Teach an Old Dog New Tricks with the 60/40 Portfolio

This year has been a wee bit agonizing for investors because there have been very few places to take cover now that gravity has pulled stocks, crypto and other asset classes back down to earth after soaring sky high for a couple of years through the pandemic. Irrational exuberance has led to irrational anxiety for many as the media is in full blast covering the market swings and rate hikes from the sidelines with tons of opinions and forecasts.

There is no doubt that many investors are getting PTSD crash syndrome from vivid memories of past debacles like the dotcom and Great Recession and are tempted to give up and cash out even though longer bull and shorter bear market cycles are par for course. Markets have yet to stabilize this year as the S&P 500 and Nasdaq both spectacularly landed in bear market territory, having declined 23% and 31% this year, respectively with many name -brand tech stocks down near 70%.

Is the 60/40 Dead?

Jon here. It’s been a challenging year for the 60/40 portfolio that may lead summer headlines to come out of the woodwork once again noting that the “60/40 is dead.” In our opinion, perhaps the 60/40 is a bit injured like a broken foot in a cast, but not dead.

What has made it especially difficult this time around is that bonds, that typically help insulate disciplined investors through bear markets as part of a diversified portfolio, have had one of their worst years in history due to the sudden jump in interest rates. The U.S. Aggregate Bond Index has fallen 11.5%, the corporate index 15%, and long-term bonds are down 22% this year which is as uncommon as the skyrocketing inflation and gas prices at the pump.

Per our Morningstar research reports, moderate risk model portfolios have been trending down near 16% year to date with other lower and higher risk models not too far off. With the above average gains these models posted for the past 5-10 years, this year’s temporary downdraft has not overtly thrown off most investors long-term rolling returns.

As noted in more than a few optimistic articles, patient long-term investors who are diversified in accordance with his or her age, stage in life and risk tolerance can not only endure a bear market, but profit from it. Remember: The market can be miserable at times, but its long-term trend for decades has been up and to the right.

Teach an Old Dog New Tricks

Taking a set-it-and-forget-it approach to diversification or simply utilizing a traditional target date fund could lead to excess volatility. It’s critical to understand that there are different sectors and flavors of stocks and bonds that can help mitigate inflation and interest rate risk while helping to smooth-out returns over time

It appears there is no place to hide with the “everything-bubble” popping and decelerating down led by big tech. While it can be difficult to teach an old dog new tricks, experienced investment pros can continue to adjust balanced portfolio components from overall asset allocation risk perspective (cash/bonds/stocks/alternatives) down to diversification thematically from bonds to stock industries, sectors, regions credit quality and durations, to help weather the storm while still being in the game when the momentum changes.

Our playbook for managing inflation risk includes deploying financial stock sectors in our core large cap space that cover the gamut from national and regional banks to broker dealers and credit card issuers that may directly benefit from higher earnings fueled by increased rate margins on loans and cash as the Fed continues to hike short term rates. This is in addition to investing moderately in commodities, energy, industrials, materials, healthcare, defensive and value stock sectors that have held up a bit better from valuations to results than just core growth and tech plays.

We chain-sawed down our bond duration closer to 1.5 years in January and continue to manage for interest rate, credit and inflation risks by utilizing short-term investment grade and municipals to high yield bonds, floating rate (bank loans), treasury inflation protected securities (TIPS) as well as a good dose of reinsurance catastrophic bond funds and global investing to boot.

Fed’s Historic Rate Hike Affects Consumers and Investors

In many ways, investors are stuck between a rock and a hard place with the Fed on the move to tamper inflation with record high hikes. (see below) On the one hand, many are applauding the Fed’s latest effort to combat the highest inflation rates in forty years. On the other hand, doing so by tightening interest rates will likely soften demand for goods and services across the economy. In the best case, spending will slow, and inflation will moderate but remain above historical averages. In the worst case, tightening financial conditions will lead to a recession, albeit possibly a mild one.

