How to Position for a Bear Market Attack

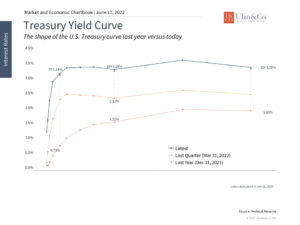

The S&P 500 officially fell into a bear market this week. Rapid inflation across the economy has affected consumers and businesses, raising questions about spending and corporate profits. These pressures have pushed interest rates higher across the curve, breaking a four-decade pattern of falling yields. This has prompted the Fed to tighten more quickly. Altogether, these events have led investors to swiftly re-evaluate asset prices across financial markets, resulting in steep declines in most all assets classes from stocks to bonds.

Jon here. It’s possible that the markets are grinding down while “pricing in” the worst-case scenario of a Fed-induced mild- recession in order to ease these price pressures.

Bear Encounters

While a bear encounter is a special treat for any visitor to a national park, it can be a more dire experience for investors of all ages. Just like in the wild, each bear market and personal response is unique; there is no single strategy that will work in all situations and that guarantees physical or financial safety.

While remarkably most bear encounters end without injury, many investors end up making poor decisions in the short term that may create adverse outcomes for their savings and retirement. While your safety in the wild can depend on your ability to calm a bear, your ability to navigate through a bear market may depend more on your emotional IQ (calming yourself) while deploying a more tactical investment strategy than just holding core S&P 500, Nasdaq and bond indexes while the Fed is working to pop the ‘everything’ bubble with an aggressive rate hike strategy.

As bears can run as fast as a racehorse and chase you up a tree, the National Park Services basic guidelines to implement when confronted with a bear amazingly include (1) stay calm and talk quietly (2) move slowly away sideways and do not turn your back. (3) If attacked, play dead. Seriously, do nothing! Lay flat on your stomach with your hands clasped behind your neck. Spread your legs to make it harder for the bear to turn you over. Eventually it will leave.

3 Basic Investor Rules for Bear Market Attacks

1 Stay Calm: Being rational, calm and unemotional can be difficult when it comes to managing money while being inundated by the terrifying headline news and near thousand-point market gyrations. In a perfect world, every investor could “buy low and sell high”- however, the realities of markets, behavior and investing “know-how” often prove more complex and require a more measured approach.

Stress can leave a lasting, negative impact on your health and brain while affecting your sleep to your short-term memory and decision-making capability. The answer to this dilemma may be to consume less headline news while stress-testing your portfolio and making any suitable modifications. Not knowing your strategy or portfolio results through volatility is the definition of driving blind.

2 Stay Liquid: Maintain at least 12 months in your “cash reserves bucket” of essential expenses for when a bear market arrives. Also ensure your home equity and credit lines are in order whether you are an individual, family or small business. Avoid “retail therapy” as an emotional outlet. While you may have extra time and money on your hands, now is not the time to go on a major online spending spree to help reduce stress while increasing your obligations.

If you lose your job or are forced into an early retirement, you do not want to have to sell stocks at a low point during a bear market or take a taxable distribution (or expensive loan) from your 401(K) account or IRA because you are cash poor. If you are under 59 ½ you may also end up paying a steep 10% penalty on top of taxes for any retirement account distributions.

3 Stay Diversified: If you are diversified and know your portfolio risk tolerance matches your time frame and financial goals, “doing nothing” if appropriately diversified may provide a better outcome for your investing and retirement goals than making a lot of unnecessary changes or executing a “fire sale” during an ugly bear market and or recession.

Market timing is a fool’s game. Investor studies indicate that the human brain is not a rational economic actor. When faced with uncertainty, even the best investing minds may throw good money after bad, sell at the first sign of trouble or make all manner of jumbled financial decisions when stress and volatility hits.

For long-term, disciplined investors, the answer to market volatility isn’t to jump in and out of the market. Instead, it’s to stick with a well-balanced portfolio that can weather bear attacks. Sound Investing truly is about your “time in the market” and not “timing” the market. Sometimes this is all easier said than done. Just remember that historically markets have never traveled in a straight line up to the sky.

