Bear Market Diminishing Despite Bank Crisis, Fed Hikes

The menacing bears have been out in full force since the top of 2023 fueling fear in nervous investors that some sort of major catastrophic event (war, housing crisis, credit debacle, banks failing, U.S. Debt snowballing, etc.) would be the lynchpin to help throw the markets and economy into a tailspin back to levels not seen since 2008.

It may then come as a surprise to most anyone watching the ongoing negative financial news shows and forecasts, like watching the weather channel during hurricane season in South Florida, that most major asset classes are up for Q1 and the world has not yet ended.

The recent banking debacle kicked off by SVB in Silicon Valley was more of a headline and social media frenzy, than an actual widespread financial contagion event like 2008 as I recently discussed in Yahoo Finance. This was nothing like my own memories of 1989, where more than 1,000 S&L institutions failed for about $160B, including my personal bank in Margate, NJ.

The two silver linings to the recent bank failures are that (1) these events should lead to greater financial tightening with cash and lending across all banks from business loans to mortgages and other lines of credit while helping to do some of the Fed’s “heaving lifting” to slow down the heated economy, inflation and hiring while (2) the recent events should also influence the Fed to put the brakes on a bit more regarding rate hikes and monetary policy with it’s goal to reach 2% inflation by end of 2024.

Confirmation Bias

Many of us have cognitive deficiencies when it comes to making unbiased decisions. Confirmation bias is the tendency of people to favor news and information that confirms their beliefs on an outcome while often ignoring any flaws or contradictions.

Plugged into the internet 24/7 can only help amplify personal opinions and theories in our heads on potential outcomes for stocks, crypto and inflation, or any topic for that matter including the upcoming Presidential elections.

This bias cannot be eliminated, but it can be managed by education and self-awareness. Today’s plethora of AI and tech may only be making confirmation bias more difficult to overcome as news and media to advertisements can now specifically target and follow you around on the web, like in Steven Spielberg’s 2002 movie “Minority Report” set in the year 2054. It’s here now already!

Lack of Patience

Humans are impatient by nature while counting down the days and hours to their next vacation, birthday, favorite holiday or sport season, in as much the ball dropping New Year’s Eve.

Many investors may be quickly losing patience while waiting for the next bull market to begin after counting the days and months since the current bear market began in January 2022. They may be itching to do something with their savings and investments- when in many cases doing nothing may be the best option.

Buffett was once quoted as saying, “remember that the stock market is a manic depressive. Markets will rise and fall for many reasons, but most of the declines will be relatively temporary. It’s important not to be manic depressive along with the markets.”

Jon here. We are getting many incoming calls from investors seeking to take a large portion of their cash or investments off the table to quickly “lock in rates,” or to “hedge against a rapidly approaching Armageddon” in longer term CD’s, fixed and indexed annuities or various types of REITS and limited partnerships that come with other costs and risks baked in that are not being considered.

Rather than run for the hills, now would be a good time for long term investors to continue buying low into a diversified portfolio of stocks and bonds, rebalancing, and updating their retirement plan and strategy, more so than (1) bailing out (2) sitting on the sidelines or (3) concentrating their savings in a few longer term, illiquid products as a hedge.

Fed Rate Hikes vs Potential Rate Cuts

In this market environment, investors have had no choice but to balance a number of difficult issues related to the tightening of financial conditions. These have ranged from rising rates to a slowing economy, and a housing market downturn to the current banking crisis. While each of these issues has its own unique circumstances, it’s also important to recognize the common underlying causes.

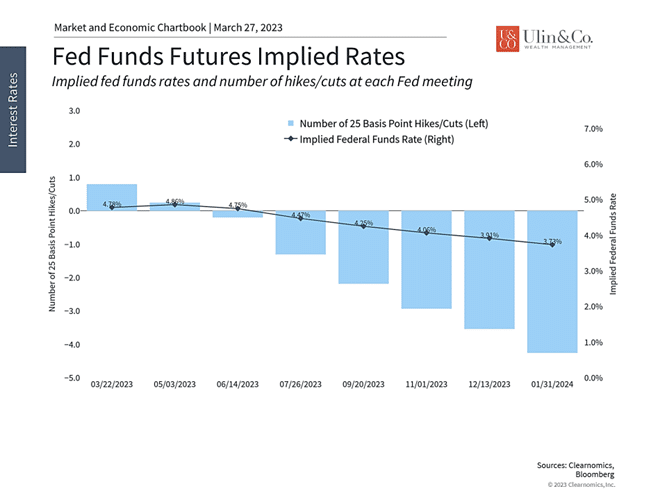

Markets expect the Fed to cut rates later this year

At its recent March meeting, the Fed announced that it would raise rates another 25 basis points, pushing the fed funds rate to a range of 4.75% to 5.00%. They did this in spite of the recent runs on banks, reiterating that “the U.S. banking system is sound and resilient and that recent developments are likely to result in tighter credit conditions for households and businesses and to weigh on economic activity, hiring, and inflation” as we discussed above.

