2026 Market Outlook: The Bull Market Broadens With More Runners

“Don’t confuse brains with a bull market.” — Humphrey B. Neill

As the final bell rang this week, the S&P 500 locked in a third straight year of double-digit gains, finishing near record highs. Wall Street heads into 2026 with rare confidence. Bullishness is nearly unanimous. This rally unfolded alongside a second Trump presidency, renewed tariff tensions, and sharp crosscurrents across asset classes.

The backdrop was anything but quiet. Gold pushed to record highs as investors hedged policy risk. Bitcoin, after a speculative surge, suffered a sharp pullback of nearly 30%. Meanwhile, the AI boom rolled on, again driving leadership in equities. On the surface, 2025 may look like a rerun of 2023 and 2024. Same themes. Same winners. Different risks under the hood. And importantly, more runners have entered the race to compete with tech and may excel over the next year.

While the U.S. stock market rises roughly 85% of the time and bull markets often last seven to eight years, lack of complacency remains a risk. Strong trends can persist, but unexpected shocks and black swan events will still matter. Discipline will matter more than confidence or luck in 2026.

Sentiment Check: Everyone’s on the Same Side

That confidence and exuberance of the crowd shows up clearly in forecasts. In a year-end strategist survey from Bloomberg, every major bank and boutique research shop expects U.S. stocks to rise again in 2026. Not one of the 21 strategists surveyed is forecasting a decline. If correct, it would mark a fourth straight year of gains, the longest winning streak in nearly two decades.

Consensus optimism is not a forecast. It’s a temperature check. When expectations line up on one side of the boat, future returns tend to be harder earned, even if markets continue to grind higher. Bull markets don’t end because optimism exists. They end when expectations outrun reality and bubbles begin to crack.

We remind clients in every quarterly review that consistency remains the most effective risk-management tool. Stay diversified. Stay aligned with your plan. Avoid emotional decisions driven by headlines or short-term market swings.

2025 in Review: Reality Beats the Narrative

Heading into 2025, investors were warned to brace for trouble. Tech valuations looked stretched. Tariff risks dominated headlines. Recession calls were everywhere. January’s DeepSeek shock and April’s Liberation Day tariffs triggered real volatility. The recession never arrived.

From May forward, markets regained their footing and advanced through year-end, extending the bull market into a third year. Tech again led the charge, continuing a trend that began with the release of ChatGPT at the bottom of the last bear market. Many now view this as the third major tech revolution, following the PC buildout of the 1970s and the dot-com era of the 1990s.

For patient, diversified investors, the traditional 60/40 balanced portfolio quietly delivered a strong year. Returns approached equity-only portfolios with meaningfully less volatility. Our retirement-age clients understand the risk at both extremes. Sitting too heavy in cash erodes purchasing power. Chasing yield or complexity invites a different set of problems. Focus on the return on your money and the return of your money. Free lunches do not exist.

Tariffs and the Illusion of Relief – Why Inflation Feels Better but Isn’t Gone

Markets don’t trade current headlines. They trade future expectations, positioning, and the gap between fear and reality. Data looks backward. Markets look ahead.

Early signals matter. December’s S&P surveys showed momentum slowing. Marginally higher prices, sticky inflation, and softer sales weighed on activity. Manufacturing slipped to 51.8, a five-month low. Expansion, but barely. Tariffs continue to show up where it counts. Costs. Duties on many trading partners jumped a decimal point from roughly 1.5% to closer to 15%, and far higher on China. The impact arrived slowly, cushioned by inventory buildups and companies absorbing costs to protect margins. That cushion is thinning.

A 2.7% CPI print in December, down from 3.0% in September (US BLS) and below a 3.1% forecast, confirms the direction even without October data. Inflation is cooling, but not collapsing toward the Fed’s 2% target. This is a disinflationary glide path, not deflation. Services remain sticky. Price levels remain elevated. Cost pressures are passing through gradually, not in shocks. This is less inflation, not cheap again.