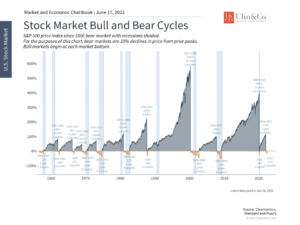

Bear Market Perspectives Over Time

For all investors, this is a challenging period that can be financially and emotionally stressful. In times like these, it’s important to remember that staying patient and disciplined in times of market volatility is one of the core principles of long-term investing. This is because markets fluctuate on a regular basis in response to a variety of market, economic and geopolitical factors. Having the knowledge and experience to separate important changes in long-term trends from short-term reactions can help investors to be positioned for future opportunities. The following chart is a good visual between long summers of bull markets vs short winters of bear markets every decade since the 60’s.

Markets have fallen into bear market territory

In The Intelligent Investor, Benjamin Graham, the father of value investing and Warren Buffet’s mentor, wrote a parable about a manic investor, “Mr. Market.” Every day, Mr. Market offers to buy or sell you stock at a price based not on the fundamental value of the asset but on his mood. In many cases, this mood is determined by what the stock has done in the past day or two, not by a more objective measure of what it is worth. It is up to you, as the more rational investor, to be disciplined and diligent in deciding if the price on any given day is attractive.

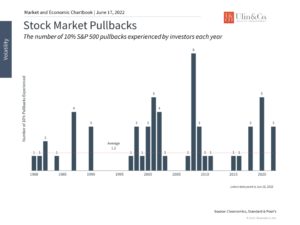

Stock market pullbacks and bear markets are normal

It’s straightforward to see that there may be days when Mr. Market has underpriced these assets, making it an attractive time to buy and hold. It’s the long-term investor who can decide what to do on any given day. In many cases, they could choose to ignore the price swings proposed by Mr. Market, especially if they have studied market history. This is true no matter how large the fluctuations or whether we assign them labels such as “correction” or “bear market.”

Unfortunately, it is human nature to be drawn to assets with prices that are rising and avoid ones that are falling. This is true even when this has little impact on what a stock may do next. The irony is that when stocks are the most attractively valued, investors want them the least. Recent price movements should have little bearing on what an asset is truly worth, so learning to overcome this bias takes training, experience, and often the guidance of a trusted advisor.

Thus, the questions are always “what is priced in” and “what should be priced in.” Rising interest rates should prompt a re-evaluation of asset prices. In technical finance terms: the discount rate is higher today than it was even at the start of the year. This means that the present value of future cash flows is lower, which disproportionately impacts investments with large uncertain payoffs in the distance. In simple terms: it’s hard to know what to pay today to receive $1 in the future because it’s very unclear how high interest rates may go. As rates rise, it becomes more attractive to simply buy bonds instead.

Interest rates have climbed steeply after falling for 40 years

At the same time, markets have been worried about these factors since inflation began to pick up a year and a half ago. Markets have been well ahead of the Fed which has, by their own admission, been behind the curve in responding to higher prices across the economy.

It’s not difficult to argue that markets are pricing in the worst-case scenario of a Fed-induced recession in order to ease these price pressures. If this is the case, any unexpected slowing of inflation, e.g. if energy or food prices decline, would be viewed as positive for markets. This is especially true because the economy is, by many other measures, still strong.

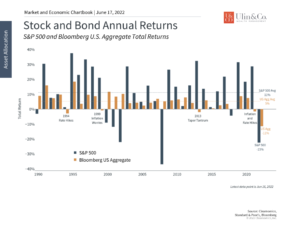

Perhaps what makes this bear market especially difficult is that nearly all asset classes have been impacted. It is unusual for stocks and bonds to be down at the same time, but this is in many ways a reversal of the “everything rally” of the previous two years, and arguably since the global financial crisis.

This is also because inflation has pushed interest rates higher which hurts bonds exactly when many investors needed them the most. Falling bond prices have occurred across several episodes over the past 30 years, during other periods of rising rates and inflation concerns, only to recover soon thereafter. While this time may be different if interest rates remain elevated, the silver lining is that generating portfolio income is easier today than at any time over the past decade.

Both stocks and bonds have struggled this year due to rising interest rates

The bottom line? As markets find a level and the inflation story evolves, it’s important for long-term investors to maintain perspective in the face of a bear market attack and possible recession. Although the S&P 500 has been hovering near 21% below its all-time high, it has experienced similar or fewer major pullbacks this year compared to 2020, 2018, 2009 (when the market was rapidly recovering), and throughout the early 2000s. While these were all difficult periods, the best course of action was to stay patient, hold a balanced portfolio, and avoid being unduly influenced by Mr. Market.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), and it advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.