In other words, the Fed’s view is that the problems in the banking industry will naturally tighten conditions, reducing the need for larger rate hikes. Despite the many calls for the Fed to cut rates, part of the Fed’s calculus is likely that overreacting to these banking problems would spark more panic, not less. (there may still be a few more hikes left.)

The Fed also published its Summary of Economic Projections which showed that officials expect growth to slow to 0.4% in 2023, unemployment to rise to 4.5% (from 3.6% today), and PCE inflation to decelerate to 3.3% (from 5.4% today).

This is at odds with what the market expects. Fed funds futures show that investors believe the Fed might hike again in May but will need to begin cutting rates soon after. Over the past year, the market has arguably been ahead of the Fed. Thus, despite what the Fed might do in the coming months, it is likely that we are in the midst of an inflection point in financial conditions.

Since the Fed began hiking rates to fight inflation a year ago, many economists have worried about financial stability and the possibility of a recession. Many episodes over the past century, including the Great Depression and the mid-2000s housing bubble, show that the Fed tends to be reactive – that is, it often keeps policy conditions too loose for too long before then tightening aggressively. This is partly because the Fed only has blunt tools at its disposal that operate with a lag. It’s also because the Fed relies on broad economic indicators which are only published monthly or quarterly, with an eye toward the factors that caused the last crisis.

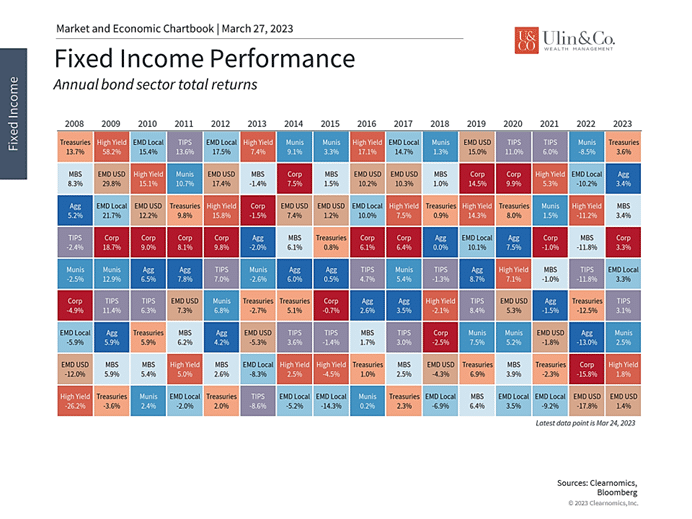

This has a number of implications today. On the one hand, the probability of a “soft landing” is still highly dependent on inflation, the labor market, and economic growth, just as it has always been. When it comes to inflation, there are many positive trends. For the most part, inflation rates are improving and some measures, such as goods inflation and core inflation excluding shelter, are already at or near the Fed’s target. For investors, markets have also performed better this year across stocks and bonds compared to 2022 due to reduced inflation risks. Bonds have had taken a major turn for the better.

Fixed income has helped to stabilize portfolios

What does this mean for investors? Within the S&P 500, regional bank stocks and financial sectors have not-surprisingly plunged. Meanwhile, the broader S&P 500 gained 3.4%. This is because sectors such as Tech and Communication Services have risen by near 19% and 17%, respectively, over this same period. Market swings have been more pronounced throughout this episode, but it goes to show the importance of staying diversified both across and within markets.

An important driver of the gains in these sectors has been the decline in interest rates, despite ongoing Fed rate hikes. This has helped re-establish the negative correlation between stocks and bonds that have helped long-term investors for over four decades.

Throughout the challenges this year, a diversified basket of fixed income securities has gained 3.4%, driven by Treasuries, mortgage-backed securities, corporate debt, and more. (see chart) This is a reminder that diversified investors with a focus on longer time horizons are more likely to stay on track, with a much steadier ride, than those that overreact to every new headline.

The bottom line? Despite the big market and financial events this year, the Bear Market is diminishing over time. The best course of action is still to stick to well-constructed portfolios and financial plans.

For more information on our firm or to request a complementary investment and retirement check-up with Jon W. Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com. Get Started Today: Contact Us below.

Note: Diversification does not ensure a profit or guarantee against loss. You cannot invest directly in an index.

Information provided on tax and estate planning is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), and it advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.