The inflation path has been downward, and nothing in the data suggests a sudden spike higher. Even as inventory buffers thin and companies pass along costs in small increments to consumers, the result is slow, steady price creep, not a renewed inflation surge. Your chips and guac may cost a bit more next year if the cost of avocados increase from nearly .80 cents to .95 cents. Not shocking on its own, but it adds up at checkout.

This is not 2022. We are not forecasting a return to 9.1% inflation. But the path forward is narrower. Higher input costs and sticky prices remain part of the backdrop going forward. Tariffs are the 800-pound gorilla in the room. Not catastrophic. Not imaginary. And very much part of the 2026 investment landscape.

In November, the Supreme Court heard oral arguments challenging the use of emergency powers to impose broad tariffs. A ruling is not expected until mid-2026. Even then, tariffs may not fully disappear. Other statutory tools could keep many duties in place.

What this means: volatility may rise, but the foundation remains intact

Credit Bellwether: What the Bond Market Is Saying

Of the five indicators we track weekly, equity breadth, earnings revisions, inflation trends, Fed policy expectations, and credit conditions, credit remains our preferred early warning signal. Stocks grab headlines. Credit whispers first.

For now, credit remains calm. High-yield spreads are tight by historical standards, signaling limited stress. At the same time, unusually tight spreads can also reflect complacency.

Today, high-yield bonds yield roughly 6.5% while the 10-year Treasury sits near 4.1%,(FRED) leaving a spread of about 240 basis points, which is historically tight. A move toward 8% would likely reflect rising credit stress and widening spreads, while a move toward 6% would signal increasing risk appetite as investors demand less compensation for risk.

Spreads matter more than absolute yields. Slower growth, rising defaults, or renewed inflation pressure that keeps the Fed restrictive could push spreads wider. With the 10-year Treasury likely anchored between 4% and 5%, mortgage rates may stay elevated. Credit cards, HELOCs, and small business loans remain sensitive to Fed policy.

History helps. During Donald Trump’s first term, markets suffered a near-20% correction in 2018 during the initial China trade war before conditions stabilized. Credit led the signal then too. It is worth watching closely again.

Leadership Is Rotating, Not Reversing

After three strong years of gains, pauses should be expected. U.S. stocks delivered an unusually powerful run led by mega-cap tech and AI. That does not mean the bull market is over. It does mean leadership is changing.

Investors are trimming recent winners and reallocating toward laggards. Capital is rotating out of crowded AI-linked names and into cyclicals, value, small caps, and international stocks. Recent Fed rate cuts helped accelerate that shift. This is not panic selling. It is a healthy repositioning that we have been expecting since the April dip.

Jon here. Rotation is often a sign of confidence, not fear. When investors believe the economy can keep growing, they broaden exposure instead of hiding in a narrow group of winners. Markets get healthier when participation widens. The bull market does not need to sprint. It just needs more runners.

Breadth Is the Story- The S&P 493 Steps In

The recent turbulence on Wall Street pushed the S&P 500 back a few months toward October levels, fueled by renewed fears around tech valuations and familiar bubble warnings. It feels dramatic. It usually does. But this looks less like a reason to hide in cash and more like a routine reset after an extended run.

Our outlook for 2026 does not assume a recession or a market crash. We expect a shift toward more balanced growth and more normalized rates, not a break in the cycle.

