AI and ChatGPT Transforming Portfolios to Productivity

The world has been abuzz this year over artificial intelligence and the possible benefits and threats. These range from the practical such as better tools for knowledge workers and ways for students to avoid writing papers, to the philosophical including what it means to be sentient and the impact on human civilization.

With over 3 billion search results this week for “ai news,” should you be concerned that the world of Terminator robots may be right around the corner that time-traveled back from 2029? Not just yet. Still many nuances of the 2002 sci-fi movie “Minority Report” are already seeping into society from tech recognizing our behaviors and modifying our environment and advertising.

It’s like we are taking a step closer to the world of the Jetsons cartoon TV show that was based in 2062. The first episode released in 1962 was broadcast just a few weeks after US president John F. Kennedy gave his famous “Moon speech.” Ironically, that discussion was motivated by fears of the Soviet Union winning the Space Race along with the premises that technology holds the promise of a better world.

Practice and Productivity Efficiencies

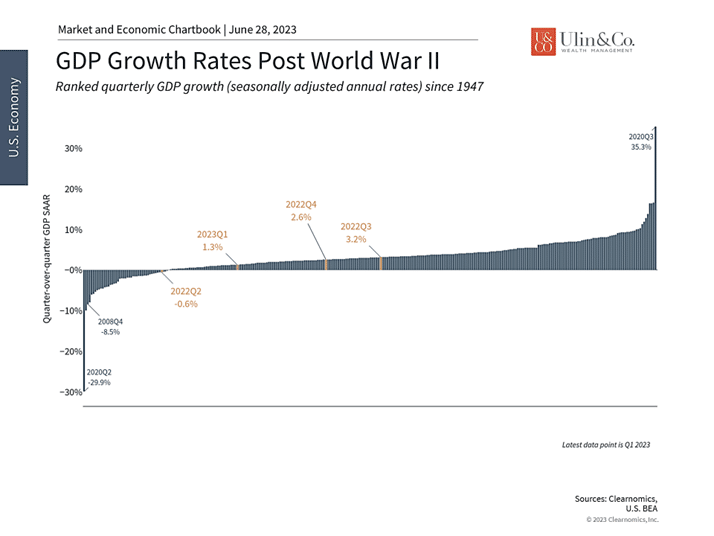

The promise of any new technology is a boost to productivity. Whether it’s new machines, software, or just a better way of doing things, technology is what allows us to accomplish more with less. After all, the simplest way to think about the economy is that growth occurs when there are more workers (labor), more machines (capital), or improved technology. Productivity, or the ability for the same number of workers to produce more, is what improves quality of life generation after generation.

Our world has become greatly automated over the past five decades from tech replacing cashiers, switchboard, lift and toll booth operators, robots eliminating manufacturing and factory jobs, to fully automated warehouses and distribution centers that run nonstop around the clock.

The new AI revolution is not quite coming for your less labor-intensive job whether you are a physician, financial advisor, educator or chef, but may add a torrent of efficiencies over time with disruptions that will affect every data point along the way down to each patient, client, student or customer. Still, we are not at a point where most advisors and doctors may fully trust AI to run portfolios, write financial plans, or diagnose critical ailments. But like the push with self-driving cars, we may be only at the tipping point of human/tech thinking and productivity.

Artificial Intelligence and Investing

There are more questions and concerns now arising around the economy and markets, especially for technology-related sectors. Given the promises and hyperbole around AI, consider the following points to help long-term investors maintain perspective.

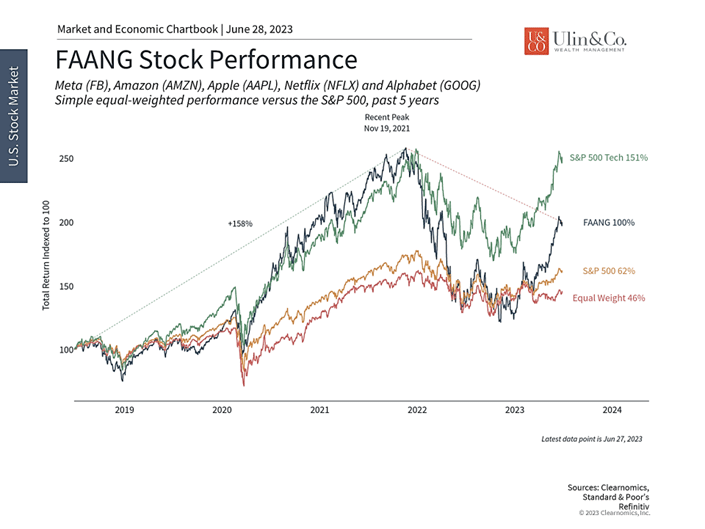

The two decades since the internet bubble have witnessed numerous hype cycles over new technologies with tech stocks pulling the entire market forward even over the past five years (chart below.) In just the past few years, these have included the metaverse, virtual reality, blockchain technology, self-driving cars, space exploration, and many more. Each of these has been accompanied by narratives on how they will transform society.

The computer scientist Roy Amara famously said that people tend to overestimate the impact of technology in the short run and underestimate the effect in the long run. Although many new technologies do eventually play an important role in business and everyday life, investors can often get ahead of themselves in the meantime.

Tech stocks benefited from falling rates and AI enthusiasm

When it comes to AI, this is partly because the term naturally ignites the imagination. However, even if the promises are vast, today’s generative AI and large language models are the culmination of statistical and computer science techniques that can be accurately described with the more sober-sounding term “applied statistics,” without understating their importance. Just as with any other new development, investors should strive to maintain levelheaded views on how new technologies can benefit companies and individuals.