Mortgage rates now north of 6% and gas prices above $5 are already creating economic weakness in areas such as the housing market and retail spending. Last week’s retail sales report was a negative surprise with consumers spending -0.3% less in May than April. On a year-over-year basis, retail spending still grew 8.1%. (see below) However, these figures aren’t adjusted for inflation. So, with the consumer price index rising 8.6% over the same period, consumers most likely received less for their money over the past year, even if they felt as if they were spending more. In this environment, there are two facts that long-term investors should remember.

First, the temptation to sell investments and hide in cash is even more counterproductive today because high inflation erodes the value of that cash as we have discussed in many past newsletters. Additionally, it’s difficult even in more normal times to try to time the market (and cash out!) since rebounds can occur rather quickly when investors least expect them.

For both of these reasons, overreacting and shifting from an appropriately constructed portfolio is likely to be counterproductive. It is better to hold onto a diversified portfolio that can help offset these inflationary pressures going forward, even if it has struggled so far this year alongside almost all asset classes. As the old saying goes, it’s best to be fearful when others are greedy and greedy when others are fearful. While there are many reasons to be negative, this is also the best opportunity to take advantage of the most attractive valuations in years.

Second, markets tend to focus too much on the Fed, even in good times. The truth is that the core drivers of inflation are either out of their control or the result of stimulus decisions made two years ago by the Fed and Congress. Specifically, the Fed acknowledges that it cannot directly address higher food and energy prices which indirectly affect all prices. On a technical basis, these prices, which hurt consumers the most, are important components of “headline” inflation. Traditionally, economists and the Fed closely follow “core” inflation, which excludes the prices that matter the most today, since policy tools can only affect longer-term trends.

Perhaps the best the Fed can do is to prevent inflation expectations from worsening and leading to an inflationary spiral. This would be a situation reminiscent of the 1970s in which persistently higher prices lead workers to demand higher wages which further causes businesses to raise prices. It goes without saying that whether this happens will depend on the direction of energy and food prices, which in turn depends on global conflicts and supply challenges.

The timing of the global economic recovery and the war in Ukraine created the perfect storm for the prices that impact consumers the most. Still, oil prices have fluctuated and are now back to the same levels they reached in March. There are also signs that some supply chain and manufacturing problems are easing, including for semiconductors and building materials. So, while these pricing pressures have remained high, they could naturally fall in the coming months.

Ultimately, investors ought to focus on what they can control. In this challenging market, sticking with a well-considered financial plan is still the best way to achieve long-term financial goals. Below are three charts that highlight the importance of the Fed’s historic rate hike on consumers and inflation.

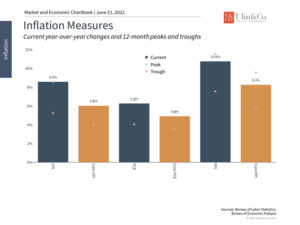

1 All inflation measures are near their peaks

All inflation measures are at or near their recent peaks. This is especially true for measures based on consumer prices, such as the Consumer Price Index and Personal Consumption Expenditures.

2 Consumer spending unexpectedly declined last month

Retails sales unexpectedly declined in May compared to the prior month. In all likelihood, the actual numbers are worse than they appear because they don’t account for inflation. These early signs suggest that consumers are responding to high inflation rates for necessities such as food and gas.

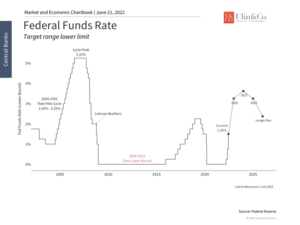

3 The Fed is stepping up the fight against inflation

The Fed raised its main policy rate by 75 basis points in June, the largest individual rate hike in 28 years. However, the Fed can’t control many of the underlying drivers of inflation such as supply chain problems, high energy prices, etc.

The bottom line? Investors ought to stay diversified with their 60/40 portfolio or similar strategy and avoid the temptation to shift to cash in this inflationary environment. Where the market goes from here will depend heavily on the direction of consumer prices.

For more information on our firm or to get in touch with Jon Ulin, CFP®, please call us at (561) 210-7887 or email jon.ulin@ulinwealth.com.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), and it advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.