blindsided by Gold

From Wall Street to main street, concerns over inflation, the Fed, war, mounting U.S. debt, bank failures, and the crypto crash, have all in some part helped drive up gold prices. Gold climbed above $2,000 per ounce in early May, reaching just around its peak levels during the pandemic in 2020, and heights not seen since the 2011 debt ceiling debacle 12 years ago.

Gold is distinguished around the world for its deep history and insurance-like value as a currency, which has been acknowledged by cultures for thousands of years. While gold does not corrode and is utilized in coins, luxury watches, jewelry, circuit boards, and tooth fillings, should you include this shiny asset as part of your investment portfolio? The short answer is perhaps in moderation.

The maxim from the gold rush of the mid-19th century was, “don’t dig for the gold, sell the picks and shovels.” We may amend that a bit for investors today to not just buy physical gold and gold stocks- but diversify in a globally diversified portfolio of asset classes.

While boomers and retired investors may buy gold in some form as an inflation, deflation or fear hedge in uncertain times, a wave of younger investors, weary from bitcoin’s wild swings, are showing symptoms of gold fever. In an about face, a recent WSJ headline noted, “How to Buy Gold hits a google search record in the billions as crypto investors chase world’s oldest asset.” The old-school precious metal has new allure for younger generations seeking a respite from the crypto winter.

Don’t Get Blindsided by Gold

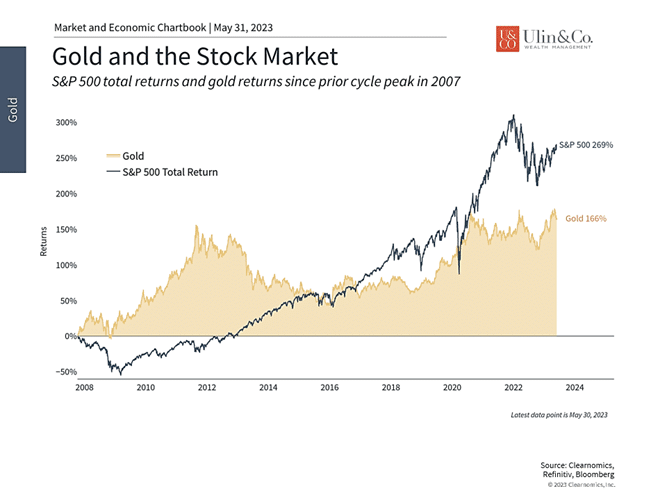

What’s most amazing Is that investors of all ages buying gold today at a premium are not recognizing the value of buying stocks and bonds at a discount. When the fear and inflation hedge “shine” of gold diminishes as the next economic cycle commences, consider that history could repeat itself a bit after the Great Recession cooled off where in August 2011, the elevated gold index got cut almost in half, close to today’s valuation, almost twelve years later. (See chart below.)

While the ominous debt ceiling debacle behind us, and the S&P still moving forward off the lows of last September, perhaps we are already on the cusp of a new bull market despite record low investor sentiment mirrored by Armageddon-driven news show topics and predictions. As noted on another recent WSJ headline this week “Why the U.S. Remains Far from Recession-The pandemic’s after-effects fuel economic resilience, despite rising interest rates.”

Jon here. Ultimately, the choice to invest in gold – or any individual asset – should be viewed in the context of a diversified portfolio and long-term financial goals. Being overconcentrated and holding too much of any one traditional or unorthodox niche investment from gold to crypto, NFT’s, startups, real estate, artwork, luxury watches, jewelry, or even fine wine, could greatly backfire when least expected.

Opportunity Cost

Gold has a defensive quality, and at times low correlation with most other asset classes, which is why novice to expert investors hold it. Whether you buy a gold index fund in your portfolio, or you simply feel better owning a tangible investment you can see and touch, don’t overlook the opportunity cost.

History shows that while gold can play a part in a carefully constructed portfolio, investors should not do so to the exclusion of other asset classes, starting with a foundation of stocks and bonds. In the worst case, a focus on gold can result in missed opportunities for investors in more appropriate asset classes selected as part of a tailored financial plan.