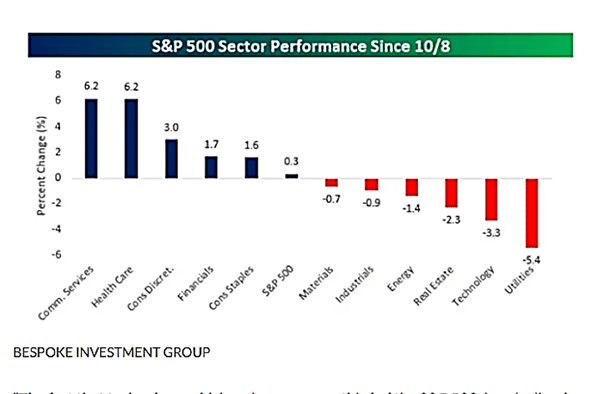

The internal market action matters more than the headlines. Technology, now nearly 35% of the S&P 500, is down roughly 3% over the past few months. (see chart) Yet the index held steady as other sectors stepped up. Staples, financials, discretionary, health care, and communication services have quietly carried the market. That tells us leadership is broadening beyond mega-cap tech and into the rest of the S&P 500, with international markets starting to participate as well.

We expect this broadening to continue through 2026. Returns are likely to be lower and more evenly distributed, with the S&P 500 landing closer to an 8–10% gain by year end. That would represent a healthy cooling after an unusually strong three-year stretch, not a warning sign. There may be continued strength by the notorious “S&P 493,” stocks outside of the top 7-mega-cap tech stocks (Mag-7) including momentum by small and midcap stocks and sectors benefiting from lower rates and inflation, otherwise lower valuations.

In addition to maintaining a moderate exposure to tech, our clients’ balanced portfolios are positioned for a world of rangebound interest rates, nominally higher inflation readings, and a moderating dollar. We continue to favor international and emerging markets, alongside selective exposure to cyclicals, financials, health care, industrials, communication services, energy, and utilities. On the fixed income side, we emphasize high-quality short to intermediate duration bonds, diversified across sectors and across both taxable and tax-free portfolios.

Five Themes We’re Watching for our 2026 Market Outlook

For the sixth time in the past seven years, the stock market is on track to deliver double-digit returns. That run, interrupted only by the inflation-driven decline in 2022, has left many investors in strong financial shape.

Strong returns are always welcome. They move plans forward, expand flexibility, and create options. That’s especially true as market leadership has broadened beyond artificial intelligence, international markets have rebounded, and fixed income has once again contributed to portfolio returns. But success has a way of breeding anxiety. As gains pile up and markets hover near all-time highs, investors grow uneasy. Valuations rise. Comparisons to past bubbles resurface. The mood shifts from relief to caution.

2025 marked a turning point across many of the issues that dominated investor concerns in recent years. Inflation, while still noticeable at the household level, has stabilized near 3%. (US BLS) Tariffs, elevated by historical standards and a major source of market volatility this year, have not produced the economic damage many feared. The Federal Reserve continued cutting rates, and the economy grew at a steady, resilient pace.

Zooming out, the more durable lesson is a familiar one. The events investors fear most often fail to materialize. The recession widely predicted since 2022 never arrived. For every genuine market shock, there are countless anticipated crises that fade quietly into the background. The real challenge for long-term investors is not forecasting the next headline, but maintaining discipline when uncertainty feels highest.

Looking ahead to 2026, the landscape remains complex. The midterm election, leadership changes at the Federal Reserve, the evolution of artificial intelligence, credit concerns, and the direction of the U.S. dollar will all compete for attention. What matters most is not predicting each outcome, but building portfolios that can absorb uncertainty while continuing to compound over time. The following five themes help frame how we’re thinking about the year ahead.

1 Many asset classes are supporting portfolios going into 2026

Importantly for investors, many asset classes are contributing to portfolio returns as we near 2026. This is in contrast to much of the past decade when U.S. stocks outperformed the rest of the world. In 2025, international stocks are outpacing U.S. markets, with developed market stocks (MSCI EAFE) and emerging market stocks (MSCI EM) each gaining around 30% in U.S. dollar terms. This has been driven by two key factors: improving growth expectations in many economies and the weakening dollar, which boosts returns for U.S.-based investors.

