-

Investment Strategy

Instability in the worldwide capital markets has reiterated the need for a disciplined approach to investment management strategy

Process.. Process.. Process

Process is not just another word for us, it’s the core of every single phase of our disciplined investment management process, from providing economic and market research to ongoing monitoring.

Process helps to keep us disciplined, focused, rational and unemotional, when the rest of the world is not. Our core maxim is that “performance without process is just luck.”

Our Investment Management Strategy

At Ulin & Co. we take a forward-looking and contrarian approach to the stock market and economic cycles. We respond to what the markets are actually doing, while considering where they may be heading.

This process follows along the lines of the great Wayne Gretzky quote to “skate to where the puck is going to be, not where it has been.”

Breaking from the traditional “buy, hold and hope” approach, our strategic portfolios and diversification strategy evolves and adapts to information we continuously gather from global market indicators and our research partners.

Our goal is to keep our fees and process transparent and easy to understand-while providing our clients a selection of sophisticated “all-weather” portfolios that are actively managed to balance risk and return through volatile bull and bear markets.

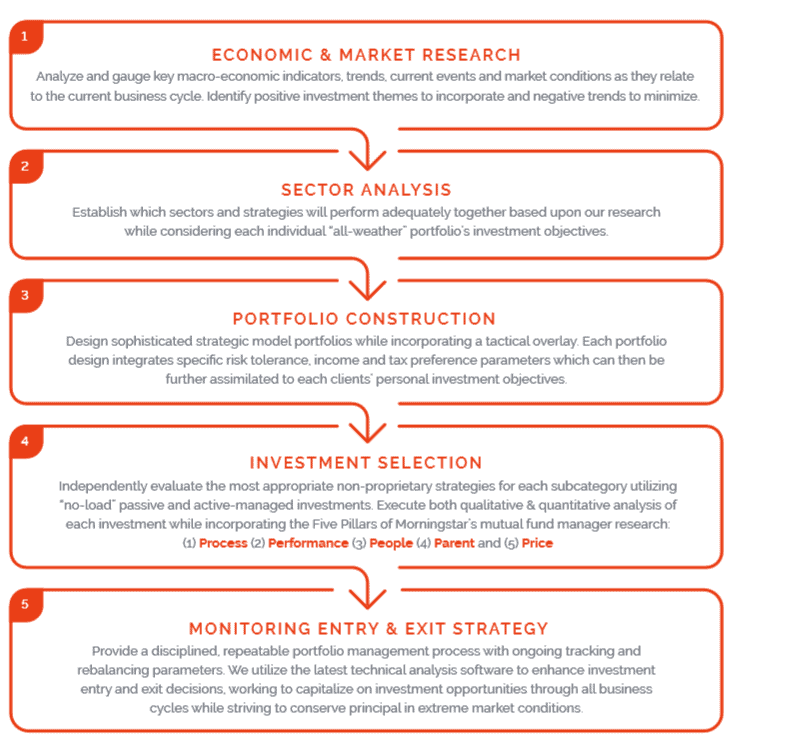

When constructing our investment management strategy, our goal is to provide a sophisticated top-down investment decision-making process based on the following five key factors:

Diversification does not guarantee a profit or protect against loss.

No investment strategy assures a profit or protects against a loss. Diversification does not protect against market risk.

There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio.

Call us today at (561) 210-7887 if you have any additional questions on this information or if you would like to set up a no-obligation retirement consultation and portfolio risk-analysis.

A Wealth of Insight® Blog

-

How to Hire the Right Financial Advisor in 2026

February 1, 2026

-

Beyond Big Tech: 4 Reasons Market Leadership Is Broadening

January 24, 2026

-

Venezuela, War and Wall Street

January 10, 2026