Trump vs Biden Brawl: Stock Sectors to Tax Effects

The Trump vs Biden presidential election cycle will be exceptional unlike anything seen before in U.S. history, and never more important to domestic and foreign policy, otherwise world order. There are many unique, unsettling issues about this race, even more so than it’s the first time two incumbents are running against each other.

Never has America had to choose between two candidates so old, and never in modern times has the choice been between two so strongly polarizing candidates. If Trump wins, it would be only the second time in U.S. history a former President returns for a second term since the 1885 Civil War when President Grover Cleveland was reelected.

In their first debate of 2024, President Joe Biden, 81, and his Republican rival Donald Trump, 78, brawled it out in a heated exchange on CNN while covering key issues including inflation, jobs, immigration, wars and their respective economic policies, offering voters a rare early glimpse of the two oldest candidates ever vying for the U.S. presidency to be elected. Half the time they were taking jabs at each other’s physical health and mental acuity, which has also been a concern for most Americans.

Market reactions were not surprising, with prediction markets indicating a rise in Trump’s election probability from 55% to 60%. Financial analysts indicated that a Trump victory would likely lead to increased interest rates and a stronger U.S. dollar, notably due to Trump’s tariff policies. Biden’s performance was perceived as so poor, it contributed to an immediate rise in the dollar’s value overnight and raising questions about his viability as a candidate.

The influence of a presidential election on stock market sectors and corporate tax policies demands careful consideration. Exploring each candidate’s proposed policies and agendas reveals potential winners and losers across industries. Additionally, examining corporate tax implications provides insights into broader market and economic outcomes.

Key Sectors to Monitor

In a prospective second term under President Trump, sectors like traditional energy (with potential increases in oil and gas production), finance (possible deregulation benefiting banks), healthcare (anticipated regulatory changes with less pharmaceutical regs and adjustments to the ACA), and aerospace and defense (potential expansion) could see significant impacts.

Conversely, a second Biden administration might favor sectors such as renewable energy (with increased infrastructure investments targeting climate change solutions), healthcare (expected ACA expansion alongside stricter pharmaceutical regulations), technology (potential regulatory tightening and antitrust measures), and infrastructure (growth in broadband, transportation, and construction sectors).

Understanding these dynamics is crucial for investors navigating the complex intersection of politics and economics in the stock market.

Impact on Income Taxes, Corporate Taxes and the Federal Deficit

Under both Trump and Biden administrations, huge spending from domestic programs to support of other foreign countries has added significantly to our almost $35 Trillion debt. They both added combined nearly $12 Trillion dollars in a 10-year window, or a 34% increase. About half of was due to the CARES Act, COVID relief programs, and the American Rescue Plan. This is a snowballing effect that we may eventually need to tax our way out of (hiking income taxes) while cutting down some social programs -as at some point we will not have enough revenue to service the annual debt interest payments.

As the presidential debate season kicked off this week, controversial topics fueled by strong political views on our nation’s priorities, government spending, inflation, entitlement programs, social issues, boarder security, gun laws, and abortion rights will be center stage. Still the financial “canary in a coal mine” for Wall Street (and may silently sway some voters to vote red) will center on the expiration of the 2017 Trump tax cuts set to expire in 2025 that benefits Americans with incomes in the top 20%. It may be no surprise that these cuts will not be extended under a second Biden term where Biden is striving to cut taxes on lower earners – but greatly increasing taxes on the top 1% of Americans and on corporate taxes.

While taxes affect all parts of our financial lives, their impact on the stock market and “the street” is not what many might guess. As the rhetoric from both sides of the aisle heats up, consider the following points on corporate taxes and the stock market.

