Bitcoin ETFs: No Go to FOMO

In recent times, the approval of eleven Bitcoin exchange-traded funds (ETFs) by the SEC has been a significant milestone in the world of cryptocurrency and finance. The approval marked a shift in regulatory stance towards Bitcoin investment products, particularly ETFs, after a decade-long wait.

Bitcoin was the first cryptocurrency created and is now the most valuable and well known. It was first launched 15 years ago in January 2009 by a computer programmer or group of programmers under the pseudonym Satoshi Nakamoto, whose actual identity has never been verified. Santoshi and other Bitcoin holders are probably popping champagne bottles this month now that the U.S. government is helping to provide greater access and legitimacy to crypto.

While even the most conservative investors may find the Bitcoin millionaires over the past decade to be enticing, the 50%- 75% swings up and down of bitcoin are not for the faint of heart. Most of the newly minted Bitcoin ETFs are already down 15% since launching this month. Just remember the maxim that “there is no such thing as a free lunch,” as with any benefit comes unforeseen hazards, costs, and risks, including risk of principal.

Caveat Emptor

To provide a comprehensive understanding of bitcoin access and ownership, investing and risks, let’s break down a few key aspects. A few large holders commonly referred to as “whales” continue to own most of Bitcoin. About 2% of the anonymous ownership accounts that can be tracked on the cryptocurrency’s blockchain control 95% of the digital asset, according to researcher Flipside Crypto. The study also found Ninety-five percent of spot bitcoin trading volume is faked and manipulated by unregulated exchanges.

More ominous than the SEC ironically issuing its own crypto “No Go to FOMO” warning that the explosion of digital assets and meme stocks can burn you, or that Vanguard recently stated they are “avoiding speculative, unregulated crypto,” JPMorgan’s renowned CEO Jamie Dimon stated that bitcoin was a hyped-up fraud, though he is in favor of smart chain-enriched blockchains noting “you can at least utilize it to buy and sell real estate and move data, tokenizing things that you do something with.”

Jon here. From a disciplined and objective investor’s standpoint – whether or not one believes decentralized finance will change the world – cryptocurrencies and related investments are simply assets with specific characteristics and may be here for the long run. The question of whether and how much to invest in these assets should be no different than deciding on any individual stock, bond, currency, commodity or investment theme, though on the very high end of the risk spectrum.

Selecting ETFs

Trading began Thursday, January 11 for this brand new group of ETF’s that run the gamut from Ark Invest and Black Rock i- Shares, to Invesco and even Fidelity. Spot bitcoin ETFs should all deliver the same thing: exposure to bitcoin. Physically holding bitcoin doesn’t leave much room for issuers to carve out an edge.

However, that doesn’t mean these ETFs are all equal. Investors can pick the best option for themselves by focusing on three fund criteria: fees, liquidity, and fund trading costs. Buy-and-hold investors should emphasize fees, those actively trading ETFs should focus on liquidity, and everyone should keep an eye on how trading costs affect performance.

Bitcoin ETFs offer a more efficient way for the average investor to gain exposure to Bitcoin compared to trading on cryptocurrency exchanges. Here’s three reasons why:

1 Ease of Access: ETFs are traded on traditional stock exchanges, making them easily accessible to investors through their existing brokerage accounts. This eliminates the need for setting up and navigating cryptocurrency exchanges. ETF’s make unique sector holdings and bets possible, like holding a gold ETF vs buying and storing actual gold.

2 Custodianship: ETFs typically employ reputable custodians to securely hold the underlying assets. This covers concerns related to theft and fraud associated with holding cryptocurrencies on personal wallets or exchanges.

3 Regulatory Oversight: The approval of Bitcoin ETFs by the SEC implies a level of regulatory oversight and compliance, providing investors with a sense of legitimacy and security that may be lacking in some cryptocurrency exchanges.

Charting out Bitcoin, Crypto and Stocks

Bitcoin has become a household name as the most well-known cryptocurrency (sometimes referred to as a digital currency or digital asset). For purists, cryptocurrencies hold the promise of a fully decentralized financial system beyond the control of governments and large institutions. For others, blockchain technology enables the frictionless exchange of value across the globe, regardless of who controls the networks. Whether these visions of a future financial system will come to fruition is still unclear. Given these ambitions, it can be difficult for everyday investors to understand and judge the merits of digital assets for their portfolios.

Let’s cover a bit more on why the SEC approved these ETFs, what took so long, what were their concerns, and what does this mean for everyday investors. Interesting note that Bitcoin and the stock market have been on a similar path and correlation.