Fixed income is also playing an important stabilizing role in portfolios. The Bloomberg U.S. Aggregate Bond Index has gained 7% for the year as the Federal Reserve continues cutting interest rates and inflation stabilizes. Higher-quality bonds have been serving their purpose by providing income and offsetting stock market volatility during periods of market uncertainty.

In the coming year, this underscores the importance of balance and diversification. While it may be tempting to make sudden portfolio changes based on headlines, investors who stay on track with their financial plans are likely to be rewarded.

2 Market valuations are approaching dot-com levels

One effect of the strong returns of the past several years is that stock market valuations continue to rise. The S&P 500 currently trades at a price-to-earnings ratio of 22.5x, approaching the all-time high of 24.5x reached during the dot-com bubble. By definition, this means that investors are paying more for each dollar of future earnings than in recent years.

Investors typically worry about valuations when they become disconnected from the underlying fundamentals. For example, the dot-com bubble experienced historic valuation levels that far outpaced revenues and earnings, as investors rewarded any company related to the “new economy.” While valuations are expensive today due to enthusiasm around AI and ongoing economic growth, corporate fundamentals remain strong. Earnings have grown at a healthy pace, with the expectation they could continue to do so according to consensus estimates data by LSEG.

So, it’s important to recognize what high valuations do and do not tell us. Valuations don’t necessarily predict immediate market declines since markets can remain expensive for extended periods. While some investors worry about an “AI bubble,” the reality is that not all bubbles pop. Instead, some deflate slowly as the fundamentals catch up. This is one difference between the dot-com bust of the late 1990s and early 2000s and the growth of cloud computing over the past decade.

However, high valuations do suggest that returns could be more modest going forward, since markets are already accounting for future growth. This can also increase the market’s sensitivity to disappointments. Investors often say that markets like these are “priced for perfection,” so even minor misses on earnings or economic data can spur volatility. This means that being selective and maintaining balance across different parts of the market – including asset classes, sectors, sizes, styles, and more – will only grow in importance.

3 AI is driving economic growth and returns

Perhaps no single trend has captured investor attention more than AI. Capital spending on AI infrastructure surged in 2025, reaching extraordinary levels. Trillions of dollars are being directed toward new data centers, advanced chips, and specialized talent.

Some of this investment has taken on a circular feel. Large technology firms are funding AI developers that, in turn, are among their largest customers. That dynamic has raised fair questions about how durable the ecosystem may be if enthusiasm cools or returns take longer than expected.

What’s clear is that AI requires scale. The infrastructure demands are enormous, and only a handful of companies can afford to build it on their own. For now, AI spending remains a meaningful driver of economic activity. The open question is whether the value created ultimately justifies the pace and size of today’s investment.

Adoption continues to move in the right direction. Census Bureau surveys show the share of businesses using AI more than doubled from 4% in late 2023 to 10% by September 2025. Expectations for near-term adoption have risen as well. These are real gains, but they still point to early innings rather than full maturity.

For investors, AI offers both opportunity and risk. The Magnificent 7 continue to lead markets, powered by infrastructure spending and expanding use cases. At the same time, this concentration creates exposure most investors already have. These companies now represent roughly one-third of the S&P 500, whether held directly or through index funds.

The question is not whether AI will reshape the economy. It will. The question is whether current valuations reflect realistic timelines for turning innovation into profits. History offers perspective. From railroads to the dot-com era, transformative technologies tend to arrive faster than their cash flows.

The takeaway is discipline. Markets often overestimate the speed of monetization. Investors should assume they already own AI exposure and focus on maintaining balanced allocations rather than chasing the theme at any price.

4 Economic growth is slowing but remains positive

Economic growth has slowed, but it remains more resilient than many expected. U.S. GDP dipped slightly in the first quarter of 2025, then rebounded quickly as tariff uncertainty eased. Growth accelerated to 3.8% in the second quarter, one of the strongest quarterly readings in several years.

