60/40 Portfolio – Dead or Alive?

Headlines are again asserting that the 60/40 portfolio is dead. Should you be concerned? “Dead or alive” may bring back distant memories of your black leather jeans from the 80’s Bon Jovi song of the same moniker, yet the quick answer is no.

While it does not appear that we will have a repeat of the 70’s Great Inflation decade debacle, start dusting off your Gordon Gekko Wall Street suspenders and primp up your big hair. We may be heading back to the ‘80s disinflation cycle later this year with moderate, yet declining inflation and market gains brought about by elevated rates and lessening supply side pressures.

From investing to football success, having a plan in place with key players is vital to help weather uncertainty. As the Patriots head coach Belichick is often quoted as saying, “the best offense is a good defense,” though it may not always lead to a winning season. Just the same, investor portfolios playing a strong defense with bonds and diversification did not hold up as usual in 2022.

TINA is Dead

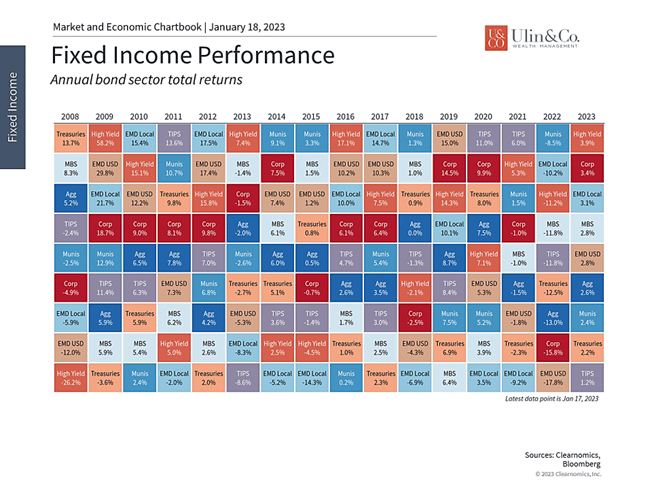

The bear market in bonds last year was a shock to markets and raised questions around the role of fixed income securities in portfolios. This is because, until 2021, inflation had been steadily falling for 40 years, pushing interest rates lower and bond prices higher. This period supported the idea that bonds act as a stable foundation to portfolios, counterbalancing the price swings in stocks and other riskier assets.

Warp-speed forward through 2022 and investors have become anxious that record high inflation and interest rates destroyed the 60/40 portfolio method after delivering the worse performance for bonds in history along with one of the most terrible annual returns for the 60/40 approach as discussed in WSJ 1.6.23 “Your Investing Strategy Failed.”

Jon here. Before you throw out the baby with the bath water, if you study major U.S. stock and bond index performances over time, last year may have been a once in a century scenario for the markets, where at times major stock and bond indices were both in bear market territory with an unusual level of correlation. Now TINA may in fact be dead, referring to the acronym for “there is no alternative” to stocks as bonds are coming back to life.

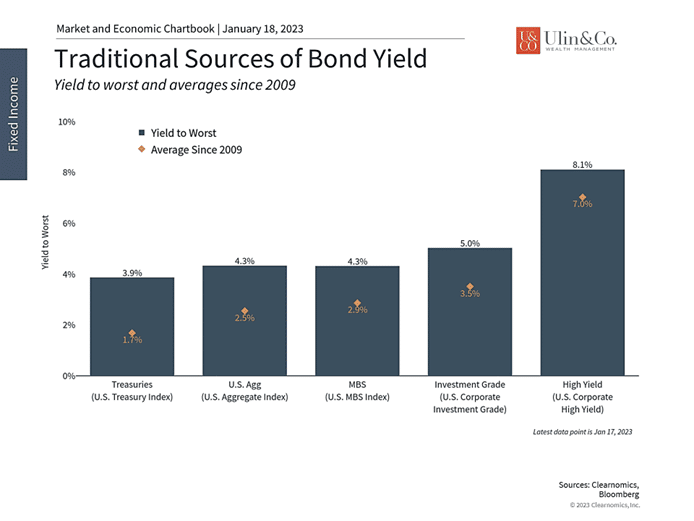

As CPI benchmarked by the U.S. Bureau of Labor Statistics along with interest rates as benchmarked by the 10 Year Treasury are starting to cool off, the start to 2023 appears to show that bonds are getting their footing back and working to provide a negative- to low correlation to stocks while delivering excellent dividends not seen in 14 years. (See below) As recently noted in the WSJ headline, “Bonds open 2023 with a Rally” while providing a glimmer of hope to investors.

Naturally, with stocks and bonds both falling last year, many investors may be wondering if they need to rethink the role of fixed income in their portfolios. As is often the case, it’s important for investors to maintain a longer-term perspective on recent events while looking back at history.

