| To restate Einstein, “Investing is like riding a bicycle. To keep your balance, you must keep moving, watch out for obstacles and focus on the horizon.”

The fact that we are living through the longest bull market and economic expansion in U.S. history should, unequivocally, be good news. The economy has grown steadily over the past ten years. Over 20 million new jobs have been created, eclipsing the 9 million that were lost from 2008 to 2010. The S&P 500 index has risen 327% over this period and fixed income has also done well with interest rates remaining low. Of course, not all Americans have participated in this recovery, either economically or financially. Broadly speaking, however, many diversified investors have done well over the past decade personally and in their portfolios.

But even for many investors who have benefited, the glass is always half empty. They fear that a recession, policy mistake, global conflict, or Fed error lurks around every corner. This is heightened by recent global events and even this week’s Fed meeting. And while these factors are often the reason for economic downturns, there are always many more false positives than actual economic crises – the investment equivalent of crying wolf.

This is why understanding the business cycle and economic fundamentals can help investors stay focused on the long run, rather than day-to-day market movements and headlines. Despite short-term concerns around the age of the business cycle, trade wars and the Fed, markets are driven in the long run by economic trends. Historically, healthy economic growth supports portfolio returns while economic downturns result in pullbacks.

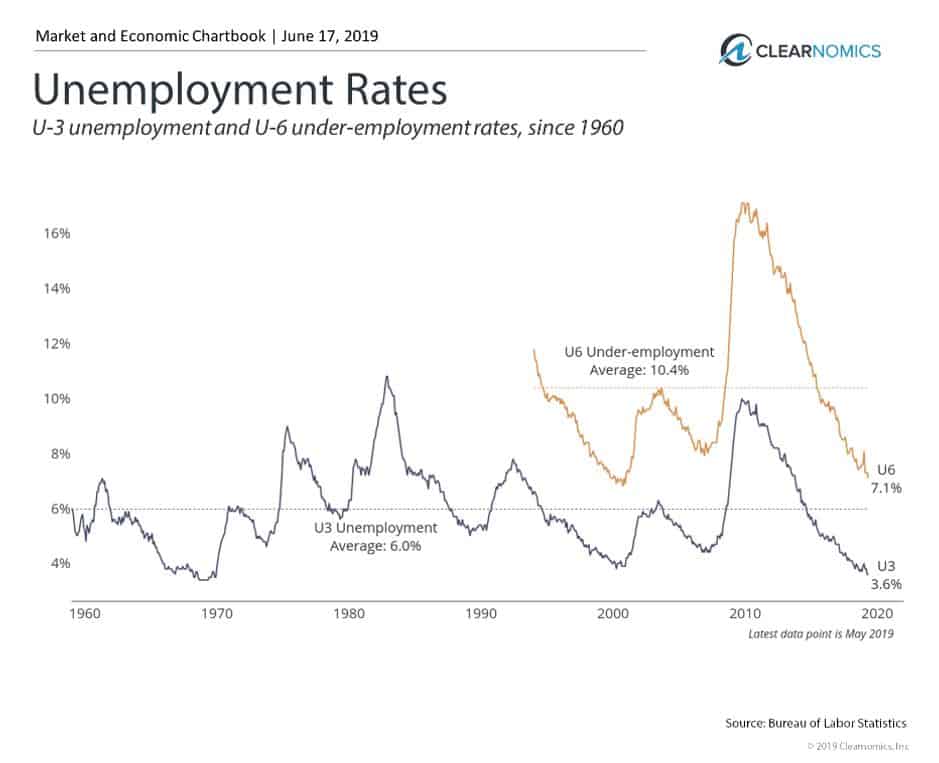

Fortunately, the U.S. economy continues to look healthy, even if it is decelerating. At only 3.6%, the unemployment rate is still near historic lows, no matter how you slice it. Inflation is showing no signs of over-heating with Core CPI at 2%. Household net worth has never been higher, and interest rates are still low, further supporting consumers.

Thus, it’s never been truer that business cycles don’t die of old age alone. There are always risks from policy and global events – but this occurs in both directions. Last year, the market was jubilant over tax reform. This year, it’s in the doldrums over trade. Yet, over the past two and a half years, the S&P 500 has risen nearly 30%.