Corporate Tax rates have fluctuated throughout time

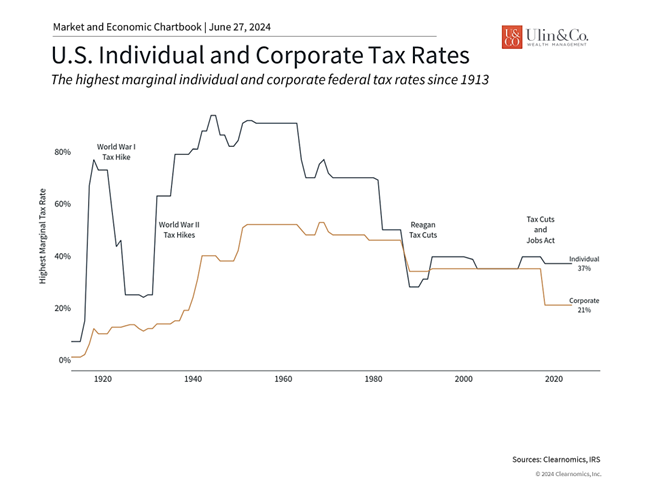

Investors often focus on corporate tax rates because they can directly affect the profitability of large companies and thus their share prices. However, tax rates and the nation’s philosophy around taxes have both fluctuated throughout history. As the following chart shows, corporate and individual tax rates were higher for much of the 20th century before declining during the Reagan era. The stereotype of each party is that Republicans favor lower taxes while Democrats support higher rates, particularly for corporate income taxes. Of course, the exact priorities and proposals of each party have evolved over the decades, especially around balancing the budget.

The cornerstone of President Trump’s tax policy was the 2017 Tax Cuts and Jobs Act, which reduced the corporate tax rate from 35% to 21%. To put that in context, the U.S. previously had the highest corporate tax rate of any OECD country, and the reduction puts us just below the OECD average. The corporate tax rate peaked at 52.8% in the late 1960s, although changing tax brackets make historical corporate tax comparisons challenging. Also, what corporations actually pay can differ significantly from statutory rates.

Unlike individual tax rates, the 2017 corporate tax cut is not set to expire but can be changed by the party in power. While it is still early in the election cycle and the candidates’ platforms may change, President Biden has proposed raising the corporate tax rate to 28% and the corporate alternative minimum tax rate (CAMT) to 21% from 15%. CAMT, created as part of the Inflation Reduction Act of 2022, is intended to ensure that large profitable companies pay at least a minimum amount of taxes. While President Trump’s proposals are not yet clear, he has suggested to business leaders that he would cut the corporate tax rate to 20%.

Corporate Tax Rates and Wall Street

Politics aside, there is unfortunately no simple economic answer as to how taxes impact growth and markets. One important concept is known as the “Laffer curve” – the idea that tax receipts rise as tax rates do, but only up to a point. Ideally, tax policy balances societal priorities with economic growth.

Proponents of cutting the corporate tax rate argue that lower taxes give companies long-term incentives to invest in productivity and can boost global competitiveness. In theory, corporate taxes are really taxes on individuals including shareholders, workers, customers, etc. On the other hand, given the ever-growing federal deficit and debt, proponents of raising corporate taxes argue that it is an important way to raise needed revenue.

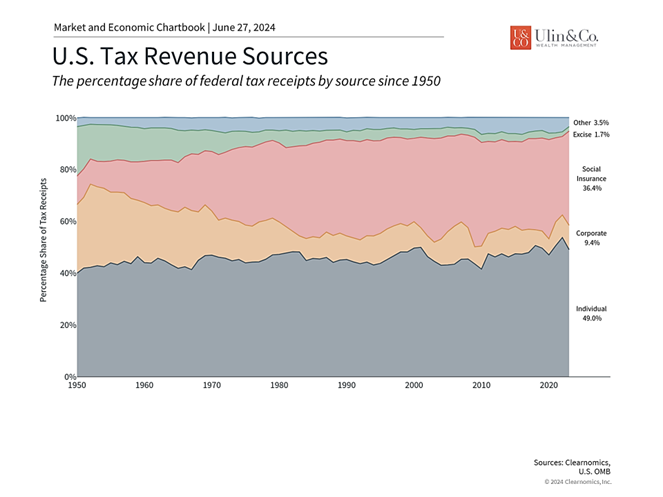

As the above chart shows, the share of revenue from corporate taxes has declined dramatically from 27% in 1950 to just 9.4% today. In contrast, individual income taxes have remained an important share of government receipts, growing from 40% to 49% over the same period. Social insurance and retirement receipts have helped to make up the difference, rising to 36.4% from 11.0%, as other taxes including excise taxes have declined in importance as a source of government funding.

