-

Financial Planning

Plan your best life®, with our financial planning counseling expertise and personal guidance.

Comprehensive financial planning is a distinct counseling service for people just like you who work hard for their money and want to get their “financial house” in order. Don’t let life get in the way of properly addressing and organizing your financial affairs.

The Ulin & Co. Plan Your Best Life® program (through E Money) provides a customized “cloud-based” encrypted client portal and website, designed to help you better coordinate, track and report on your entire financial life in one place for your family and your financial team (advisor, CPA, Attorney).

This interactive and dynamic gateway includes live account data feeds, goal tracking and a secure vault to store vital documents. By aggregating data from your net worth to your cash flow, you can more effectively manage your financial life while looking at your “big picture,” like an MRI or blueprint.

.

.

FINANCIAL PLANNING COLLABORATION TOPICS:

- Portfolio management

- Household cash flow

- Retirement planning

- Social Security analysis

- Trust and Estate planning

- Advanced Tax Planning

- Life & Disability Insurance

- Employer benefits analysis

- College Education Planning

A well-designed plan/blueprint that covers the six key areas of financial planning should operate as your Financial GPS or roadmap, allowing you to better see and understand the current and future impact of each of your financial decisions in advance. Your financial planning analysis will provide detailed illustrations and projections on how long your money could last while testing different retirement distributions, investments and market conditions for the long run. Click here to work though our online retirement readiness calculator.

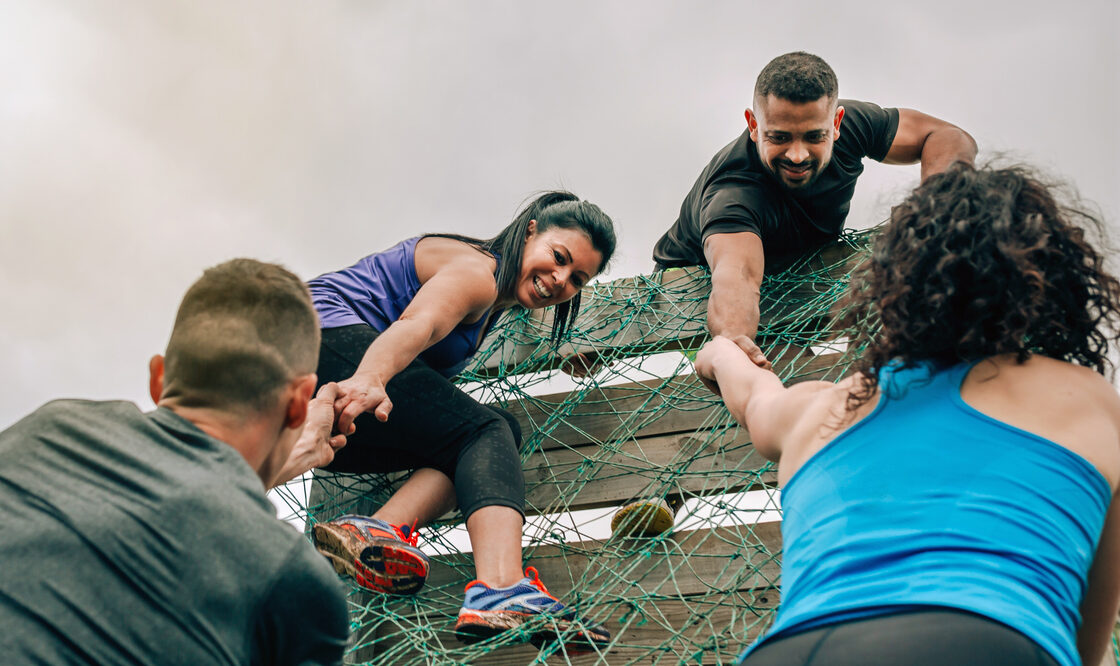

Our team will work diligently as your “CFO” and advocate to help orchestrate your financial life and holistic plan every step of the way. We will sync-up with your attorney and CPA (by request) to coordinate your recommendations.

Let’s start a conversation today! Simply call us at (561) 210-7887 or please complete the form below to set up your no- obligation financial planning and wealth management consultation.

.

Ulin and IFP CEO on holistic planning backed by a fiduciary standard

Note: Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies. IFP and Ulin & Co do not provide tax and/or legal advice.

A Wealth of Insight® Blog

-

No Acrophobia for Retirement Investors From Market Highs

March 30, 2024

-

Don’t Push Your Luck: Tech, Gold to Bitcoin

March 16, 2024