Globally, growth is expected to cool modestly rather than contract. The International Monetary Fund projects global GDP easing from 3.2% in 2024 to 3.1% in 2026. Advanced economies are expected to grow around 1.5%, while emerging markets continue to expand above 4%.2

While growth remains positive in aggregate, it has been uneven. Some households and sectors are moving ahead, while others lag behind. This “two-speed” economy reflects widening differences in income, opportunity, and exposure to economic change.

Technology plays a central role in that divide. Workers and businesses tied to AI and related fields have benefited from stronger demand and job prospects. Others face headwinds from rising consumer debt, higher auto loan delinquencies, and tighter household budgets. Growth exists, but it is not evenly felt.

Looking ahead, the more important question is productivity. Long-term economic growth depends on producing more with the same amount of labor. Historically, gains in productivity have come from better tools, training, and technology.

Productivity growth averaged just 1.2% annually during the 2010s. The promise of AI and automation is a renewed lift in output per worker. History suggests these gains arrive slowly and unevenly. For investors, the payoff is improved margins over time, which can support earnings and portfolios, even if the transition is not linear.

5 The impact of tariffs remains uncertain

While tariffs were the primary driver of stock market volatility in 2025, their economic effects have been mixed. In fact, one of the ongoing puzzles is how little immediate impact tariffs have had on inflation and growth. Despite tariff costs increasing ten times their average level compared to prior years, measures such as the Consumer Price Index have ticked up only slightly.

There are several possible explanations as to why tariffs have not had their anticipated effect. First, many of the announced tariffs were quickly paused or scaled back. Second, many companies absorbed the initial cost of tariffs by keeping their prices steady and importing goods ahead of tariff announcements. Finally, strong consumer spending, fiscal stimulus, and healthy growth in AI-related sectors helped offset any negative impact on overall growth. It’s also worth noting that the Supreme Court may rule in 2026 on the legality of the economic justification used for these tariffs.

For long-term investors, these recent developments, along with the first round of trade negotiations in 2018, highlight the fact that tariffs are part of the government’s playbook. Rather than reacting to these tariffs as a shift in the world order, they instead represent tools for the administration to support broader policy goals. While tariffs aren’t going away, their impact on day-to-day market activity could diminish.

Maintaining perspective in 2026

As we enter 2026, investors face a familiar test. The headlines are noisy. The list of risks is long. It always is. Yet markets have consistently rewarded patience and discipline far more often than prediction. For every crisis that truly disrupts markets, there are many more that dominate attention and then quietly fade away.

What separates successful long-term investors is not the ability to forecast which worry will matter most. It’s the ability to stay balanced when uncertainty feels elevated and conviction feels crowded.

Bottom Line: Markets have delivered strong gains, but elevated valuations and slower global growth point toward more modest, more normal returns in the year ahead. That is not a negative outcome. It’s a healthy one. The mistake would be reacting to any single concern with drastic changes.

The better approach is simpler and harder. Maintain diversification. Stay aligned with your plan. Build portfolios that can handle a range of outcomes, not just the one everyone expects.

For more information on our firm or to request a complimentary investment and retirement check-up, call (561) 210-7887 or email jon.ulin@ulinwealth.com.

Author: Jon Ulin, CFP® is the founder and Managing Principal of Ulin & Co. Wealth Management, an independent advisory firm based in Boca Raton, South Florida for over 20 years. As a fiduciary wealth advisor, Jon helps successful individuals, families, and business owners nationwide with multi-generational planning, investment management, and retirement strategies. Learn more about Jon and our team at About/CV.

Note: Diversification does not ensure a profit or guarantee against loss. You cannot invest directly in an index.

Information provided on tax and estate planning is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor.

You cannot invest directly in an index. Past performance is no guarantee of future returns. Diversification does not ensure a profit or guarantee against loss. All examples and charts shown are hypothetical used for illustrative purposes only and do not represent any actual investment. The information given herein is taken from sources that are believed to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as NewEdge Advisors, LLC does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.