For example, while products such as OpenAI’s ChatGPT, Google’s Bard, and others have only recently burst onto the scene, the methods underlying these tools have been decades in the making. The latest cutting-edge AI models, known as transformers, were described by Google researchers in 2017. Previous state-of-the-art techniques, which have names such as RNNs and LSTMs, were invented in the 1980s and 1990s. The exponential growth in computing power, especially the wide availability of graphics processing units (GPUs), and perhaps more importantly an abundance of natural language data (i.e., the internet), is what have allowed the field to leap from academic research to practical application.

Productivity is the key to sustainable economic growth

New technologies often lead to societal questions around “creative destruction,” a term coined by the economist Joseph Schumpeter. This is especially true when they disrupt established methods, ideas, and businesses, creating a source of resistance as jobs are lost and existing skills become outdated. At the same time, technological progress has created countless new industries, benefiting workers with the proper skills and training, as well as the consumers of these new products and services. Whether this progress is positive or negative is a classic debate that is revived each time a seemingly transformational technology disrupts the status quo.

Regardless of one’s views on AI and technology, it’s undeniable that productivity growth has slowed in recent decades. The average year-over-year productivity growth rate since 1948 is 2.1%, but only 1.5% over the last few years. Prior to the pandemic, one of the biggest macroeconomic concerns cited by many economists was known as “secular stagnation,” or the idea that the economy would grow at a tepid pace due to poor demographic trends, aging infrastructure, and slowing productivity. This isn’t just a concern in the U.S. – many parts of the world, including Japan and throughout Europe, have aging populations and poor productivity.

While the differences in growth rates may seem small, they have big implications when compounded over years and decades. If the economy grows at a steady 3% annual rate, it can double in size every 23 years. In contrast, a growth rate of 2% requires 35 years while 1% growth takes nearly 70 years. Clearly, small differences in growth can have huge differences on economic outcomes. So, regardless of whether the hype around AI pans out, technologies that can boost long run productivity are important for maintaining the quality-of-life improvements that we have grown to expect over the past century.

Market returns have been concentrated in tech-related sectors this year

From a market perspective, enthusiasm for AI has boosted tech-related sectors and benefited diversified investors. While the S&P 500 has gained 12% this year, the information technology and communication services sectors have climbed 35% and 33%, respectively. Macroeconomic factors such as a possible Fed pause, improving inflation, and steady economic growth have boosted these sectors as well. These returns have more than offset the poor performances of sectors such as energy and financials and have overshadowed problems in the banking and commercial real estate industries.

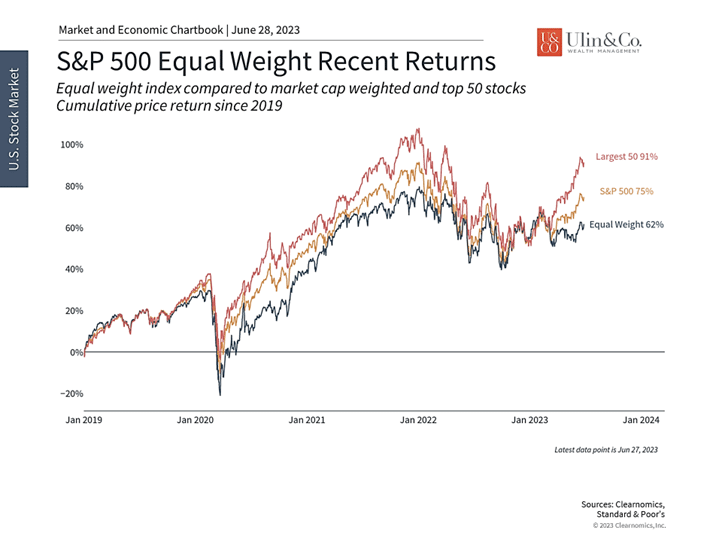

One concern with this dynamic is that a small number of stocks have generated most of the returns this year. This is often referred to as narrow market leadership or limited market breadth. Indeed, the largest 50 stocks in the S&P 500 have generated an outsized proportion of the returns this year, far outpacing a broader equal-weighted index. (chart) Unfortunately, this has been the trend over the past decade as mega caps have played an ever-growing role in market performance. This is due to economies of scale related to large technology companies which have pushed many market caps to the trillion-dollar level and beyond.

While there is a debate around whether this is good or bad for markets, the reality is that this is not something investors can control. What they can control is whether they are diversified across all of these sectors. Those that have appropriate portfolio exposures have benefited from these trends, just as they benefited from strong energy returns last year, while also staying prudent as valuations rise to higher and higher levels. These dynamics are further evidence that it is difficult to predict what will outperform in any given year, and thus it remains important to be properly diversified.

The bottom line? Investors should maintain a level head around new technologies such as AI and ChatGPT Transforming Portfolios .Greater productivity growth and strong sector returns are a reason for investors to stay diversified and focused on the long run.

For more information on our firm or to request a complementary investment and retirement check-up with Jon W. Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com. Get Started Today: Contact Us.

Note: Diversification does not ensure a profit or guarantee against loss. You cannot invest directly in an index.

Information provided on tax and estate planning is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), and it advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.

Investment advice offered through IFP Advisors, LLC, dba Independent Financial Partners (IFP), a Registered Investment Adviser. IFP and Ulin & Co. Wealth Management are not affiliated.