Bitcoin and the stock market have been positively correlated

Regardless of how transformational Bitcoin may or may not be, the SEC’s approval of Bitcoin ETFs has been long anticipated. The impact of these ETFs is analogous to investing in gold since, without the availability of these financial products, investors would need to buy physical gold and store it safely in vaults. Similarly, holding cryptocurrencies requires the use of digital wallets and safely storing cryptographic keys. The latest ruling opens the door for ETFs that hold the “spot” asset – meaning the asset itself, rather than a financial derivative on the asset such as a futures contract. For Bitcoin proponents, the hope is that this increases the accessibility and adoption for both everyday investors and institutions.

What has tarnished the adoption of cryptocurrencies is the wide range of malfeasance in the crypto industry as we covered above, ranging from poor financial management to outright fraud. This has occurred across large venture capital-backed companies such as FTX to individuals selling digital coins in classic pump and dump schemes. Over the years, these technologies have also led to hype around initial coin offerings (ICOs), non-fungible tokens (NFTs), Web3, and more. Given all of this, it’s not surprising that everyday investors might be wary these investments. These issues, along with a lack of clarity of how these assets should be regulated, delayed the SEC’s decision to approve Bitcoin ETFs.

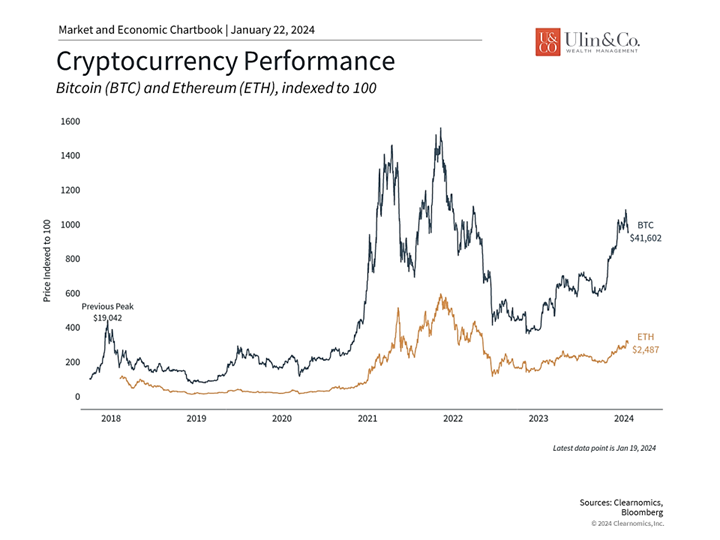

Other major cryptocurrencies have not performed as well as Bitcoin

So, when it comes to digital assets, nothing is cut and dried. Fortunately, from a long-term investor’s standpoint, Bitcoin can be thought of as another asset with specific characteristics. The question of whether and how much to invest in this asset should be no different than deciding on any stock, bond, currency, commodity, real estate property, etc. After all, the fact that corporate scandals have occurred throughout history and that bear markets occasionally occur do not, on their own, mean that stocks are not an important asset class – just that analysis and risk management are needed. Understanding the potential risks and expected returns, and weighing them against other assets in a properly diversified portfolio, are what matter.

Given this perspective, there are two facts that investors must keep in mind. First, cryptocurrencies have not yet proven to be reliable portfolio diversifiers. In fact, they have often been strongly correlated with the stock market and other risk assets, serving to amplify risk, as shown in the first chart above. In 2023, Bitcoin did gain about 156% but this was a reversal of the previous year’s 62% loss. In other words, this pattern is similar to the stock market’s round trip from the beginning of 2022 to the end of 2023. Unfortunately, Bitcoin would not have helped to offset portfolio volatility during this period.

Higher portfolio returns often come with risks that must be managed

Second, Bitcoin and other digital currencies are extremely volatile. Depending on the period, they can be 5 to 10 times as volatile as the overall stock market which is itself considered to be risky. At the time of writing, Bitcoin is experiencing a pullback from recent highs despite prior enthusiasm around the SEC ruling. This is one reason they are still poor stores of value and thus not substitutes for bonds, currencies, and most commodities. Additionally, while other cryptocurrencies such as Ethereum are volatile, they have also not performed as well as Bitcoin over the past year.

None of this is to say that digital assets may not be important in the future. It’s also not to dismiss that some investors have benefited from cryptocurrency rallies. Instead, recent developments around Bitcoin and cryptocurrencies are a reminder for investors to focus on their overall portfolios rather than individual investments. This is especially true now that investing in these assets is far easier with the approval of Bitcoin ETFs.

The bottom line? When it comes to investing in digital assets, understanding how they affect a diversified portfolio tailored to financial goals is far more important than debating how they might transform the financial system. Investors should remain disciplined and focused on the long run as digital assets and the crypto industry mature.

For more information on our firm or to request a complementary investment and retirement check-up with Jon W. Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

Note: Diversification does not ensure a profit or guarantee against loss. You cannot invest directly in an index.

Information provided on tax and estate planning is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), and it advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.