Thus, although corporate taxes receive significant attention from investors, the reality is that they make up a relatively small fraction of total tax revenues today. While it may seem counterintuitive, history shows that the stock market has performed well across different tax regimes. This is partly because corporations adapt to new tax rules quickly and minimize their tax bills through a variety of strategies. It’s also because recent presidents have tended to maintain existing tax policies to avoid raising tax burdens.

With that said, the other side of the tax coin is the level of government spending. Today, there is no clear path to reducing spending to lower the debt and deficit. In fact, the Congressional Budget Office has revised their estimates for the cumulative deficit from 2025 to 2034 up by $2.1 trillion dollars, roughly 10%. The growing national debt and mounting interest payments make it likely that additional revenue will be needed to plug this gap in the future.

Economic Growth happens under both parties

Ultimately, when it comes to market performance, investors should not overreact to broad tax policy changes or political outcomes. The chart below shows that the stock market has performed fairly well under both parties across a variety of tax regimes and other policies. This is because market returns depend far more on business cycles which typically last many years and decades, making them less sensitive to individual policy changes. The idea that markets will crash solely because of the outcome of an election or a change in tax policy is not supported by history.

When it comes down to it, long-term investors should be wary of claims that one candidate or another will “kill the market” or “ruin the economy.” It’s likely that this has been said about every president in modern times across 15 presidencies since 1933 (7 republicans and 8 democrats), and was certainly said about Obama, Trump, and Biden. Thus, it’s important to separate personal and political feelings from financial plans and investments.

This is why for most long-term investors, it makes more sense to focus on fundamentals such as those related to the business cycle, rather than day-to-day election coverage. On a short-term basis, election headlines have the power to move markets and create stock market volatility. However, these moves are eclipsed by the long-term gains created by market and business cycles. These cycles are influenced by many factors, from technological revolutions to globalization, and not just who is sitting in the Oval Office. The reason the returns since 2008 have been historically strong, with the market now back at all-time highs, is less about Obama, Trump, or Biden, than the underlying economic trends.

This is perhaps best illustrated by the 1990s and early 2000s. Bill Clinton’s two terms were perfectly timed with the information technology boom while the ensuing dot-com bust coincided with the start of the George W. Bush presidency. Unfortunately, the 2008 financial crisis also occurred at the tail end of George W. Bush’s second term, resulting in his presidency encompassing both market crashes. Despite this, it would be a stretch to argue that their presidencies were the reason for these booms and busts. While policies influenced these events, they had much more to do with technological and financial innovations. These and other historical episodes suggest that presidents often receive too much blame and credit for economic conditions.

The bottom line? As citizens, taxpayers and voters, elections are extremely important regardless of which side of the aisle you’re on and which candidate you support. (Trump vs Biden). Your vote helps to determine the principles that will be upheld by the country in the years to come.

Of course, achieving our financial goals is not just about market returns. When it comes to our personal financial plans, tax and estate planning could not be more important. Investors concerned about the impact of specific tax policies are encouraged to seek the advice of a trusted financial advisor.

While both sector and tax policies will be at the center of the upcoming election, investors should maintain a broader perspective. Staying invested is still the best way to achieve financial goals across different political outcomes.

For more information on our firm or to request a complementary investment and retirement check-up with Jon W. Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

Note: Diversification does not ensure a profit or guarantee against loss. You cannot invest directly in an index.

Information provided on tax and estate planning is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that are believed to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as NewEdge Advisors, LLC does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.

Advisory services offered through NewEdge Advisors, LLC, a registered investment adviser.