Of course, not everything is rosy. In terms of the sheer pace of growth, this is still the slowest recovery on record. The yield curve, which often functions as an early-warning sign of the late stages of an economic cycle, is still inverted at the short end and extremely flat at the long end. Still, these warnings signs are important in the context of a broadly healthy economy.

Thus, long-term investors should continue to stay diversified and disciplined.

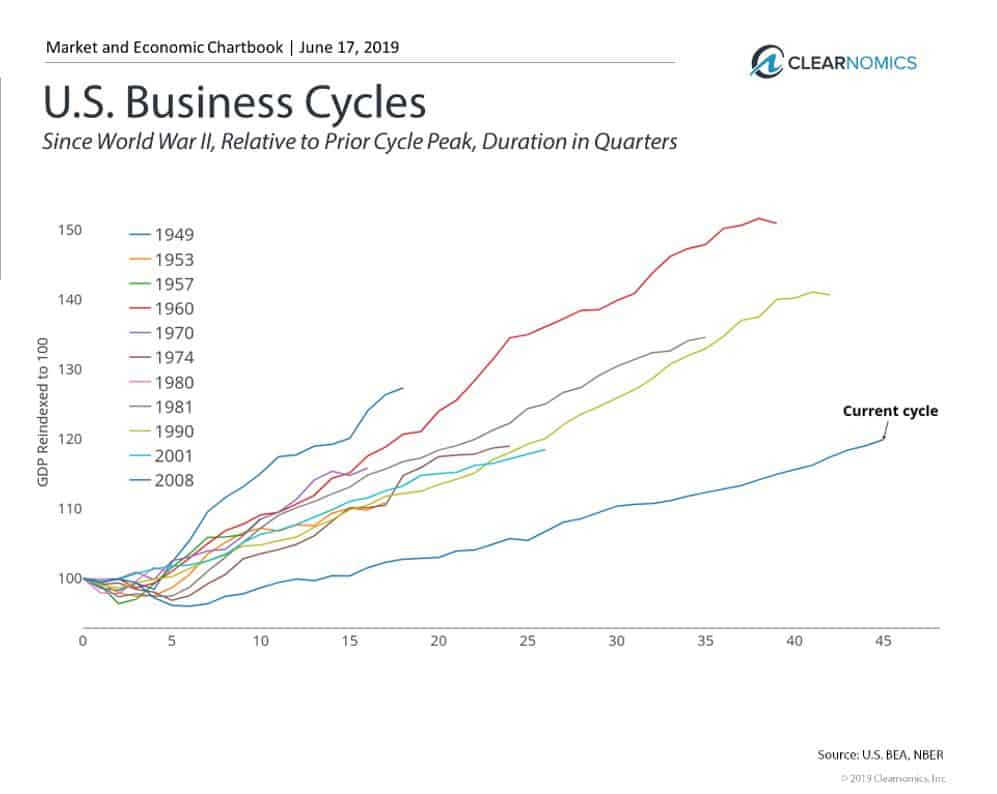

This is the longest business cycle on record

This is the longest business cycle in U.S. history, at over 10 years and counting. It has now surpassed the expansion of the 1990s, which was capped-off by the tech bubble, and the 1960s which spanned almost 9 years.

However, each subsequent market cycle since then has been slower. While we’ve enjoyed a long period of steady growth, the economy has grown only by half the rate of the 1990s. Still, even this level of growth can be positive for markets if it is sustained for long periods of time.

There are signs that the economy, while healthy, is slowing

Unemployment is still near historic lows

Despite a deceleration in growth, the level of growth is still healthy. The unemployment rate is still extremely low, with nearly 7.5 million job openings across the country. Although no cycle can last forever, there are no signs of this one overheating just yet.

The bottom line for investors? The economy is still healthy, despite various risk factors that investors fear. For many, staying invested and diversified is still the best way to achieve long-term financial goals.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com. Get Started Today.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss.

The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), IFP Securities LLC, dba Independent Financial Partners (IFP), and its advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. This report may not be reproduced, distributed, or published by any person for any purpose without Ulin & Co. Wealth Management’s or IFP’s express prior written consent. |