Bonds have had a positive start to the year

Naturally, with stocks and bonds both falling last year, many investors may be wondering if they need to rethink the role of fixed income in their portfolios. As is often the case, it’s important for investors to maintain a longer-term perspective on recent events while looking back at history.

While it’s far too soon to say with certainty, this year is already shaping up to be different and few economists and investors expect interest rates to jump as much as they did last year. In fact, it’s been the opposite – after peaking above 4.2% last October, the 10-year Treasury yield has been falling.

This is in large part because inflation is moving in the right direction. Last week’s Consumer Price Index data showed that overall inflation declined in December by -0.1% month-over-month, or an annualized rate of -0.9%. Core inflation, which excludes food and energy, is still rising but the pace has slowed over the past several months. Components such as new and used vehicles are experiencing significant price drops and improving rents may help shelter costs as leases roll over.

So, while consumer prices are still 6.5% higher compared to the year before, this is a backward-looking number since many price categories are improving. Treasury Inflation-Protected Securities (TIPS) are now being priced based on the expectation of only 2.2% annual inflation over the next 5 and 10 years. Inflation is a scourge on bonds since higher consumer prices cause investors to demand higher interest rates. The recent reversal has allowed interest rates to ease and increases the likelihood that the Fed will pause its rate hikes later this year, brightening the economic outlook.

This helps long-term investors because interest rates and bond prices are two sides of the same coin. When interest rates rise, bond prices fall, and vice versa. One intuitive way to understand this is that the cheaper you can buy a bond with a specified payout schedule, the higher your eventual return, or yield, will be. Thus, another way to view last year’s fall in bond prices is that bond yields are now much more attractive.

Bonds generate more income than they have in nearly 14 years

In other words, buying low and selling high applies just as much to bonds as it does to stocks. Today’s bond yields are the highest they have been since the global financial crisis across many major bond sectors. A diversified index of Treasuries yields 3.9% – well above the 1.7% average since 2009. Investment grade corporate bonds generate 5% and high yield bonds 8.1%. It’s now possible for investors to generate income with higher quality fixed income securities, a reversal of the trends of the past 14 years during which investors had to take more risk in order to find sufficient yield.

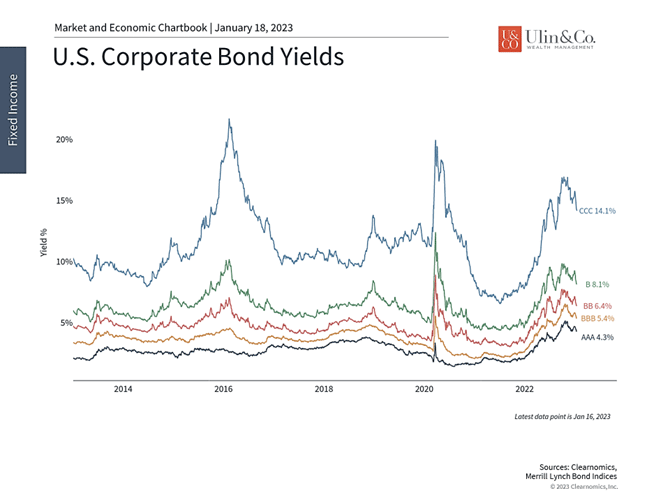

Corporate bond yields and credit spreads have improved too

Additionally, the credit outlook is still positive despite a possible slowdown in the economy and earnings growth. Credit spreads have actually improved in recent months as economic figures, especially for the job market, remain strong and the likelihood of a pause in Fed tightening increases. All in all, this means that even if there is a recession, markets expect that it would be mild and that companies would still be well-positioned to repay their debts.

Of course, it’s still early in the year and there are always risks to consider. A protracted debt ceiling battle in Washington could once again threaten the bond market as it did in 2011 when Standard & Poor’s downgraded the U.S. debt. Commodity prices could jump again and supply chains could be disrupted if geopolitical conflicts worsen. Credit default rates could rise if a worse-than-expected economic downturn were to occur, or if international weakness spills into the U.S.

As is always the case, investors will need to take these risks in stride without jeopardizing their financial goals. After all, buying and holding bonds at these prices and yields is not a short-term play, but one intended to position portfolios for the years and decades to come.

The bottom line? Despite a challenging 2022 for the 60/40 Portfolio and bonds, investors ought to maintain a proper allocation to fixed income as interest rates stabilize and bond prices recover.

For more information on our firm or to request a complementary investment and retirement check-up with Jon W. Ulin, CFP®, pleacall us at (561) 210-7887 or email jon.ulin@uli nwealth.com. Get Started Today: Contact Us.

Note: Diversification does not ensure a profit or guarantee against loss. You cannot invest directly in an index.Information provided on tax and estate planning is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), and it advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.