-

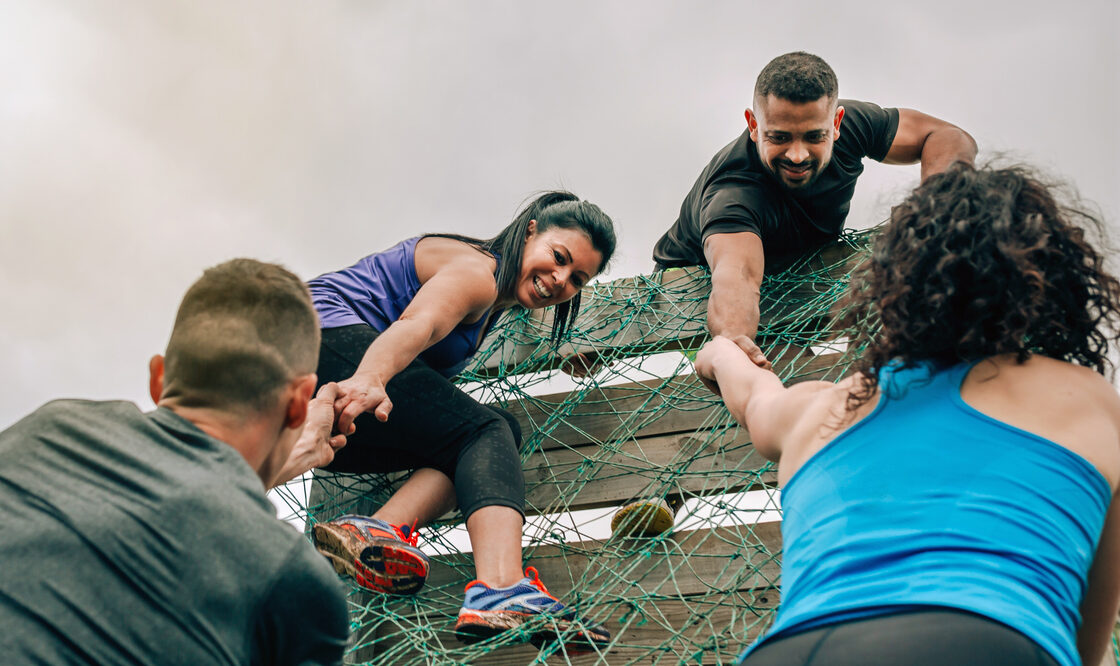

Employee Transition

It can be difficult, time consuming and stressful to be faced with many big financial decisions regarding your employee transition options and your household finances all at the same time.

We’re committed to helping you get organized, simplify complex information and increase your knowledge in multiple areas of personal finance to help you make important money-smart decisions while starting this next chapter of your life.

Tools & Resources

- Changing Job Check-list (next level tools & resources)

- Surviving Financially Strategies (budgeting, debts, credit score)

- 401(K) Choices (including rollover distribution strategies)

- Healthcare Counseling (COBRA & personal healthcare options)

- Portable Benefits Review (life, disability, LTC, HSA)

- Cash Flow Analysis (unemployment compensation, severance package, spousal benefits, pension options, Social Security)

Call us at (561) 210-7887 to set up a personal consultation or complete the form below and we will be in touch shortly.

Register today:

- 30 minute 401(K) Consultation

- One hour Transition Analysis

- Attend an upcoming Worksite Transition Workshop

.

.

Top 10 tips to consider when facing a layoff:

Experiencing a job loss can be a challenging and stressful situation. As a CFP® with expertise in personal finance, investing, and retirement advice, I understand the importance of navigating such transitions with careful consideration. Here are the top 10 tips to consider when facing a layoff:

- Assess Your Financial Situation:

Start by evaluating your current financial position. Take stock of your savings, emergency fund, and other liquid assets. Understand your monthly expenses and create a realistic budget to manage your finances during the transition period. - Understand Severance Package and Benefits:

Review your severance package and employee benefits. Understand the terms and conditions, including any continuation of health insurance, unused vacation pay, or other perks. This information will be crucial in determining your financial stability during the period between jobs. - Update Your Resume and LinkedIn Profile:

Begin updating your resume and LinkedIn profile. Highlight your skills, accomplishments, and experiences. This will not only be useful for potential employers but can also serve as a confidence boost during your job search. - Network and Seek Support:

Leverage your professional network for support. Inform colleagues, friends, and connections about your job loss. Attend industry events and connect with professionals in your field. Networking can open up opportunities and provide emotional support during this challenging time. - Explore Government Assistance:

Investigate potential government assistance programs available for individuals who have lost their jobs. This may include unemployment benefits, job training programs, or other resources designed to help individuals get back on their feet. - Evaluate Retirement Savings:

As someone well-versed in retirement advice, assess the impact of the layoff on your retirement savings. Understand any penalties or tax implications associated with tapping into retirement accounts if needed. Consider consulting with a financial advisor for personalized advice. - Consider Alternative Income Streams:

Explore short-term gigs, freelance opportunities, or part-time work to generate income during the job search. Utilize your skills and expertise in personal finance and investing to offer consulting services or advice on a freelance basis. - Reassess Career Goals:

Take this time to reassess your career goals and aspirations. Consider if the layoff presents an opportunity to pivot in your career or pursue a passion. Reflect on your skills and interests to align your next career move with your long-term objectives. - Invest in Professional Development:

Enhance your skills and stay relevant in your industry by investing in professional development. Attend workshops, online courses, or certifications that can boost your resume and make you more marketable to potential employers. - Maintain a Positive Mindset:

Finally, maintain a positive mindset throughout the job search process. Job loss is undoubtedly challenging, but approaching the situation with optimism can help you stay focused on opportunities rather than setbacks. Engage in activities that bring you joy and surround yourself with a supportive network.

In conclusion, facing a layoff requires a strategic and holistic approach. By carefully managing your finances, leveraging your network, and staying proactive in your job search, you can navigate this challenging period successfully. Remember, seeking professional advice, whether it be in personal finance or career counseling, can provide valuable insights tailored to your unique situation.

A Wealth of Insight® Blog

-

No Acrophobia for Retirement Investors From Market Highs

March 30, 2024

-

Don’t Push Your Luck: Tech, Gold to Bitcoin

March 16, 2024