Be Thankful for a Decade of Growth

Thanksgiving is celebrated each year in the United States, Canada, some of the Caribbean islands. It began as a day of giving thanks and sacrifice for the blessing of the harvest in 1621 with the Pilgrims and Indians. Similarly named festival holidays occur in Germany, Japan, United Kingdom and India.

Dinner trivia may include oddities such as Neil Armstrong and Buzz Aldrin’s first meal in space after walking on the moon contained foil packets of roasted turkey. The heaviest turkey on record weighed 86 pounds. Benjamin Franklin wanted the turkey to be the national bird, and that “Butter” and “Bread” were the lucky turkeys pardoned by President Trump this year as part of White House tradition.

While chewing over things to be thankful for with your relatives, consider that investors have much to be thankful for this year. Global stocks have risen significantly, the business cycle is the longest on record (see below), unemployment is extremely low, there are few signs of inflation, and central banks continue to support the global economy.

It’s with this backdrop that the Dow Jones (DJIA) index has returned 23% this year along with positive results for international and emerging market economies. The Barclays Aggregate bond index is up remarkably 8.74% year-to-date and the yield curve is no longer inverted.

These results are in stark contrast to investor expectations only one year ago with the markets down nearly 20% in bear territory. At the time, many investors and economists expected an imminent recession caused by a combination of slowing global growth, trade wars and a possible policy mistake by the Fed.

It’s natural for investors to worry about disruptive events. Over the past ten years, regardless of whether the market has been up or down, there have been a litany of market, economic and geopolitical issues to consider. It’s rare for investors to have an opportunity to take time and be thankful for the relative calm that has led to new stock market highs, and for what they thought might happen a year ago.

In fact, those investors with the discipline to avoid day-to-day headlines may not even have noticed that the stock market fell near bear market levels. This is because the stock market had already fully recovered by April and has made many new highs since.

One reason for a record-breaking stock market, is that the Fed made a 180-degree reversal in policy this year. They not only lowered interest rates three times but have expanded their balance sheet to support the market. In fact, the European Central Bank and others around the globe have taken similar measures.

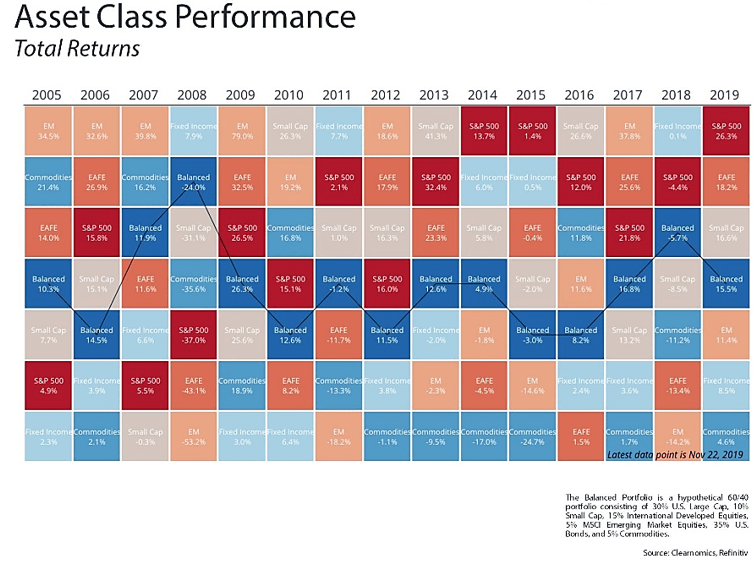

Investors should be thankful for the relative economic stability we’ve experienced over the past decade. More workers today have jobs than at any point since 2009, many are re-entering the workforce, there are a record number of open positions, and wages are rising. These factors have helped a hypothetical 60/40 “balanced” stock/bond portfolio this year to gross near 13%-15% year to-date (see below).

While the ‘Fear of Missing Out’ (FOMO) prompts waves of optimism and a jump in exposure to equities as many investors of all ages that were sitting in cash on the sidelines are now running to get back into the game, we always remind clients to follow the Buffet maxim to “be fearful when others are greedy and greedy when others are fearful.”