Gold prices have risen over the past two decades

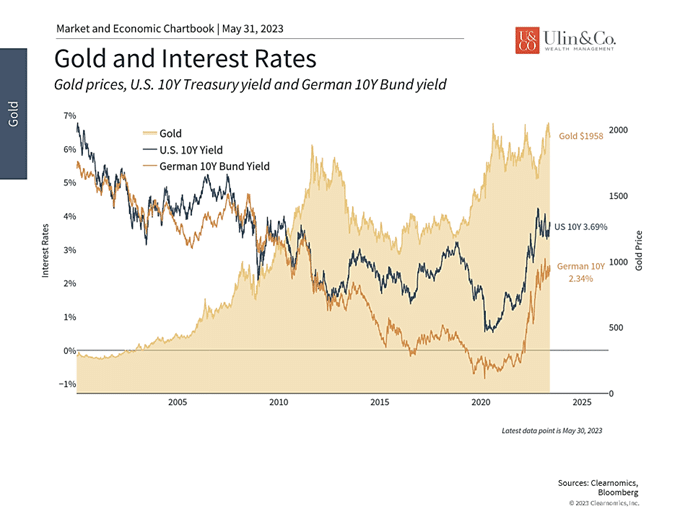

Much of the rise in gold prices over the past two decades (see above) occurred during the global financial crisis as the Fed grew its balance sheet and amid the significant fiscal and monetary stimulus during the pandemic. These periods of loose policy are often seen as the textbook environments for holding gold. More recently, gold prices have risen due to the combination of the debt ceiling debate in Washington, the possibility of a Fed pause then cut later this year, and as core inflation remains sticky.

Investors often flock to gold for safety when markets get choppy. In many ways, this is no different from how some investor’s view cash or safe bonds to protect them from short-term stock market pullbacks. Thus, the potentially more attractive purpose of gold is to help diversify portfolios, especially in times of financial distress.

The stock market has outperformed gold over the long run

The choppiness of gold prices over the past few years also shows that while it can act as a hedge during periods of uncertainty, this can reverse quickly as conditions change. For instance, while gold has gained over 6% this year, the Nasdaq has recovered 24%. In other words, relying on gold as a hedge, rather than a portfolio diversifier is similar to trying to time the market which history shows is difficult if not impossible to do.

The accompanying chart (above) shows this relationship between gold and the stock market over the past fifteen years. While stocks are well ahead of gold when tracing their performance back to their 2007 peaks, they have taken very different routes. To experienced investors, this is a tell-tale sign that holding these assets in the right proportions can create diversification benefits. The relationship between interest rates and gold shows a familiar pattern as well: gold prices tend to rise as interest rates fall. Thus, gold prices have behaved similarly to bond prices – yet more reason to believe that gold is better suited as a portfolio diversifier than as a standalone investment.

Another common issue is that, for those investors who need portfolio income, especially in or near retirement, gold does not generate yield or pay interest. So, while it can protect investors from short-term uncertainty, especially when the Fed or Washington are involved, it may not help with other financial needs. For those investors with longer time horizons who need growth, the stock market simply has a much longer track record of creating long-term wealth.

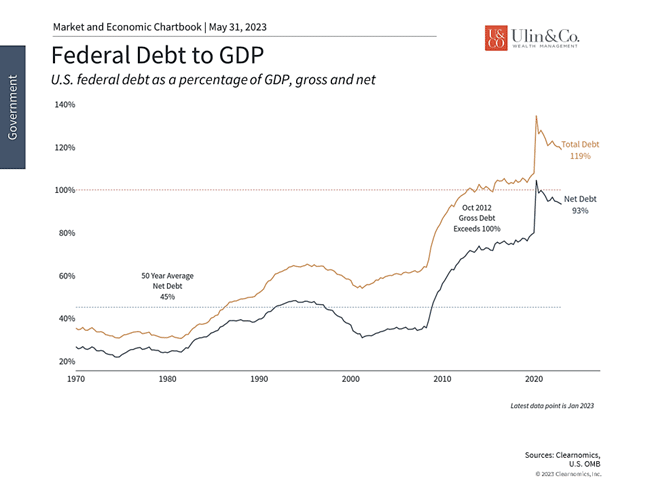

Federal debt levels remain near historic peaks

One final important note is that gold itself can be extremely volatile. For those investors worried about stock market volatility, short-term movements in gold can be as bad or worse. In just the few weeks since its peak in May, gold prices have fallen over 5%. This can happen even when the textbook reasons to hold gold are present, such as the elevated level of the U.S. debt. Just as with the stock market, movements in gold may run counter to expectations.

The bottom line? Don’t get blindsided by gold. The choice to invest in gold, or any other asset, should be viewed in the context of a diversified portfolio rather than as a standalone investment. When appropriate, doing so can help to balance other asset classes, creating a smoother ride toward long-term financial goals.

For more information on our firm or to request a complementary investment and retirement check-up with Jon W. Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com. Get Started Today: Contact us below.

Note: Diversification does not ensure a profit or guarantee against loss. You cannot invest directly in an index.

Information provided on tax and estate planning is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), and it advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.