Even though markets tend to rise over the long run, they don’t do so in a straight line and eventually arrive in bear territory. Despite continued support from central banks, not even the Fed can fight the economic reality that growth will likely be slower over the coming decade. The global population is aging, corporate investment has decelerated and there continue to be economic challenges in many parts of the world.

In this time of appreciation, investors should plan for the future. Staying diversified across asset classes while also diversifying within each asset class – such as across geographies and styles – is more important than ever.

Ensuring that one’s portfolio matches one’s financial goals will continue to be the key to long-term success. In the meantime, we can continue to be thankful for the longest market and business cycles in U.S. history. Below are three charts that put this in perspective.

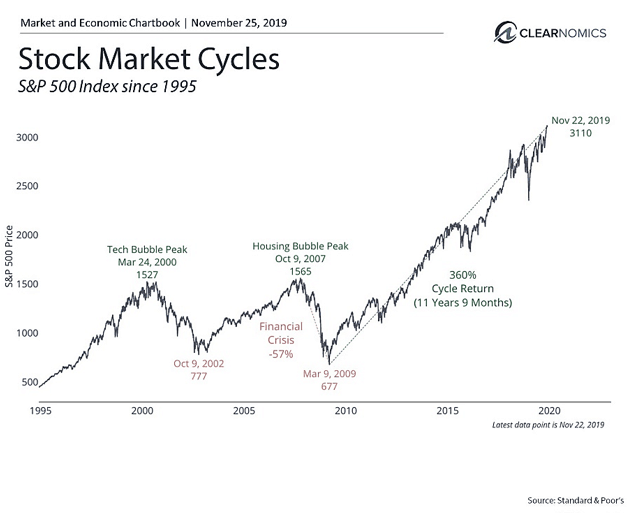

1. The stock market rebounded strongly from last year’s lows

The stock market has made new record highs in 2019. Since the low on March 9, 2009, the S&P 500 has risen 360%. Those investors who had the discipline and fortitude to stay invested over this period, despite constant market concerns, have been rewarded.

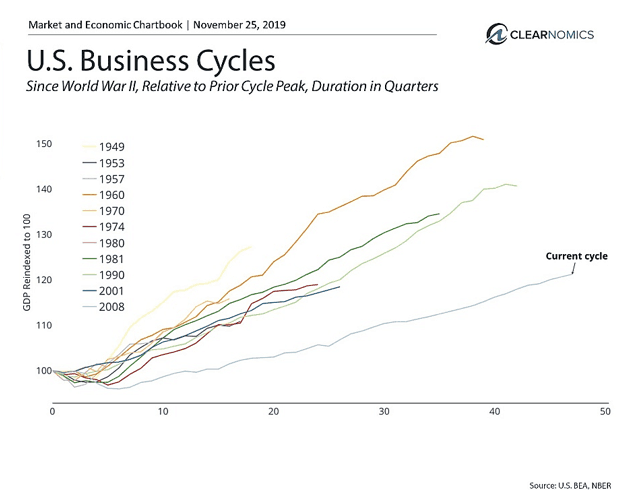

2. The business cycle is the longest on record

This is also the longest economic cycle in U.S. history, surpassing even the 1990s boom. While there are clear signs that the economy is slowing, especially in areas such as manufacturing, the U.S. consumer is still in a great position with low unemployment and limited inflation.

3. It’s more important than ever to stay diversified

Balanced portfolios have done well over the past several years. While the U.S. stock market has performed extremely well this year and over the past decade, it’s more important than ever for investors to stay diversified. This is especially true given the heightened levels of market volatility over the past several years, especially in response to geopolitical and global events.

The bottom line? Investors have much to be thankful for this holiday season. Still, it’s important to focus on financial goals and stay invested for the long run.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com. Get Started Today.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss.

The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), IFP Securities LLC, dba Independent Financial Partners (IFP), and its advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. This report may not be reproduced, distributed, or published by any person for any purpose without Ulin & Co. Wealth Management’s or IFP’s express prior written consent.